|

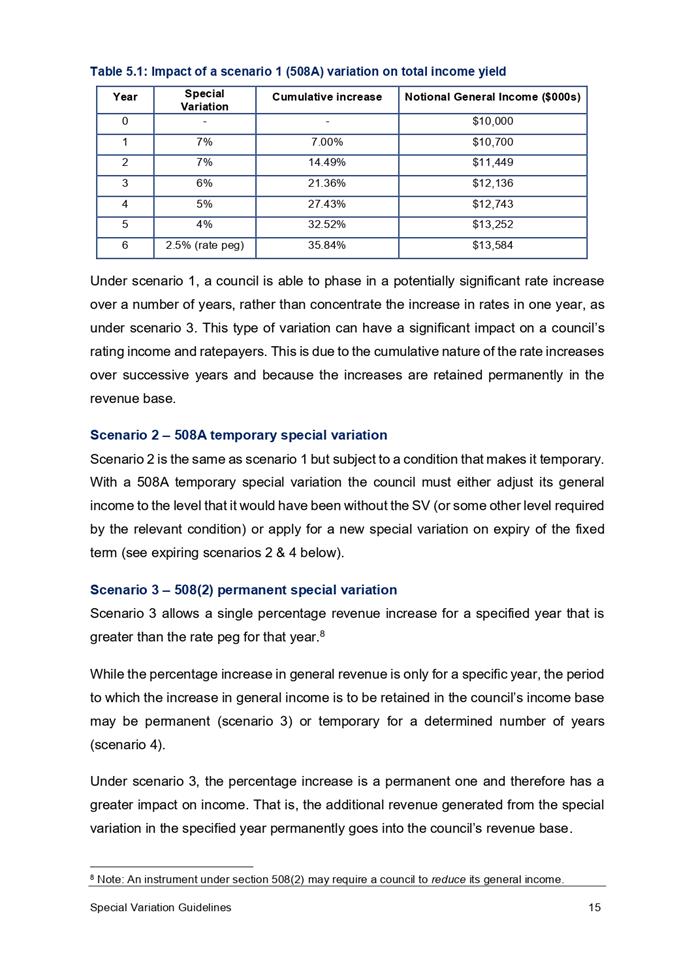

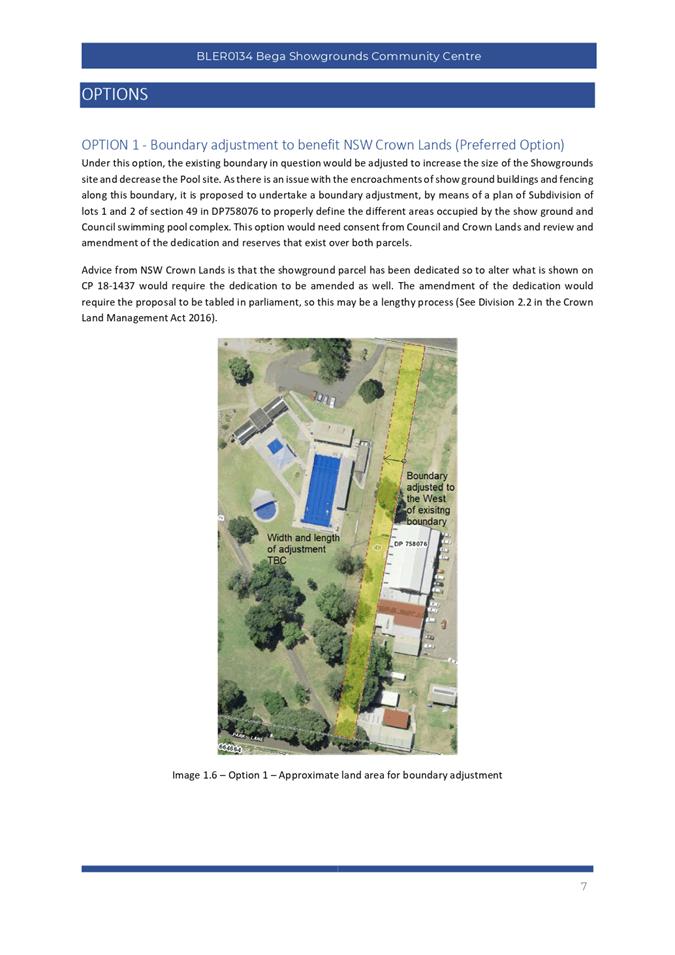

Ordinary

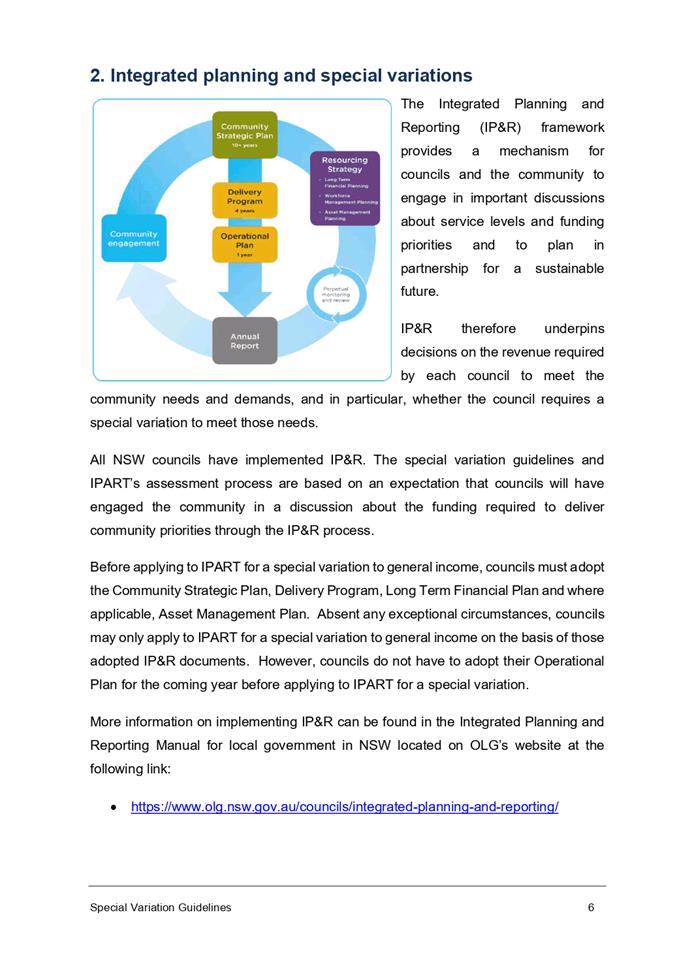

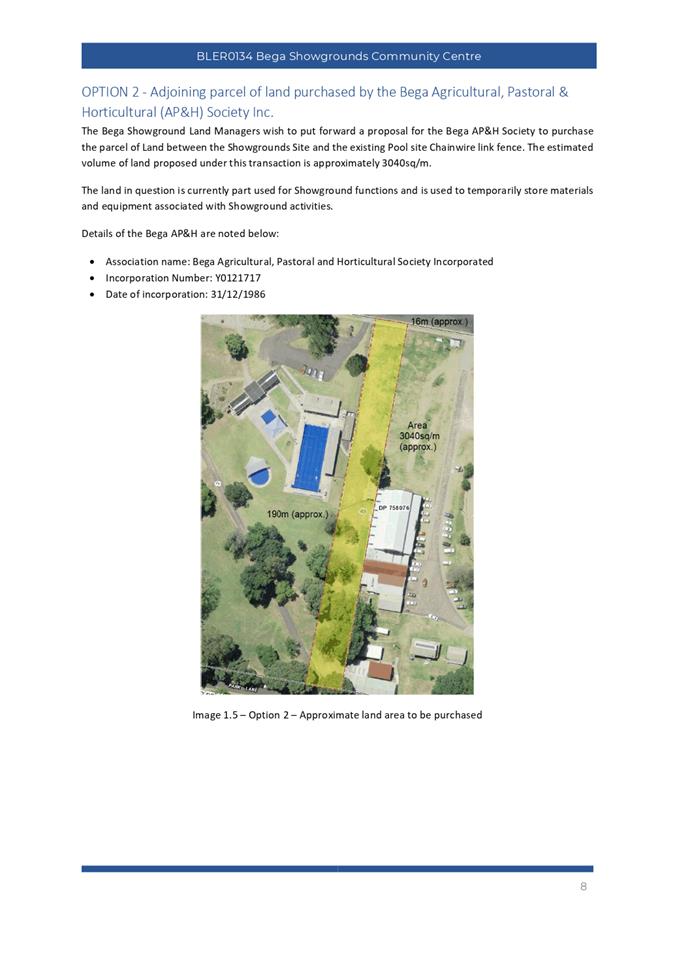

Meeting

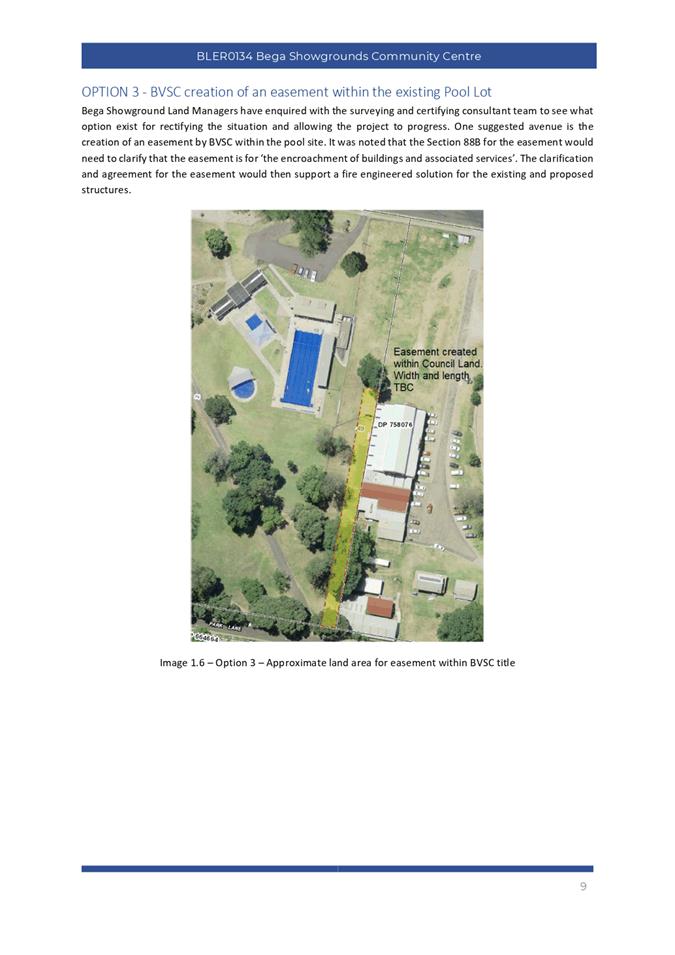

Notice and Agenda

An Ordinary Meeting of the Bega Valley Shire Council will be held at Council Chambers, Biamanga Room Bega Valley Commemorative Civic Centre

Bega on Wednesday, 16 November 2022 commencing at 2:00pm to

consider and resolve on the matters set out in the attached Agenda.

To:

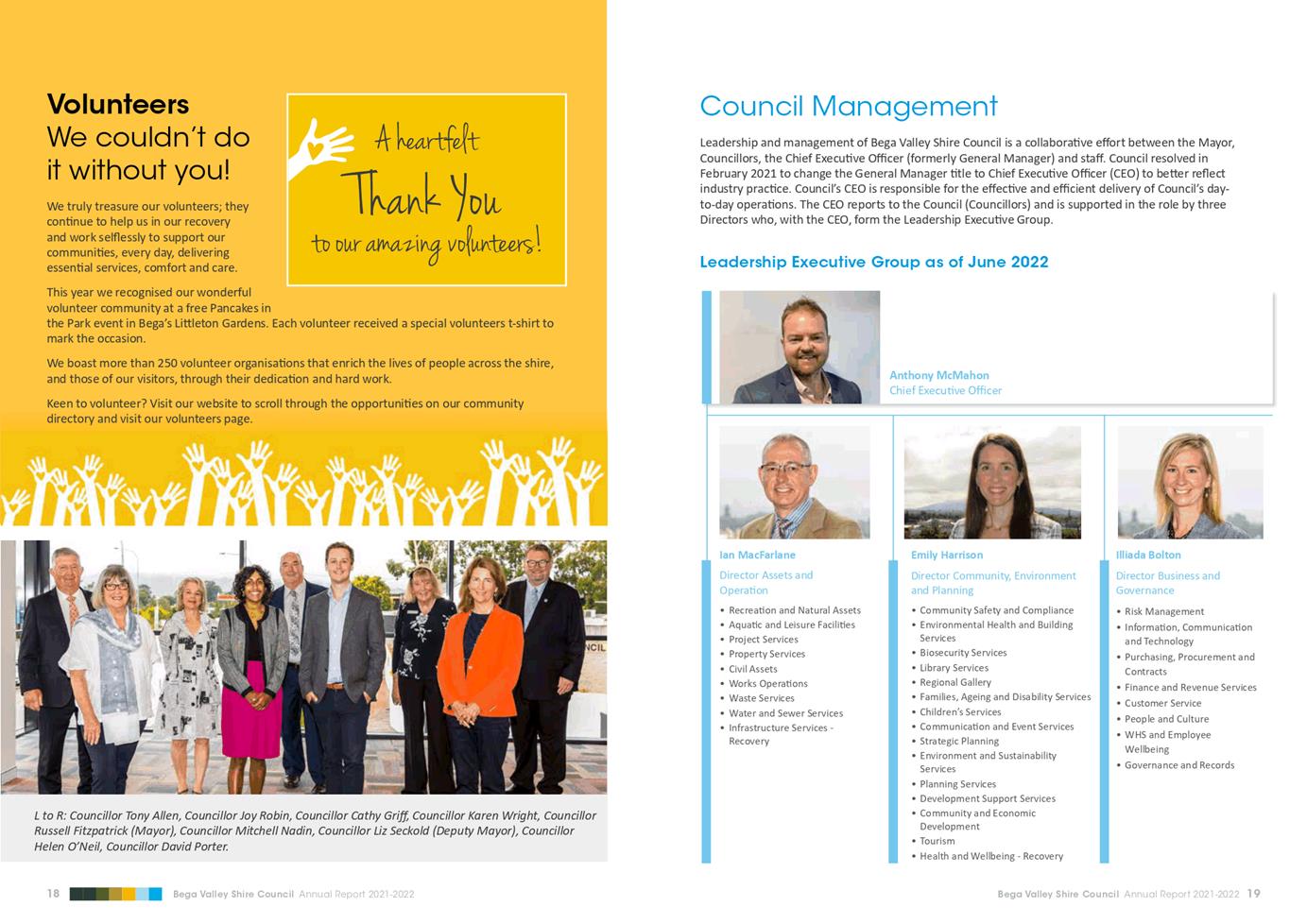

Cr Russell Fitzpatrick, Mayor

Cr Liz Seckold, Deputy Mayor

Cr Tony Allen

Cr Cathy Griff

Cr Mitchell Nadin

Cr Helen O’Neil

Cr David Porter

Cr Joy Robin

Cr Karen Wright

|

Copy:

Chief Executive Officer, Mr

Anthony McMahon

Director, Assets and

Operations, Mr Ian Macfarlane

Director, Community,

Environment and Planning, Mrs Emily Harrison

Director, Business and

Governance, Mrs Iliada Bolton

Acting Manager Communications

and Events, Ms Skye Owen

Executive Officer (Minute

Secretary), Mrs Jackie Grant

|

|

Live Streaming of Council Meetings

Council meetings are recorded and live streamed to the Internet

for public viewing. By entering the Chambers during an open session of

Council, you consent to your attendance and participation being recorded.

The recording will be archived and made available on

Council’s website www.begavalley.nsw.gov.au. All care is taken to

maintain your privacy; however as a visitor of the public gallery, your

presence may be recorded.

Publishing of Agendas And Minutes

The Agendas for Council Meetings and Council Reports for

each meeting will be available to the public on Council’s website as

close as possible to 5.00 pm on the Thursday prior to each Ordinary

Meeting. A hard copy is also made available at the Bega Administration

Building reception desk and on the day of the meeting, in the Council Chambers.

The Minutes of Council Meetings are available on Council's

Website as close as possible to 5.00 pm on the Monday after the Meeting.

1. Please

be aware that the recommendations in the Council Meeting Agenda are

recommendations to the Council for consideration. They are not the

resolutions (decisions) of Council.

2. Background

for reports is provided by staff to the Chief Executive Officer for

presentation to Council.

3. The

Council may adopt these recommendations, amend the recommendations, determine a

completely different course of action, or it may decline to pursue any course

of action.

4. The

decision of the Council becomes the resolution of the Council, and is recorded

in the Minutes of that meeting.

5. The

Minutes of each Council meeting are published in draft format, and are

confirmed by Councillors, with amendments if necessary, at the next

available Council Meeting.

If you require any further information or clarification

regarding a report to Council, please contact Council’s Executive Assistant

who can provide you with the appropriate contact details

Phone (02 6499

2222) or email execassist@begavalley.nsw.gov.au.

Ethical Decision Making and Conflicts of

Interest

A guiding checklist for Councillors, officers and community committees

Ethical decision making

·

Is the decision or conduct legal?

·

Is it consistent with Government policy, Council’s

objectives and Code of Conduct?

·

What will the outcome be for you, your colleagues, the Council,

anyone else?

·

Does it raise a conflict of interest?

·

Do you stand to gain personally at public expense?

·

Can the decision be justified in terms of public interest?

·

Would it withstand public scrutiny?

Conflict of interest

A conflict of interest is a clash

between private interest and public duty. There are two types of conflict:

·

Pecuniary

– regulated by the Local Government Act 1993 and Office of

Local Government

·

Non-pecuniary

– regulated by Codes of Conduct and policy. ICAC,

Ombudsman, Office of Local Government (advice only). If declaring a

Non-Pecuniary Conflict of Interest, Councillors can choose to either disclose

and vote, disclose and not vote or leave the Chamber.

The test for conflict of interest

·

Is it likely I could be influenced by personal interest in

carrying out my public duty?

·

Would a fair and reasonable person believe I could be so

influenced?

·

Conflict of interest is closely tied to the layperson’s

definition of ‘corruption’ – using public office for private

gain.

·

Important to consider public perceptions of whether you have a

conflict of interest.

Identifying problems

1st Do

I have private interests affected by a matter I am officially involved in?

2nd Is

my official role one of influence or perceived influence over the matter?

3rd Do

my private interests conflict with my official role?

Local Government Act 1993 and Model Code of Conduct

For more detailed definitions

refer to Sections 442, 448 and 459 or the Local Government Act 1993 and Bega

Valley Shire Council (and Model) Code of Conduct, Part 4 – conflict of

interest.

Agency advice

Whilst seeking advice is generally useful, the

ultimate decision rests with the person concerned.Officers of the

following agencies are available during office hours to discuss the obligations

placed on Councillors, officers and community committee members by various

pieces of legislation, regulation and codes.

|

Contact

|

Phone

|

Email

|

Website

|

|

Bega

Valley Shire Council

|

(02)

6499 2222

|

council@begavalley.nsw.gov.au

|

www.begavalley.nsw.gov.au

|

|

ICAC

|

8281

5999

Toll

Free 1800 463 909

|

icac@icac.nsw.gov.au

|

www.icac.nsw.gov.au

|

|

Office

of Local Government

|

(02)

4428 4100

|

olg@olg.nsw.gov.au

|

http://www.olg.nsw.gov.au/

|

|

NSW

Ombudsman

|

(02)

8286 1000

Toll

Free 1800 451 524

|

nswombo@ombo.nsw.gov.au

|

www.ombo.nsw.gov.au

|

Disclosure of pecuniary interests / non-pecuniary interests

Under the provisions of

Section 451(1) of the Local Government Act 1993 (pecuniary interests)

and Part 4 of the Model Code of Conduct prescribed by the Local Government

(Discipline) Regulation (conflict of interests) it is necessary for you to

disclose the nature of the interest when making a disclosure of a pecuniary

interest or a non-pecuniary conflict of interest at a meeting.

The following form should

be completed and handed to the Chief Executive Officer as soon as practible

once the interest is identified. Declarations are made at Item 3 of the

Agenda: Declarations - Pecuniary, Non-Pecuniary and Political Donation

Disclosures, and prior to each Item being discussed:

Council

meeting held on __________(day) / ___________(month) /____________(year)

|

Item

no & subject

|

|

|

Pecuniary

Interest

|

In my opinion, my

interest is pecuniary and I am therefore required to take the action

specified in section

451(2) of the Local Government Act

1993 and or any other

action required by the Chief

Executive Officer.

|

|

Significant

Non-pecuniary conflict of interest

|

– In my opinion, my

interest is non-pecuniary but significant. I am unable

to remove the source of conflict. I am therefore required to treat

the interest as if it were pecuniary and take the action specified in section 451(2) of the

Local Government Act 1993.

|

|

Non-pecuniary

conflict of interest

|

In my opinion, my interest is non-pecuniary and less

than significant. I therefore make this declaration as I am required to do pursuant to clause

5.11 of Council’s Code of Conduct. However, I intend to continue to be involved with the matter.

|

|

Nature of interest

|

Be specific and include information

such as :

·

The names of any person or organization with which you have a

relationship

·

The nature of your relationship with the person or organization

·

The reason(s) why you consider the situation may (or may be

perceived to) give rise to a conflict between your personal interests and

your public duty as a Councillor.

|

|

If

Pecuniary

|

Leave

chamber

|

|

If

Non-pecuniary (tick

one)

|

Disclose

& vote Disclose

& not vote Leave

chamber

|

|

Reason

for action proposed

|

Clause 5.11 of Council’s Code of Conduct provides

that if you determine that a non-pecuniary conflict of interest is less than

significant and does not require further action, you must provide an

explanation of why you consider that conflict does not require further

action in the circumstances

|

|

Print

Name

|

I disclose the above

interest and

acknowledge that I will

take appropriate action as I have indicated above.

|

|

Signed

|

|

NB: Please

complete a separate form for each Item on the Council Agenda on which you are

declaring an interest.

Agenda

Statement of Commencement of Live Streaming

Acknowledgement of Traditional Owners of Bega Valley Shire

Statement of Ethical Obligations

1 Apologies and requests for leave of

absence

2 Confirmation Of Minutes

Recommendation

That the Minutes of the Ordinary Meeting held on 19 October

2022 as circulated, be taken as read and confirmed.

3 Declarations

Pecuniary,

Non-Pecuniary and Political Donation Disclosures to be declared and tabled.

Declarations also to be declared prior to discussion on each item.

4 Public Forum – report by Mayor

of deputations heard prior to the meeting

5 Petitions

6 Mayoral Minutes

7 Urgent Business

8 Staff Reports – Community,

Environment and Planning

8.1 Draft

Procedure for reporting Development Applications to Council.................................... 9

8.2 Finalisation

of draft amendments to requirements for off-street car and bicycle parking 17

8.3 Funding

for new local infrastructure contributions plan........................................................ 29

8.4 Clause

4.6 Variations to Development Standards Approved by Council for July to

September 2022....................................................................................................................................................... 34

8.5 Policy

4.14 Burning off in open areas......................................................................................... 38

9 Staff Reports – Assets and

Operations

9.1 Bega

Valley Local Traffic Committee.......................................................................................... 53

9.2 RFT

2223-015 Construction of Kiah & Wandella Community Halls....................................... 99

9.3 RFT

2223-030 Kameruka Lane upgrade................................................................................... 104

9.4 RFT

2122-094 Construction of Bermagui Harbour and Pambula Lake Boat Ramps and

Pontoons..................................................................................................................................................... 109

9.5 Sportsground

Volunteer Site Committee Nominations........................................................ 115

10 Staff Reports – Business and Governance

10.1 Special

Rate Variation - Notice of Intent to Apply................................................................. 119

10.2 Annual

Report 2021-22............................................................................................................... 161

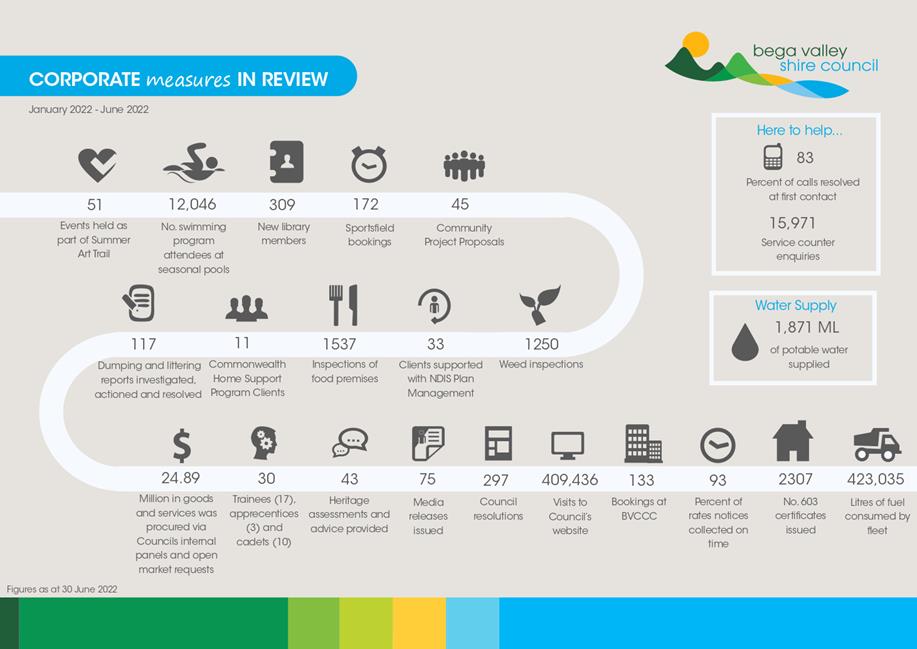

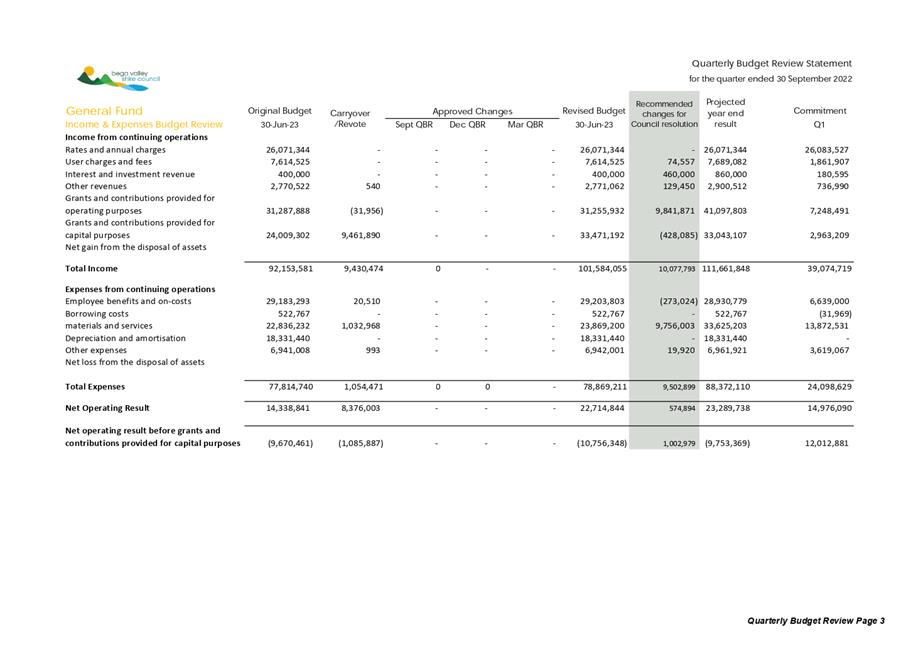

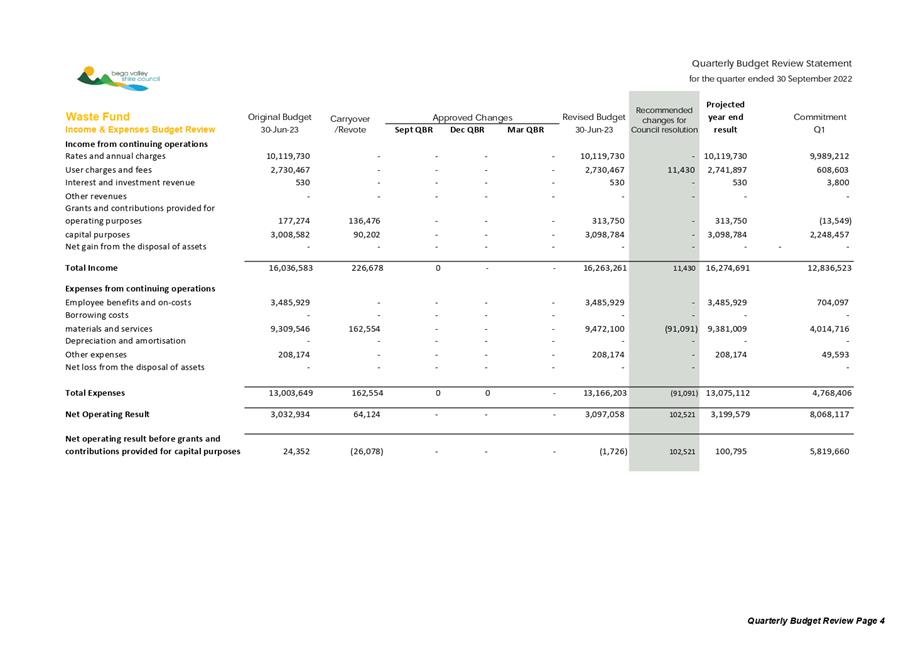

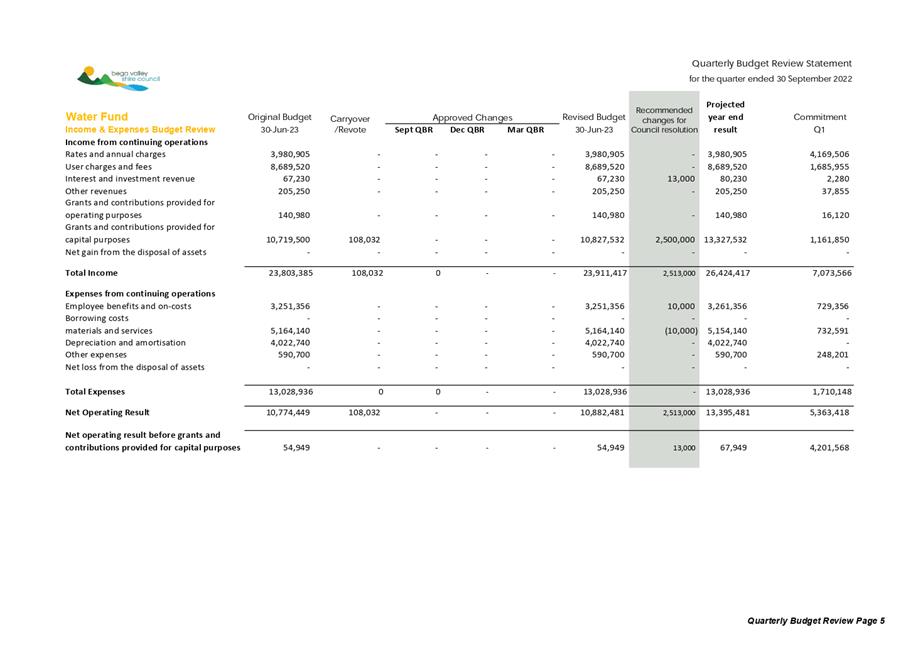

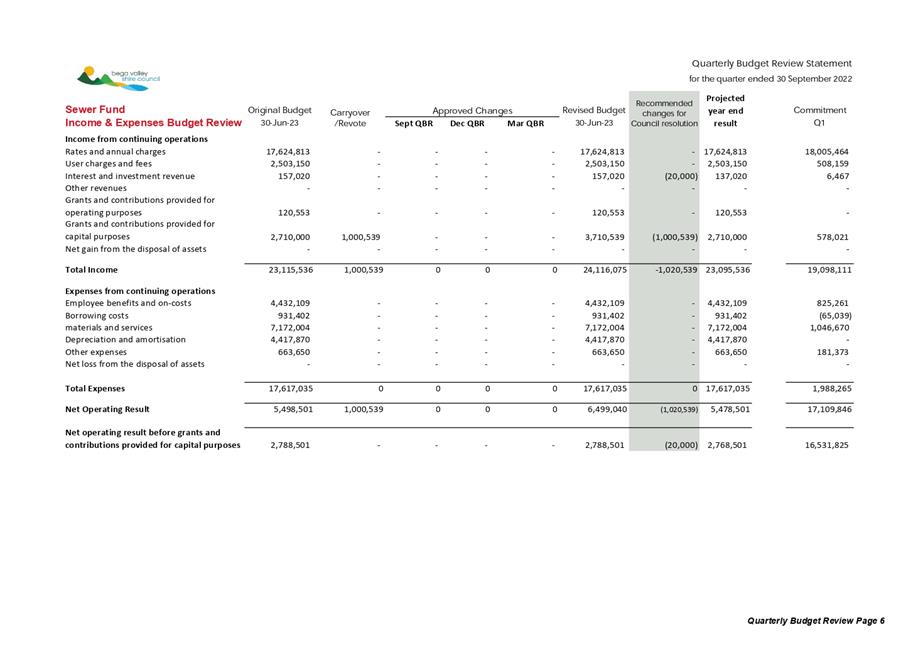

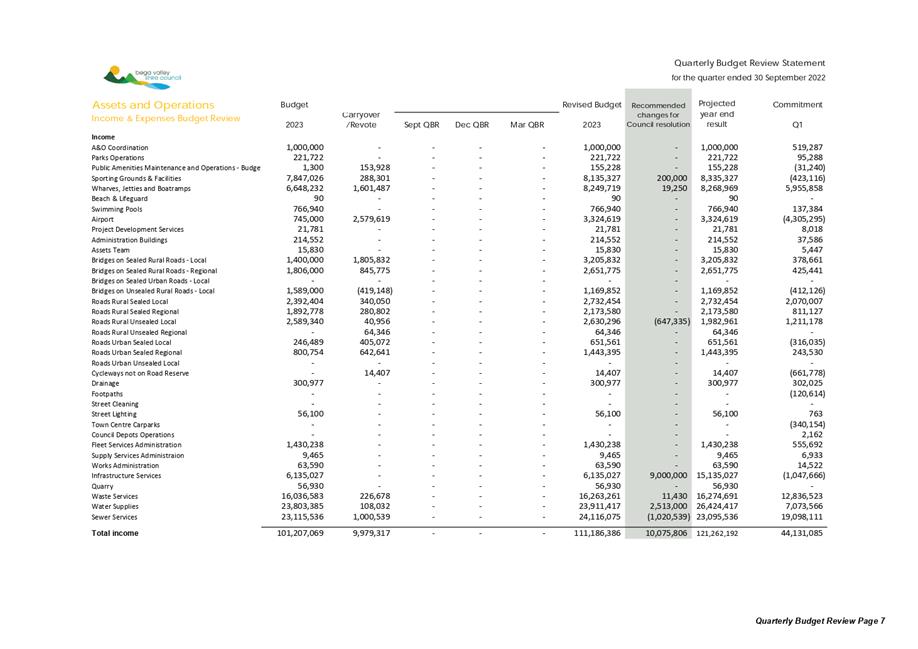

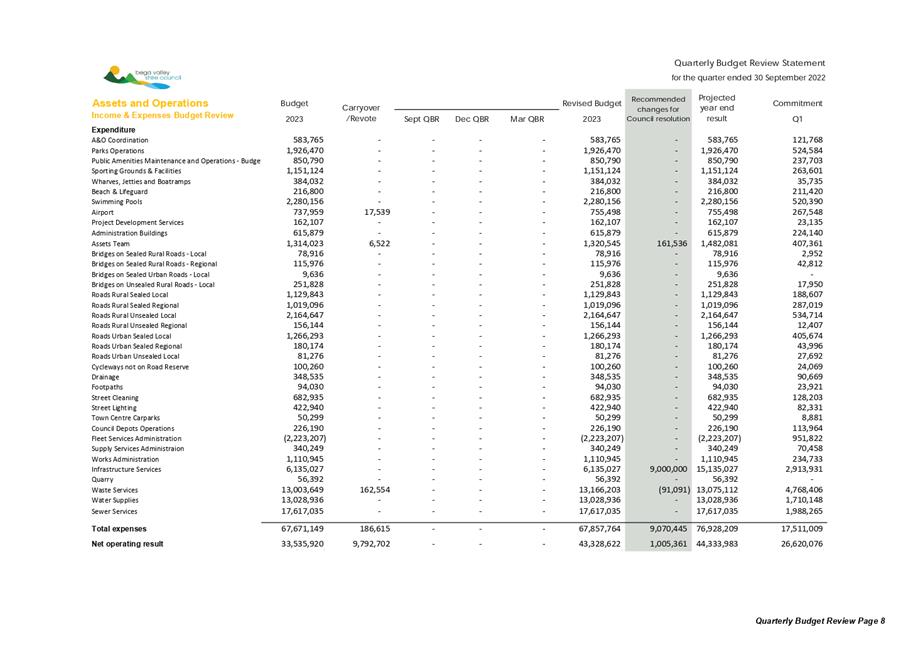

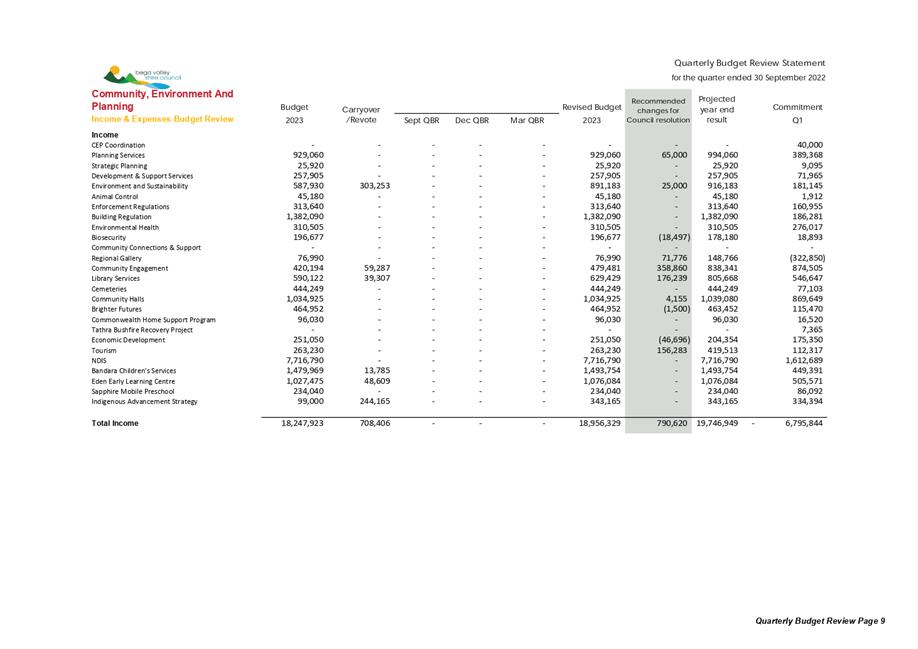

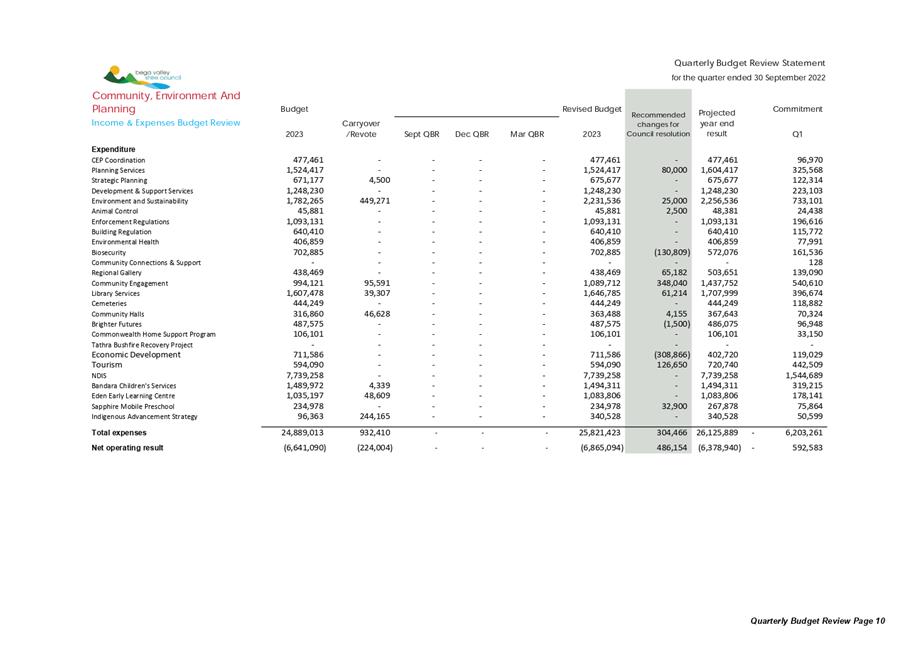

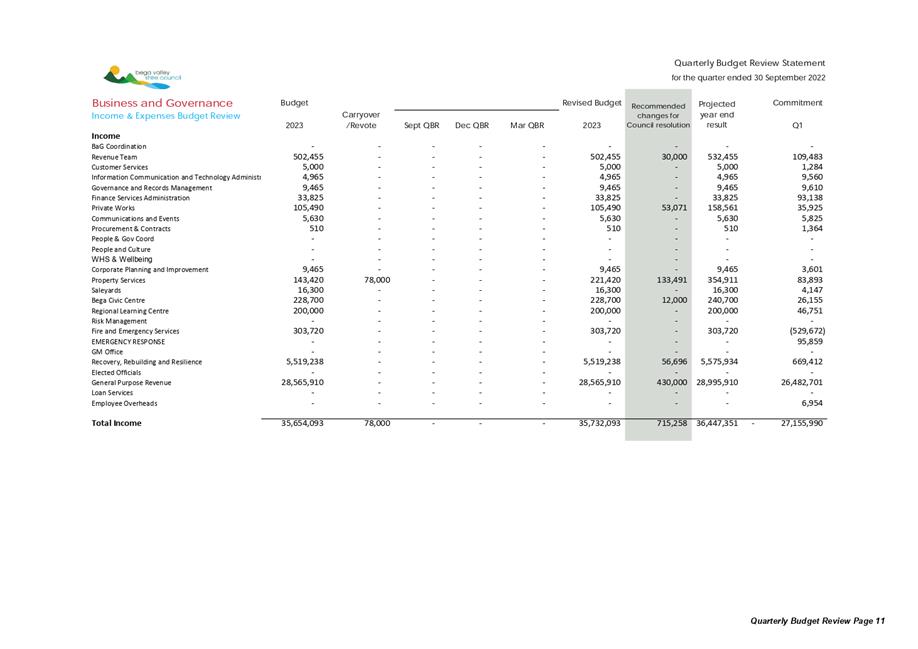

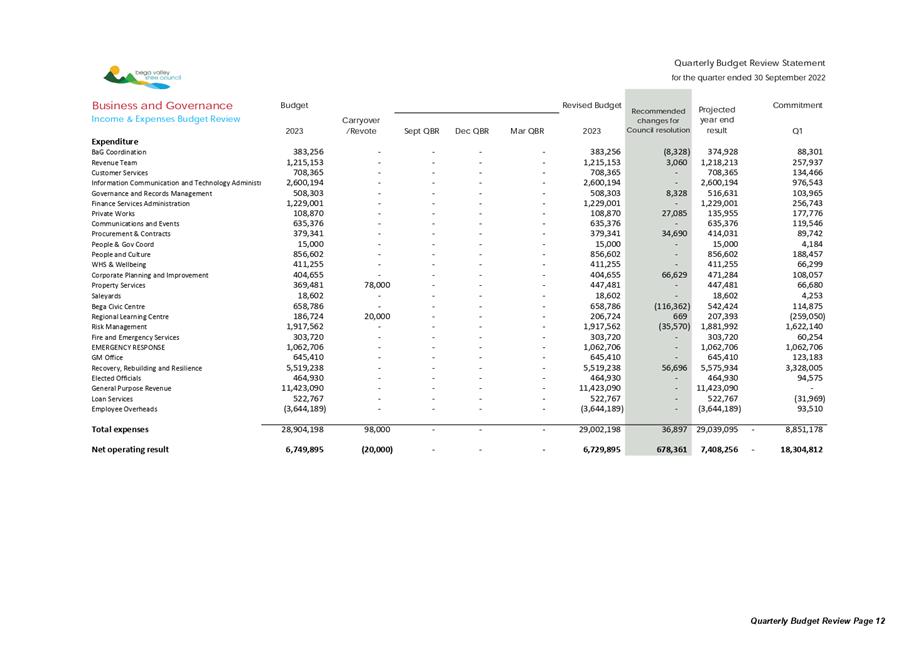

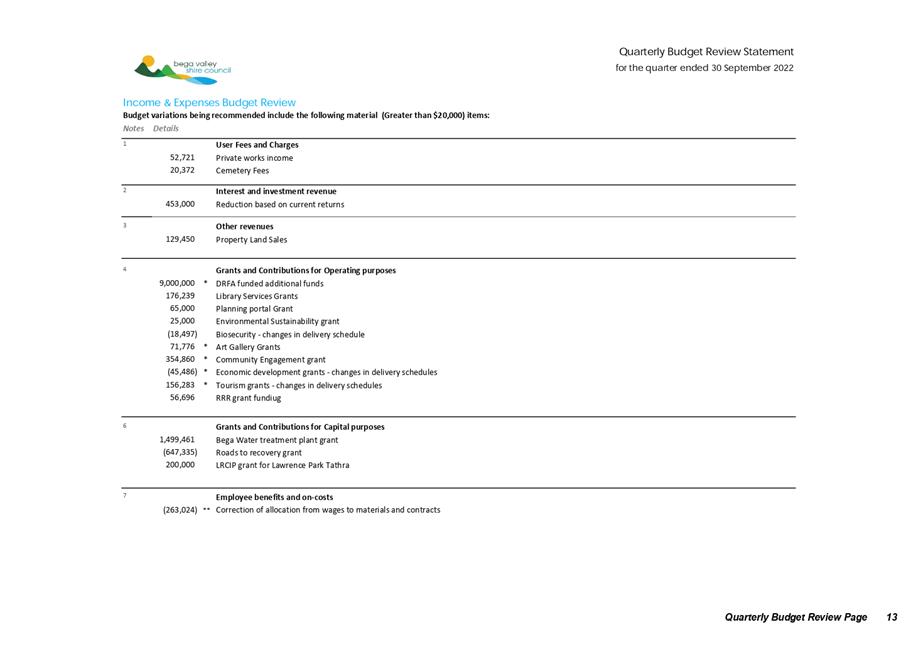

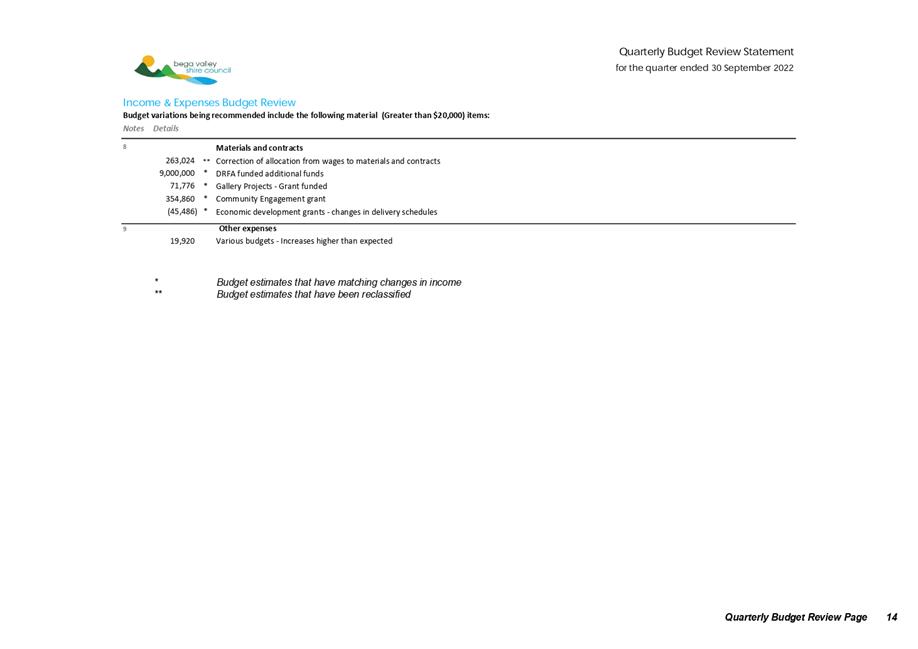

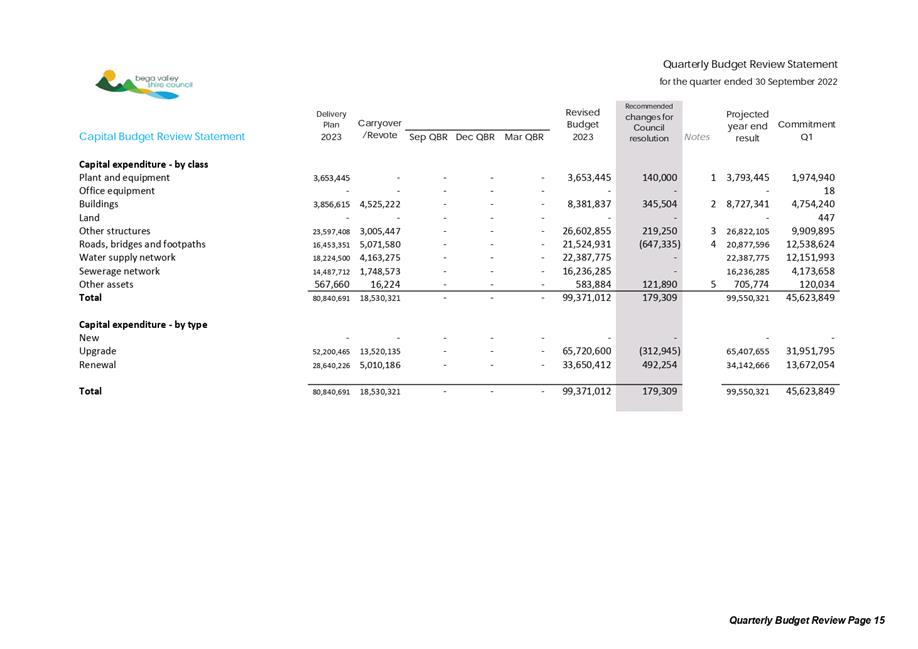

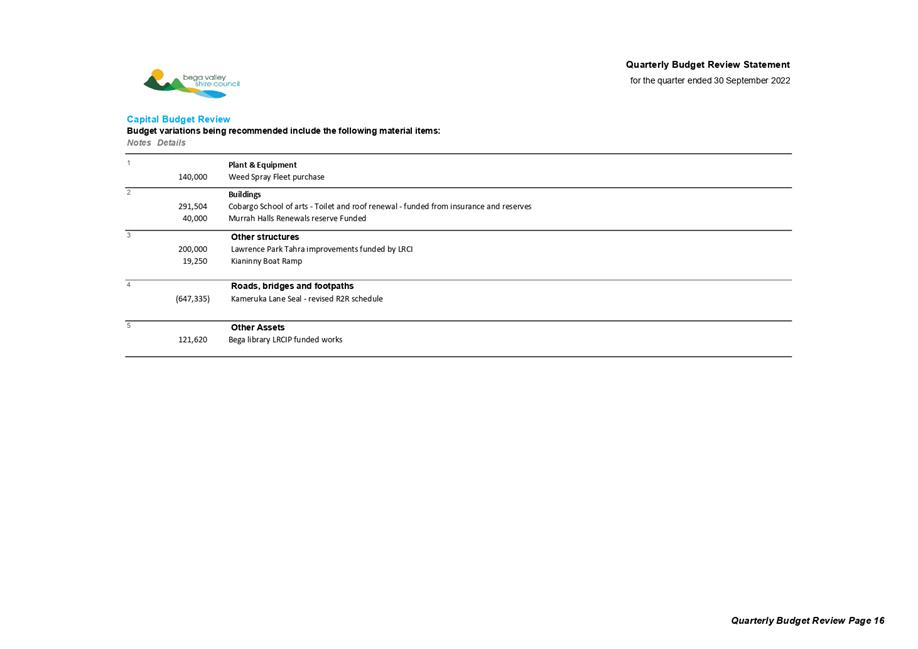

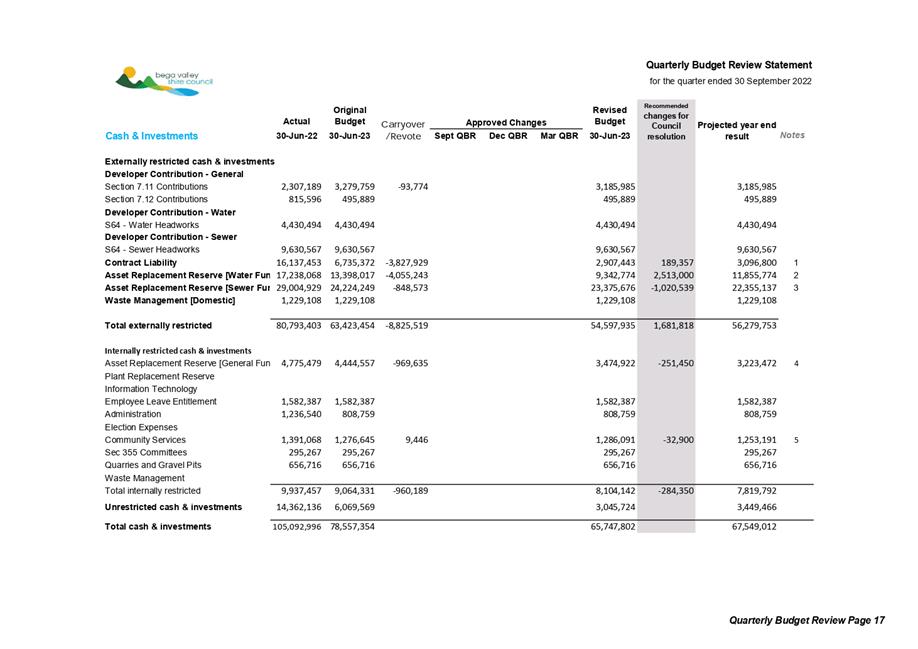

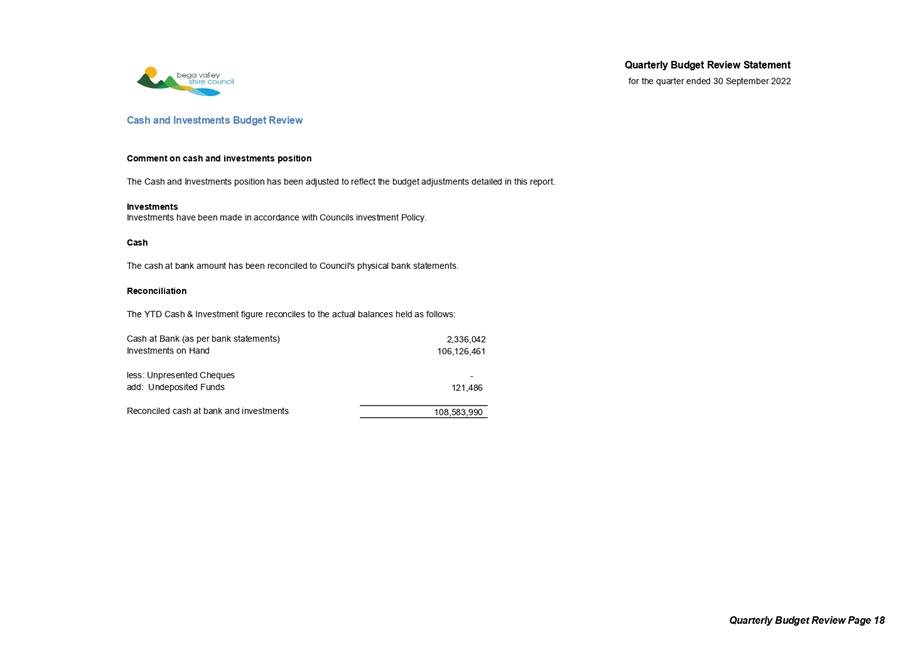

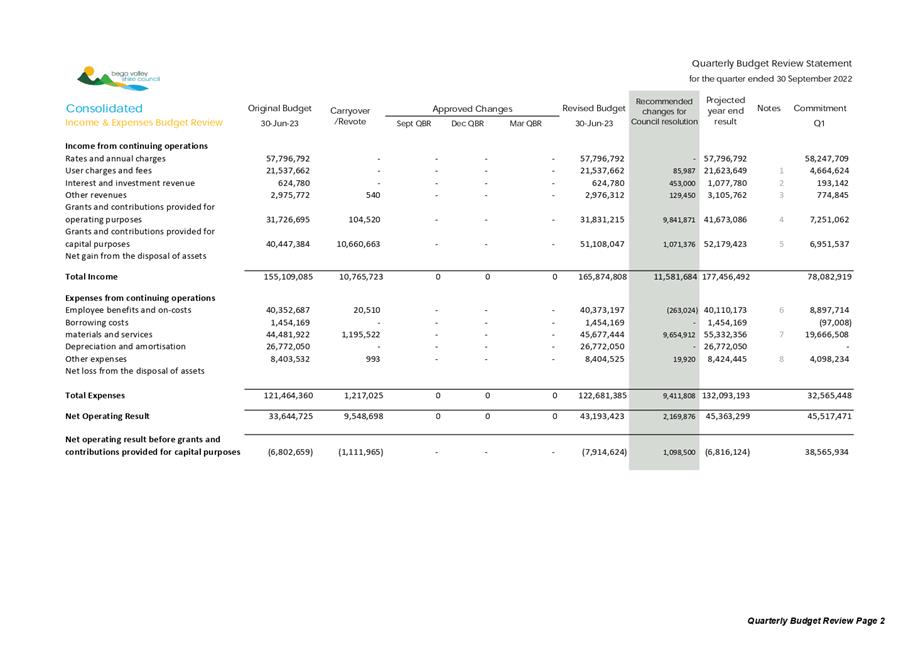

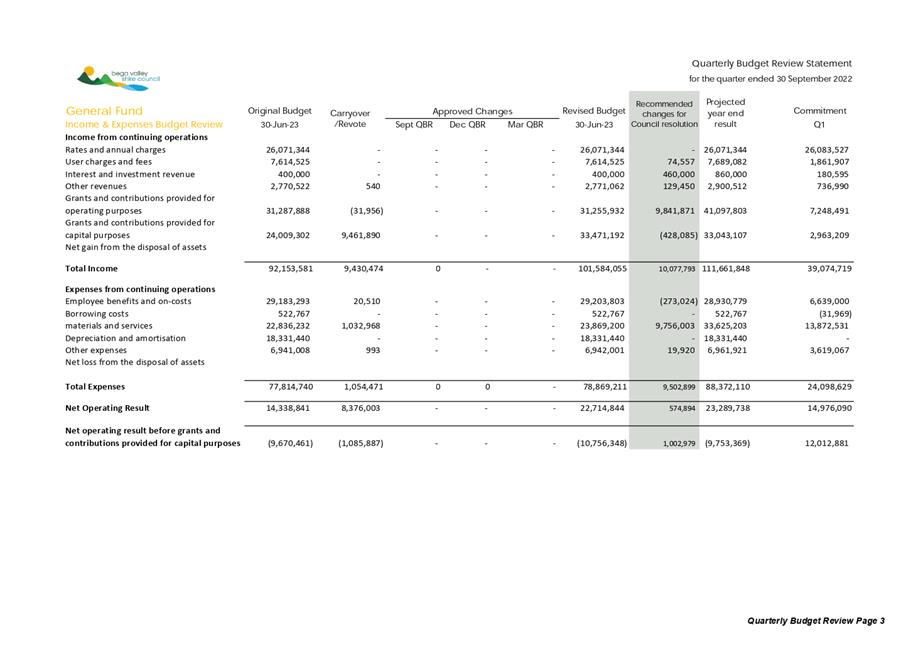

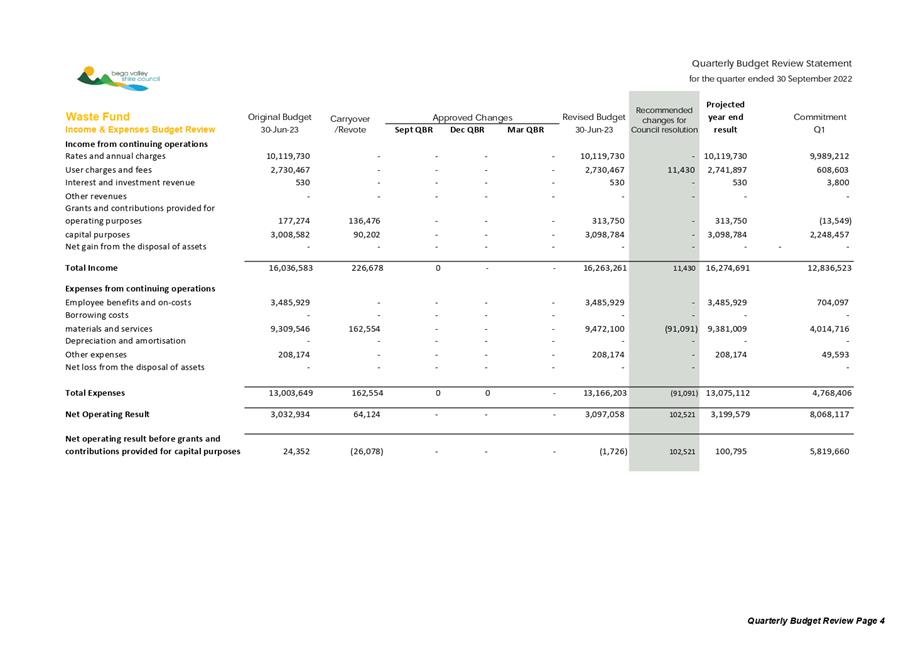

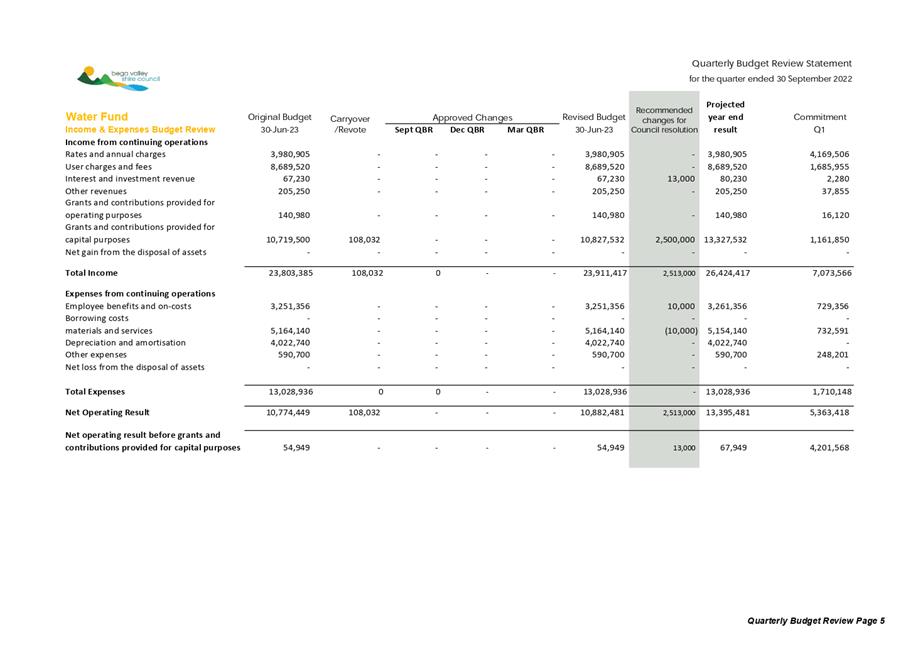

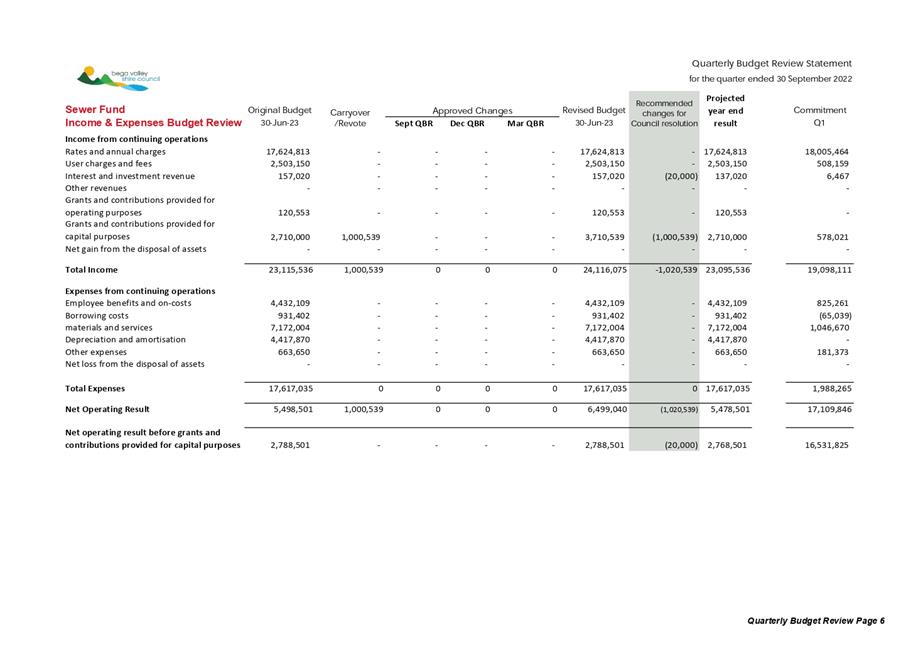

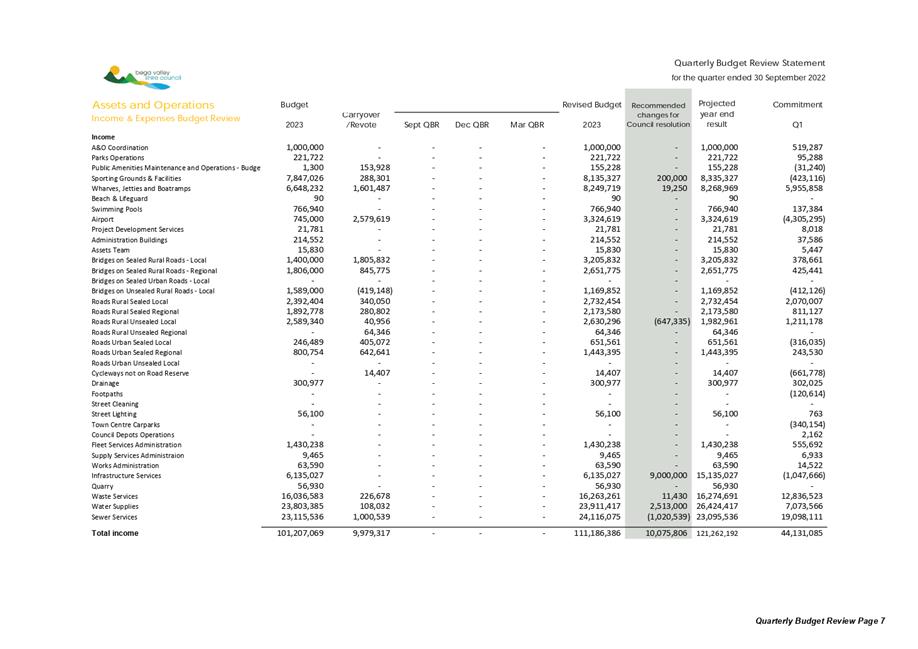

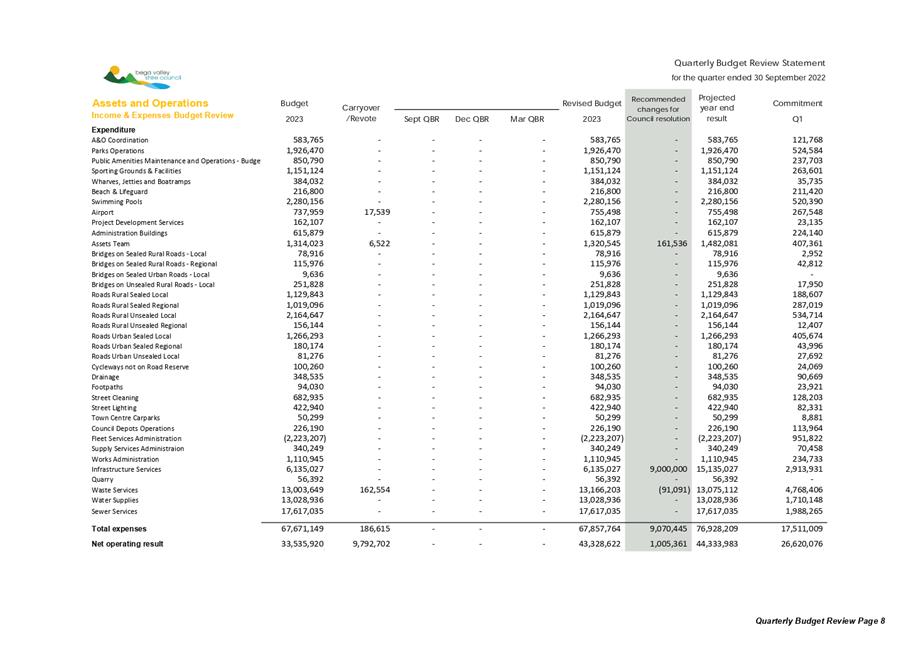

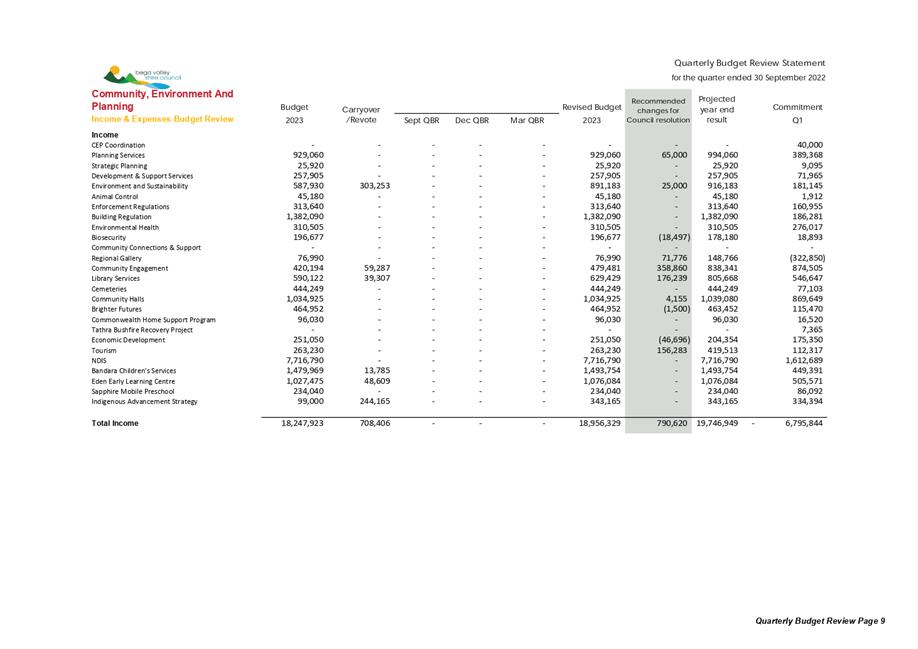

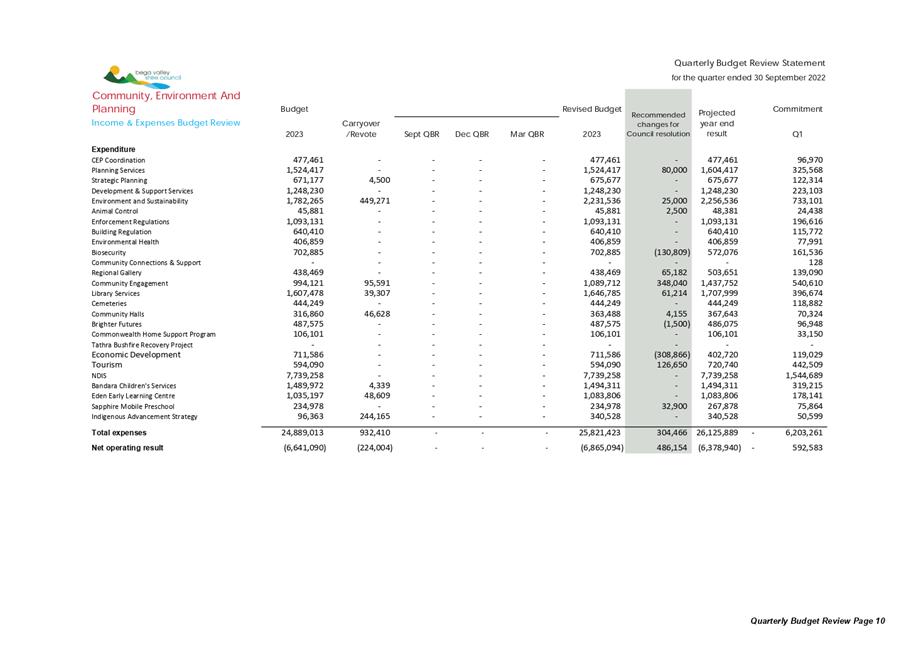

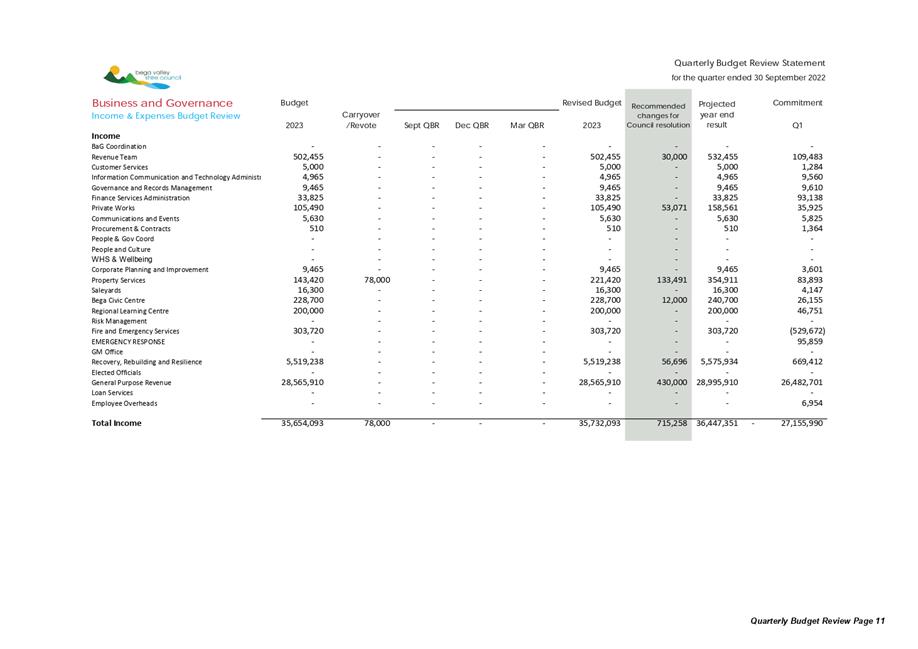

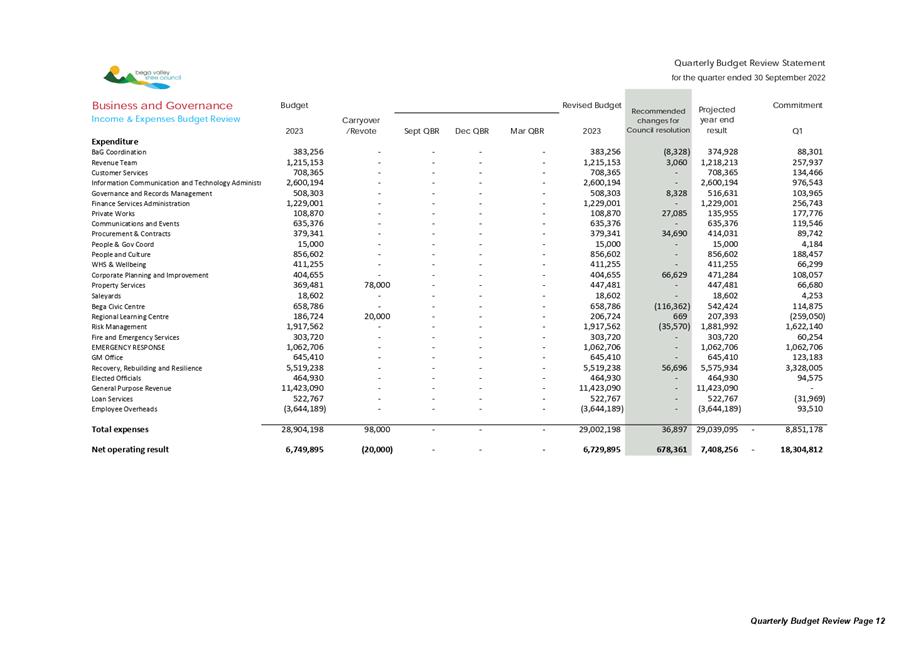

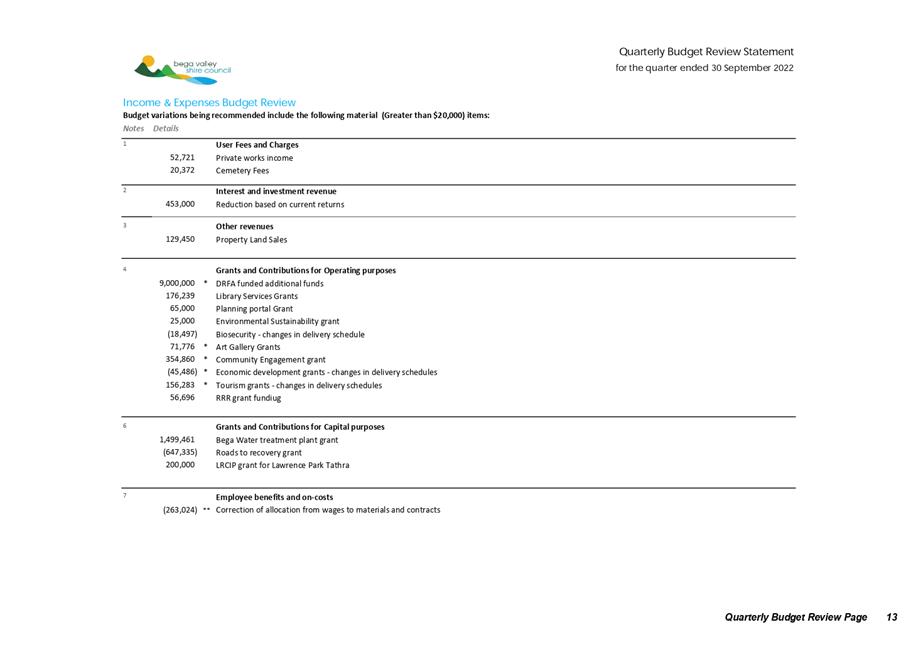

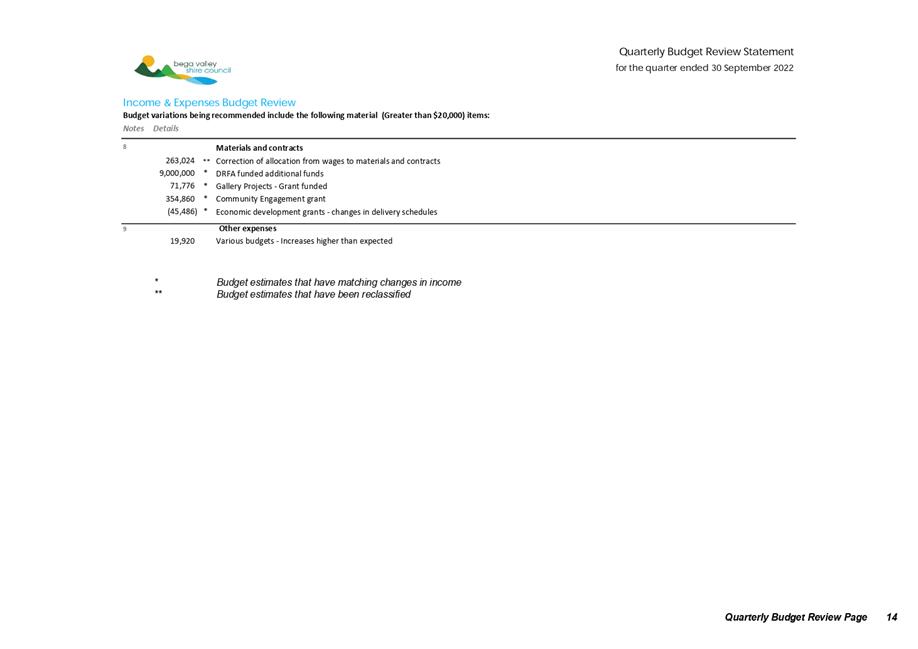

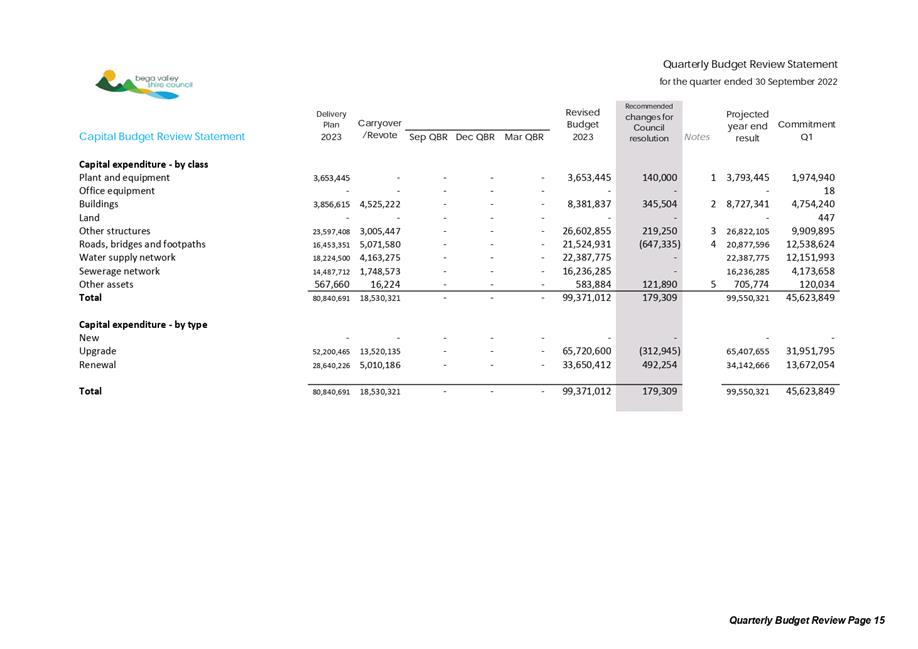

10.3 Quarterly

Budget Review Statement (QBRS) September 2022 - Q1.................................. 292

10.4 Certificate

of Investment October 2022.................................................................................. 317

10.5 Review

of Council Policies - Submission Received on Exhibited Document..................... 323

10.6 Review

of Council Policies - adoption of exhibited documents Batch 5 no submissions

received 331

10.7 Road

alignment rectification - Mount Darragh Road............................................................ 395

10.8 Expression

of Interest 2223-013 Use of reserves................................................................... 404

10.9 Licence

agreement - Tathra Beach Bowling Club................................................................... 409

10.10 Acquisition

of easements for Bega Water Treatment Plant and Water and Sewerage Services

Operations Depot..................................................................................................................... 413

10.11 Bega

Showground Community Centre..................................................................................... 461

10.12 Land

classification - Lot 882 in DP 789858 at 43 Red Gum Road, Yellow Pinch............... 481

10.13 Audit,

Risk and Improvement Committee Annual Report.................................................... 484

10.14 Actions

from resolutions of Council - Progress Report......................................................... 516

11 Councillor Reports

12 Rescission/Alteration Motions

13 Notices of Motion

13.1 Water

and Sewer access charges.............................................................................................. 519

13.2 Social

Justice Advocates development application prioritisation....................................... 521

13.3 Process

for change of rating category...................................................................................... 523

14 Questions with Notice

14.1 Cr

Allen - 2022 Local Government Conference cost update................................................ 527

15 Questions without Notice

16 Confidential Business

Representations by members of the public regarding

closure of part of meeting

Adjournment Into Closed Session, exclusion

of the media and public........................... 527

Statement of Cessation of Live Streaming for the period of the Closed

Session.

Statement of Re-Commencement of Live Streaming

17 Noting of Resolutions from Closed Session

18 Declassification of reports considered previously

in Closed Session

Staff Reports

– Community, Environment and Planning

16 November 2022

8.1 Draft

Procedure for reporting Development Applications to Council.................. 9

8.2 Finalisation

of draft amendments to requirements for off-street car and bicycle parking............................................................................................................................. 17

8.3 Funding

for new local infrastructure contributions plan.................................... 29

8.4 Clause

4.6 Variations to Development Standards Approved by Council for July to

September 2022.................................................................................................. 34

8.5 Policy

4.14 Burning off in open areas................................................................. 38

|

Council 16

November 2022

|

Item 8.1

|

8.1. Draft Procedure

for reporting Development Applications to Council

This report outlines the proposed

process for bringing a Development Application to Council for decision.

Director Community Environment and Planning

Officer’s

Recommendation

That Council adopt the draft Procedure for Reporting

Development Applications (DAs) to Council as included as attachment 1 to this

report.

Executive Summary

Most development applications (DAs) are determined under

staff delegation and are reported to Council in limited circumstances only.

Staff have reviewed this process, as well as the ‘Development

Assessment Best Practice Guide’ issued by the Department of

Planning and Environment, and are recommending changes to provide

greater clarity and transparency in the decision making process. These changes include the development of a new

procedure (Attachment 1).

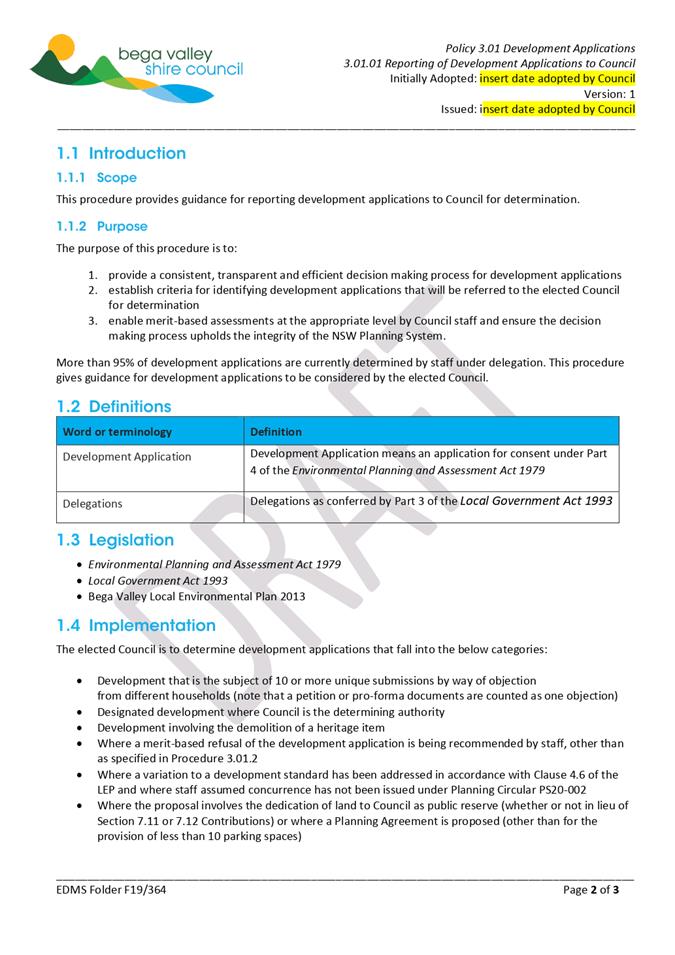

Under the proposed new procedure, the elected Council will

determine development applications in the following circumstances:

· Development that is the subject of 10 or more unique

submissions by way of objection

from different households (note that a petition or

pro-forma documents are counted as one objection)

· Designated

development where Council is the determining authority

· Development

involving the demolition of a heritage item

· Where a merit-based refusal of the development application

is being recommended by staff, other than as specified in Procedure 3.01.2

· Where a variation to a development standard has been

addressed in accordance with Clause 4.6 of the LEP and where staff assumed

concurrence has not been issued under Planning Circular PS20-002

· Where the proposal involves the dedication of land to

Council as public reserve (whether or not in lieu of Section 7.11 or 7.12

Contributions) or where a Planning Agreement is proposed (other than for the

provision of less than 10 parking spaces)

· Where notification in writing has been received by at least

three Councillors that the development application is required to be submitted

to the elected Council for determination. Any such notification should include

reasons or policy position for why the application requires reporting to the

Council for determination

This report seeks Council approval of the new proposed

procedure.

Background

Reporting of development applications to Council for

decision has been in discussion for some time with debate centring around the

number of submissions received or the sensitive nature of the proposed

development. The procedure will provide clarity and transparency in the

decision making process.

Most development applications are currently determined under

staff delegation.

Under the current guidelines a development application is

reported to Council if:

· the development

does not comply with an adopted Council policy (including the Development

Control Plan and land use planning strategies), development standard in the

Local Environmental Plan and in the assessment officer’s opinion, the

non-compliance is not justified

· refusal is

recommended on planning merit grounds (other than as specified in Procedure

3.01.2)

· where there is a

DA that has received strong community interest raising a number of matters on

planning merit, which in the opinion of the Director Community, Environment and

Planning, warrants reporting to Council

· where a Councillor

or senior member of staff is connected with a DA (in accordance with the

provisions of Procedure 3.01.4 – some exemptions apply)

· any variation of a

development standard has been addressed in accordance with Clause 4.6, and

where staff assumed concurrence has not been issued under Planning Circular

PS20.

Further, a Councillor may

call a development application up to Council for decision in accordance with

the following:

A Councillor may, via a Notice of Motion at a Council

meeting, request that any DA be referred to Council for determination. The

request must include:

· the DA number,

which is available on Council’s DA tracker

· one or more

planning reasons for the referral. Planning matters relevant to the evaluation

of a DA are described in Section 4.15 of the Environmental Planning and

Assessment Act 1979 and may include matters such as economic, social and

environmental impacts, site suitability and the public interest.

In 2017 the Department of

Planning and Environment issued the ‘Development Assessment Best

Practice Guide’ to assist Council’s in the development

assessment process. The Guide recommends reporting to Council in the following

circumstances.

· Where there are

more than 10 objections by way of individual submissions from different

households (note that a petition or pro-forma documents are counted as one

objection).

· The development

does not comply with an adopted council policy (including a development control

plan), development standard in a Local Environmental Plan unless, in the

assessment officer’s opinion:

o compliance with the policy is

unreasonable and unnecessary in the circumstances

o any variation of a development

standard has been addressed in accordance with Clause 4.6 or any other

requirements of the council’s Local Environmental Plan.

· The development is

of regional or state significance.

· Notification in

writing has been received by at least three Councillors that the DA is required

to be submitted to the elected council for determination. Any such notification

should include reasons or policy position for why the application requires

reporting to the council for determination.

The proposed BVSC specific procedure has been drafted having

regard to the best practise guide, current process and matters previously

raised in discussions with Councillors. On this basis the following is

recommended as detailed in the attached procedure.

Proposed DAs to be determined by Council under new

procedure

The elected Council is to

determine development applications that fall into the below categories:

· Development that

is the subject of 10 or more unique submissions by way of objection

from different households

(note that a petition or pro-forma documents are counted as one objection)

· Designated

development where Council is the determining authority

· Development

involving the demolition of a heritage item

· Where a

merit-based refusal of the development application is being recommended by

staff, other than as specified in Procedure 3.01.2

· Where a variation

to a development standard has been addressed in accordance with Clause 4.6 of

the LEP and where staff assumed concurrence has not been issued under Planning

Circular PS20-002

· Where the proposal

involves the dedication of land to Council as public reserve (whether or not in

lieu of Section 7.11 or 7.12 Contributions) or where a Planning Agreement is

proposed (other than for the provision of less than 10 parking spaces)

· Notification in

writing has been received by at least three Councillors that the development

application is required to be submitted to the elected Council for

determination. Any such notification should include reasons or policy position

for why the application requires reporting to the Council for determination

Rationale

The following comments are provided to clarify these

recommendations.

· It

is recommended that 10 (as per the DPE Best Practice Guide) is an appropriate

number of submissions but the reference to ‘individual submissions’

be replaced with ‘unique submissions’. It is considered that the

use of the term ‘unique’ will ensure that development applications

being reported to Council relate to a range of planning merit issues that

people feel strongly about rather than one specific issue or a series of form

letters which could be the case without the clarification. Without this

clarification, staff are concerned that minor

merit based planning matters would need to be reported to Council that

otherwise would be determined under staff delegation as is the current situation.

· Designated development is a category of development

that will have a high impact

(e.g. likely to generate pollution) or is located in or near an environmentally

sensitive area (e.g. a wetland), and warrants a detailed environmental impact

statement. It is considered that this type of development should be determined

by the Council.

· There has been much discussion around built heritage

in the shire which has resulted in significant community comment in the past.

It is considered appropriate for any future development applications which

propose to demolish registered heritage items to be reported to Council for

determination.

· Staff do not have

delegation to refuse a development application on planning merit grounds and

there is no recommendation to change this position.

· Deletion of the

reference to regional or state significant development is required as the Joint

Regional Planning Panel or NSW State Government are the determining authority

for this category of development.

· Dedication of land

to Council will always come with ongoing maintenance and administration costs.

Any decisions to accept the dedication of land should be considered by the

Council. Currently there is a Voluntary Planning Agreement Procedure in lieu of

providing on-site car parking in CBD’s. There is no proposal to change

the current Procedure which provides for the Director CEP to approve up to 10

spaces. All other proposed VPA’s are required to be considered by the

Council.

· Adopting the

recommendation of DPE’s Best Practise Guide that DAs can be called up to

Council for determination if a written request is received from 3 Councillors

would provide a more streamlined approach compared to the current requirement

for the Notice of Motion process.

The proposed draft procedure for reporting Development

Applications to Council for decision is at Attachment 1.

Options

The options available to Council are:

· Adopt the draft

procedure as recommended by staff

· Resolve to request

a further report addressing matters identified by Council to be included in a

draft procedure

· Adopt the

recommendations of the Department of Planning and Environment

‘Development Assessment Best Practice Guide’.

Community

and Stakeholder Engagement

Engagement undertaken

The draft Procedure has been reviewed by internal

stakeholders and builds on the current processes in place for reporting

development applications to Council for decision. It considers the best

practice advice issued by the Department of Planning and Environment.

Engagement planned

No further engagement is planned following this report to

Council should the draft procedure be adopted. If adopted, the procedure will

be published on Council’s website in the policies and procedures

database.

Financial

and Resource Considerations

Drafting

procedures is part of the regular business of Council and resourcing to

undertake this function is included in Council’s adopted 2022–23

Budget. If adopted, the new procedure will not have any additional budget or

resourcing implications.

Legal

/Policy

The draft procedure clearly outlines Council policy for

reporting development applications to Council for determination.

Note the provisions regarding Councillor and senior staff

DAs being considered by Council are covered by Procedure 3.01.4.

Impacts

on Strategic/Operational/Asset Management Plan/Risk

Strategic

Alignment

The draft Procedure aligns with the Bega Valley Community

Strategic Plan 2042 strategy E.8: Council has a governance framework that

promotes and guides accountability and transparency.

Environment

and Climate Change

There are no direct environment or climate change impacts

arising from the adoption of the draft procedure.

Economic

There are no direct economic implications arising from

adoption of the draft procedure.

Risk

The procedure clearly identifies which development

applications will be reported to Council for decision and addresses the risk of

a development application being determined without appropriate delegation.

Social

/ Cultural

There are no direct social or

cultural impacts arising from the adoption of the draft procedure.

Attachments

1⇩. DRAFT

procedure 3.01.01 Reporting of development applications to Council

|

Council

|

16 November 2022

|

|

Item 8.1

- Attachment 1

|

DRAFT procedure 3.01.01 Reporting of development applications

to Council

|

|

Council 16

November 2022

|

Item 8.2

|

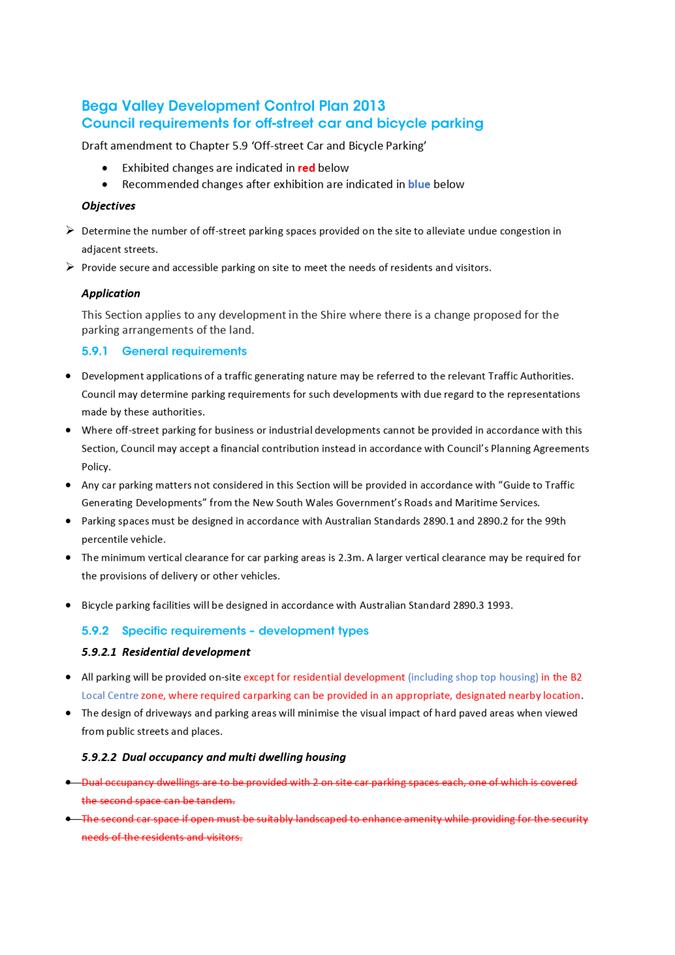

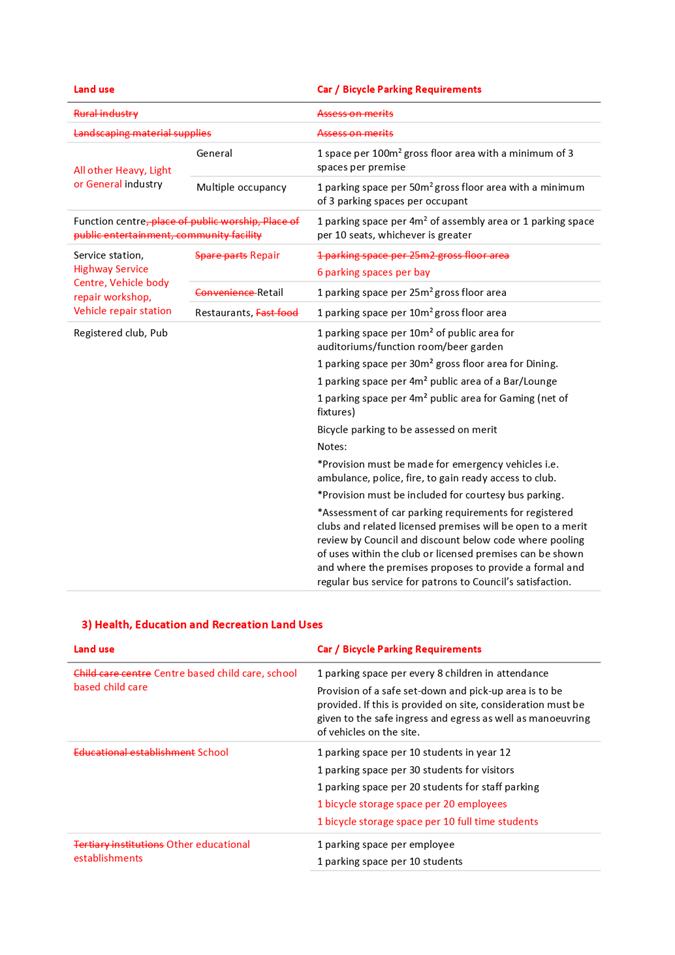

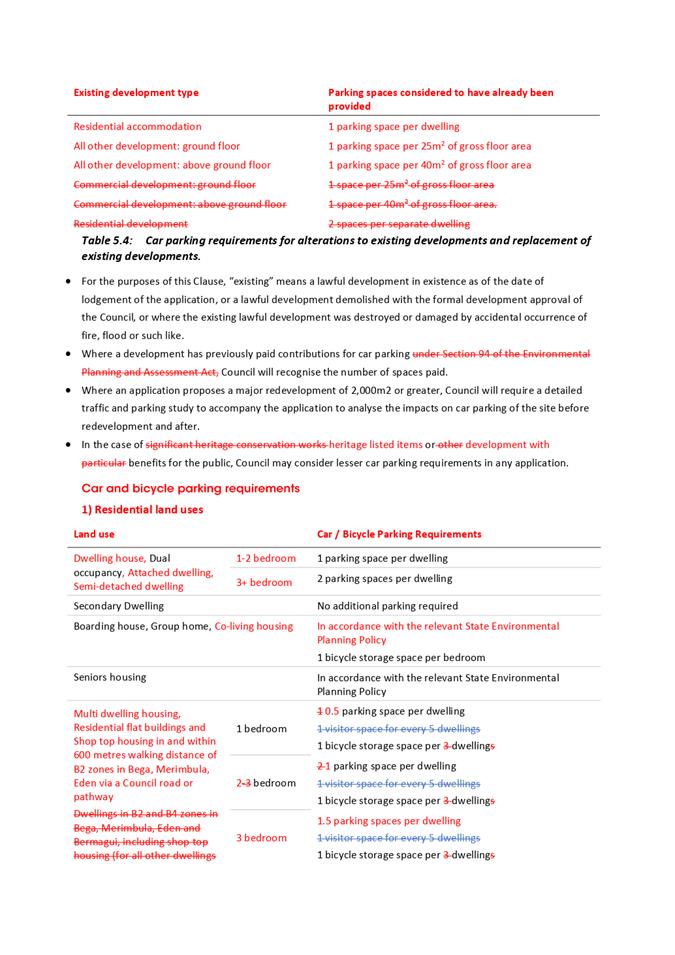

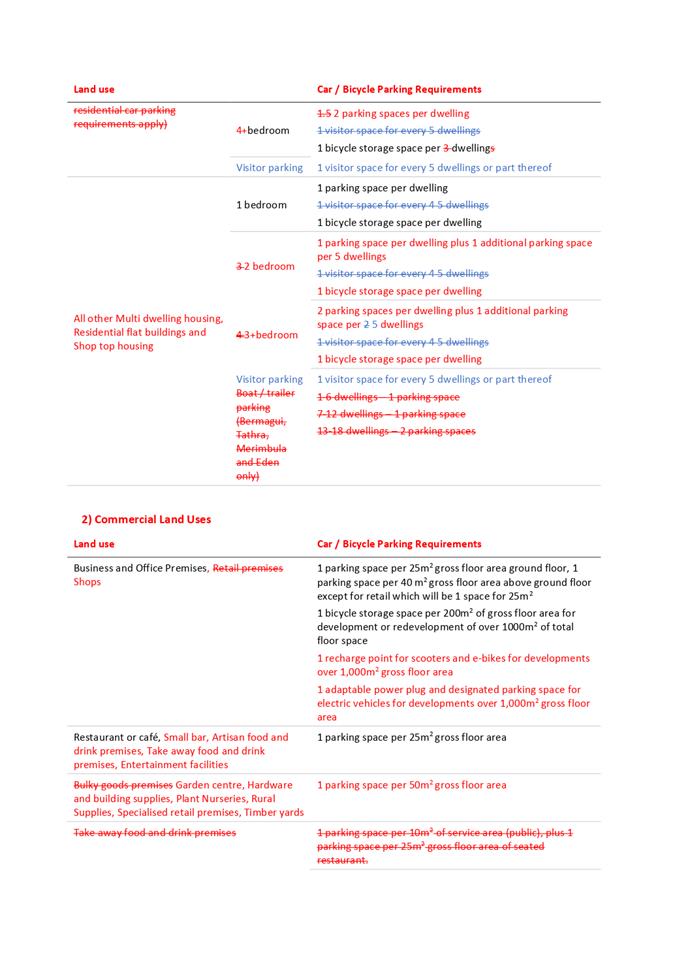

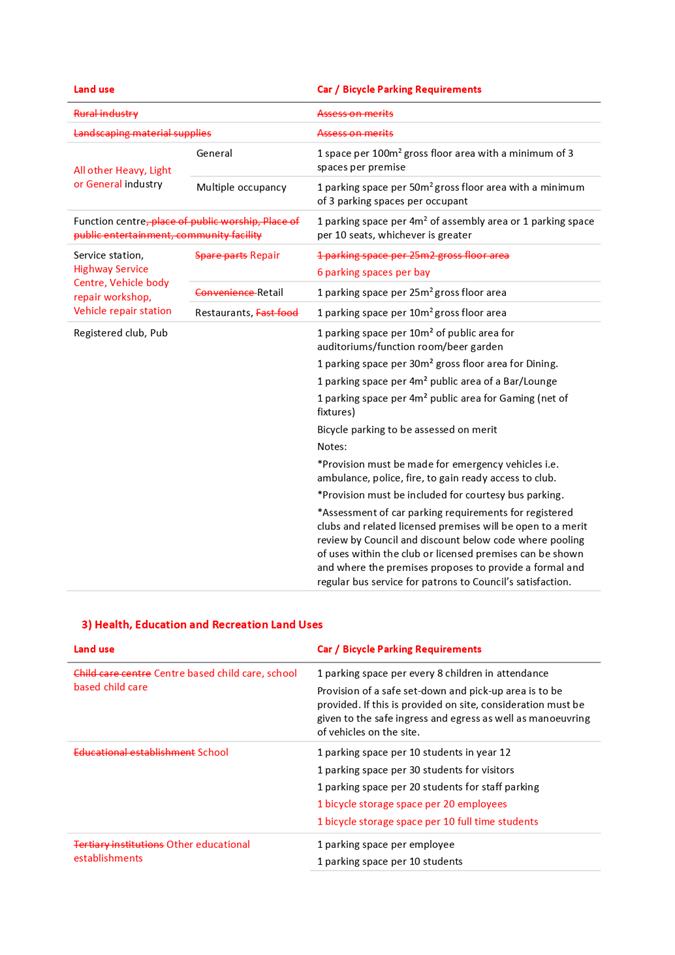

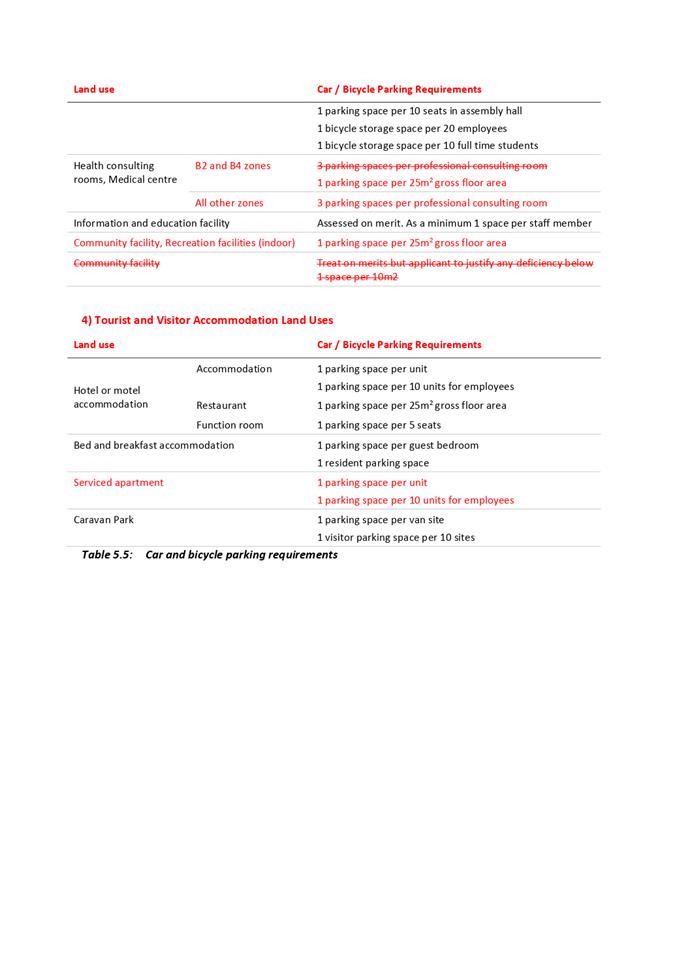

8.2. Finalisation of

draft amendments to requirements for off-street car and bicycle parking

This report seeks Council’s

support for the finalisation of proposed amendments to the requirements for

off-street car and bicycle parking in the Bega Valley Development Control

Plan 2013.

Director Community Environment and Planning

Officer’s

Recommendation

1. That Council

resolve to adopt the amendments to the requirements for off-street car and

bicycle parking in the Bega Valley Development Control Plan 2013 as

contained in Attachment 1 to this report.

2. That the

adoption of the amendment to the Bega Valley Development Control Plan 2013

be notified in accordance with the Environmental Planning and Assessment

Regulation 2021.

3. That those who

made submissions to the amendment to the Bega Valley Development Control

Plan 2013 be notified of Council’s decision.

Executive Summary

On 17 August 2022 Council considered a report regarding the ‘Finalisation

of draft amendments to requirements for off-street car and bicycle

parking’ and resolved to defer the item pending a Councillor workshop.

This workshop was held on 28 September 2022 and the matter is being presented

again for Council’s consideration.

A number of amendments to the Council requirements for

off-street car and bicycle parking in the Bega Valley Development Control

Plan 2013 (DCP 2013) were publicly exhibited to align with the

recommendations of the Bega Valley Shire Commercial Land Strategy 2040

and the Bega Valley Shire Affordable Housing Strategy. This report seeks

Council’s resolution to adopt the proposed amendments to DCP 2013 with

several minor changes in response to issues raised in submissions.

The proposed amendments aim to:

· make housing more

affordable by decreasing the strata area of units and incentivising development

of small dwellings

· reduce car parking

requirements for units to align with actual car ownership rates

· support the

transition to renewable energy by requiring large commercial developments to

provide recharge points for scooters and e-bikes, and adaptable power plugs and

designated parking spaces for electric vehicles

· create

opportunities for commercial and residential development in town centres through

more flexible or reduced car parking requirements.

Background

A number of amendments to the requirements for off-street

car and bicycle parking in the DCP 2013 are proposed which aim to reduce

vacancy rates in commercial centres, address changes in transportation and

incentivise the development of desirable housing forms in and around town

centres.

The draft DCP 2013 amendments include changes to

Council’s car parking policy to:

· help activate

commercial centres and encourage occupancy through car parking concessions for

land uses and streamlining approvals for change of use applications

· incentivise the

provision of more affordable and low-cost housing by reducing car parking

requirements for multi-dwelling housing and residential flat buildings in and

around the Bega, Eden and Merimbula CBDs

· align car parking

requirements for apartments with car ownership rates and state government

recommendations.

The amendments to the DCP 2013 were publicly exhibited from

31 May to 3 July 2022. Two submissions were received. This report outlines the

feedback received during community consultation and recommends that Council

proceed to amend DCP 2013 as exhibited, with minor changes as identified in

Attachment 1.

On 17 August 2022 Council considered a report regarding the

‘Finalisation of draft amendments to requirements for off-street car and

bicycle parking’ and resolved to defer the item pending a Councillor

workshop. This workshop was held on 28 September 2022 where Council officers

presented the background and reasoning for the proposed amendments to the DCP

2013.

Options

The proposed changes to the DCP 2013 have been developed in

response to adopted strategic directions of Council, therefore adoption of the

proposed amendments with minor changes (Attachment 1) is the recommended

option.

However, Council could resolve not to proceed with the

adoption of all or some of the proposed changes.

Community

and Stakeholder Engagement

Engagement undertaken

Community engagement was carried out in accordance with

Council’s Community Engagement Strategy and Community Engagement and

Communications Toolkit. The project was assessed to be Level 2 - Consult on

the IAP2 spectrum. The draft DCP 2013 amendment was publicly exhibited from 31

May to 3 July 2022 and was advertised on Council’s website, Facebook page

and notified to the Development Professionals Group via email. Two public submissions

were received.

Summary

of submissions

The following is a summary of the issues

raised in the submissions to the exhibition, with staff response and any

recommended changes to the exhibited draft.

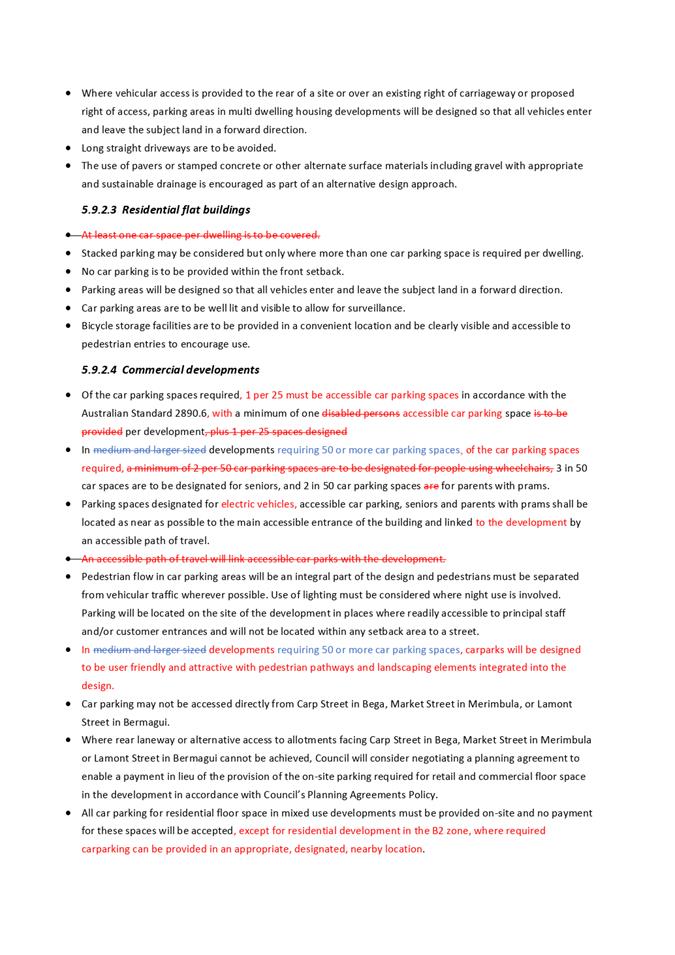

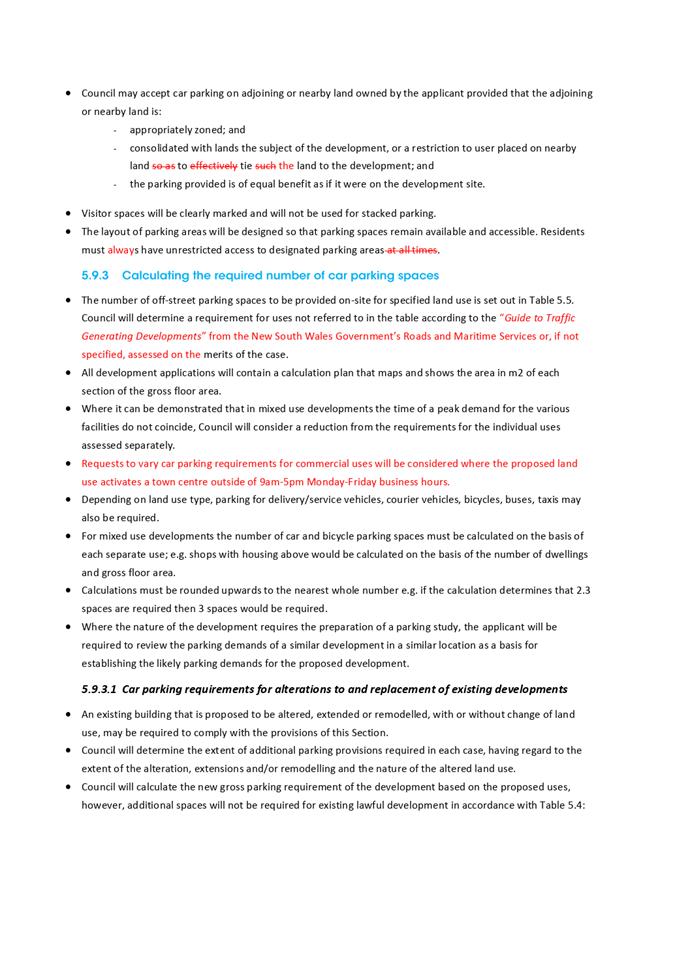

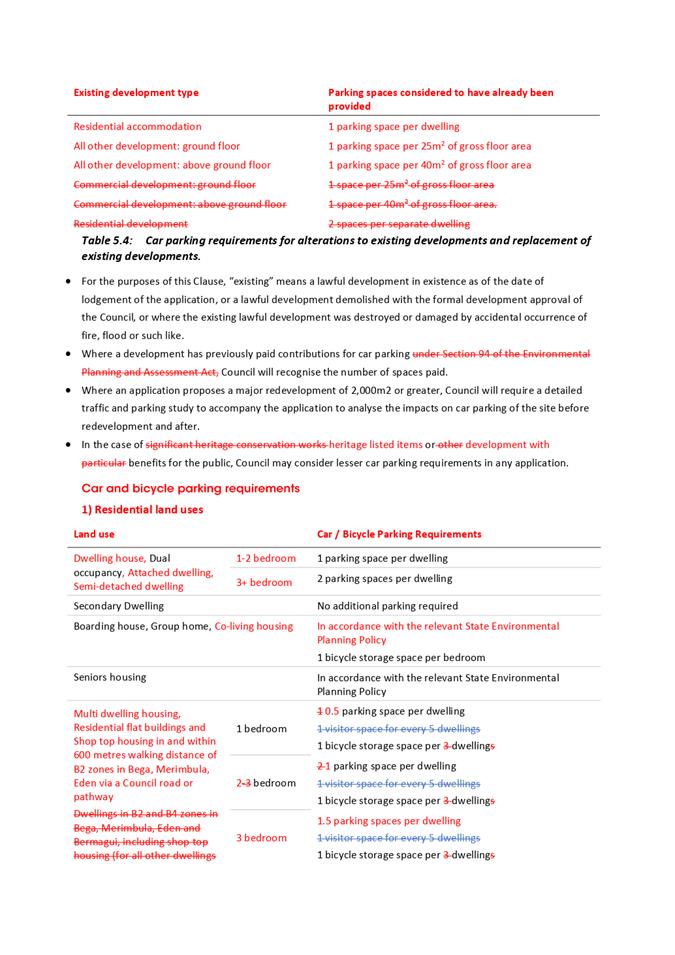

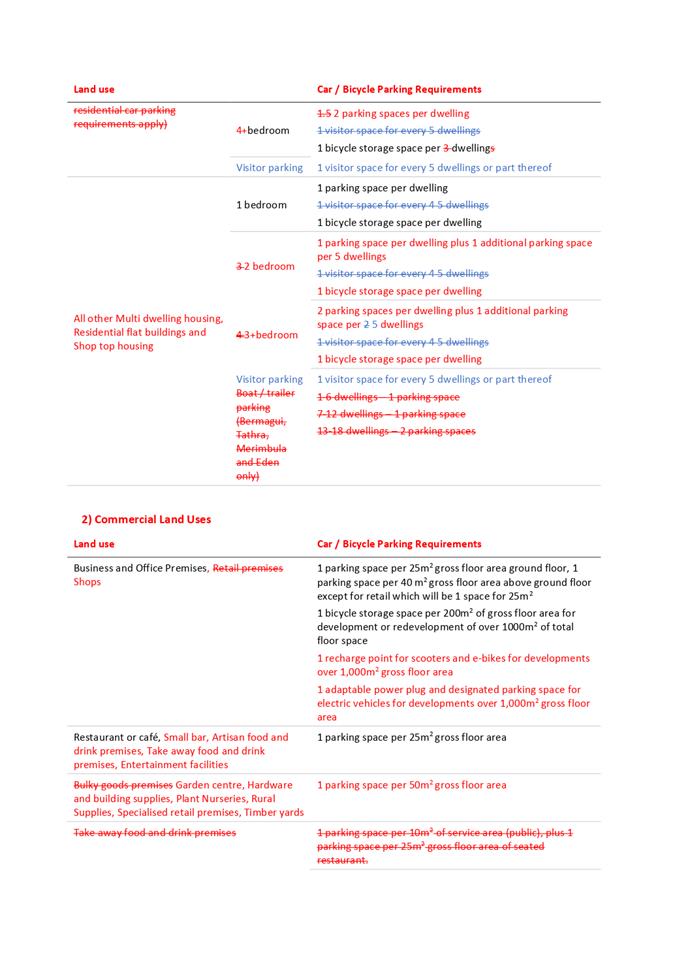

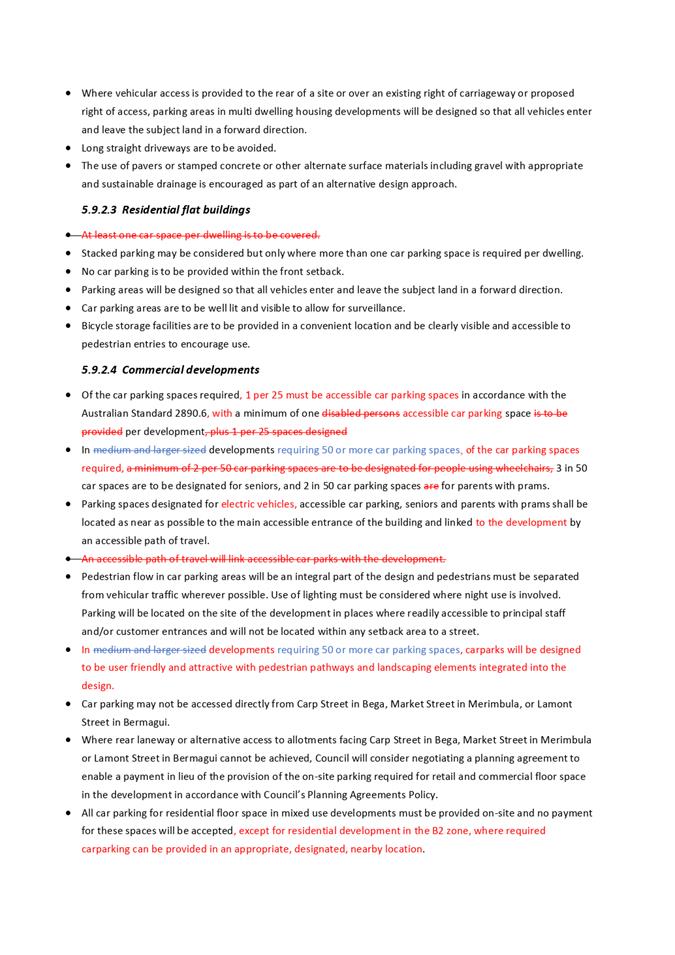

1) Provisions for residential development

in the B2 zone

Issue summary: The option of providing off-site parking for residential

development in the B2 Local Centre zone is welcomed but needs to clarify if the

provision applies to shop-top housing.

Staff comment: The reference to residential development, rather than shop-top

housing, reflects the other land uses permitted and proposed to be permitted in

the B2 Local Centre zone.

Recommendation: The following changes to the draft section 5.9.2.1 Residential

development (addition of underlined) are recommended to clarify that the

provisions apply to shop top housing:

· All parking will be

provided on-site except for residential development (including shop top

housing) in the B2 Local Centre zone, where required carparking can

be provided in an appropriate, designated nearby location.

2) Defining medium and large size

commercial development

Issue summary: medium and large size commercial development need to be defined

more clearly to remove ambiguity.

Staff comment: Noted.

Recommendation: The following changes to draft section 5.9.2.4 Commercial

development (removal of strikethrough and addition of

underlined) are recommended:

· In

developments requiring 50 or more car parking spaces, a minimum of 2 in 50 car

parking spaces are to be designated for people using wheelchairs, 3 in 50 car

spaces are to be designated for seniors, and 2 in 50 car parking spaces are for

parents with prams.

· In

developments requiring 50 or more car parking spaces, carparks will be designed

to be user friendly and attractive with pedestrian pathways and landscaping

elements integrated into the design.

3) Requirements for shop-top housing

in Bega

Issue summary: It is difficult to

understand the difference in the requirements for shop-top housing in Bega

compared to smaller towns.

Staff comment: Car parking rates for multi dwelling housing, residential flat

buildings and shop top housing are proposed to be discounted within 600 metres

walking distance, via a Council road or pathway, of the B2 zones in the town

centres of Bega, Eden and Merimbula as recommended in the Bega Valley Shire

Affordable Housing Strategy. The reduction in parking requirements reflects

actual car ownership rates and would provide an incentive for development

of one bedroom apartments.

Census data (2021) identifies that car

ownership rates are lower in Bega, Eden and Merimbula than in other parts of

the shire, including in other town centres. For example, in Bega, Eden and

Merimbula, households with no car make up 10% of the population, whereas for

other towns and villages the rate is 3.8%.

Recommendation: No changes are recommended to the draft.

4) Requirements for apartments

Issue summary: The disparity between requirements for two and three bedroom

apartments is not equitable or necessary and will result in developers pursuing

smaller 1-2 bedroom apartments, rather than 3+ bedroom apartments.

Staff comment: The changes to the car parking provisions for two and three bedroom

apartments are specifically designed to incentivise the provision of smaller

dwellings. The Bega Valley Shire Affordable Housing Strategy details

that by 2036, around 70% of affordable housing need will be for smaller (lone

person and couple only) households. The strategy found that Council’s car

parking standards have been a disincentive to the supply of one and two bedroom

dwellings and that given the forecast increase in lone person and couple

households and subsequent demand for affordable dwellings, it was necessary to

amend the car parking requirements for one and two bedroom dwellings to remove

this disincentive.

In reviewing this submission, council

officers found an error in the parking requirements for some 3+ bedroom

dwellings and that the additional spaces required for visitor parking require

clarification.

Recommendation:

The following changes to Table 5.5 are

recommended:

· Remove the per bedroom requirement for visitor parking for multi

dwelling housing, residential flat building and shop-top housing and uniformly

apply 1 visitor space for every 5

dwellings or part thereof

· Reduce the parking requirement for 3+ bedrooms for ‘all other

multi dwelling housing, residential flat building and shop-top housing’

from 2 parking space per dwelling plus 1

additional parking space per 2 dwellings to 1 additional parking space per 5

dwellings

5) Adoption of city parking standards

Issue summary: There is inadequate public transport for adoption of city parking

standards and minimum car space provision should be 1 space and not 0.5 space.

Staff comment: The proposed amendments to the car parking requirements for medium

density developments in and within 600 metres walking distance of B2 zones in

Bega, Merimbula and Eden were tested against household car ownership Census

data (2021). It was found that the total likely car parking spaces required

based on an average spread of car ownership as per the 2021 Census data aligns

very closely to the proposed amendments to car parking standards in Bega, Eden

and Merimbula. The existing DCP 2013 requires that the total number of

carparking spaces required is rounded up to the nearest whole number.

Recommendation: No changes are recommended to the draft.

Engagement planned

No further engagement is planned.

Financial

and Resource Considerations

The development of the amendments to the DCP 2013 and its

public exhibition have been undertaken as part of Council’s regular work

program and within the adopted 2021-22 budget.

Legal

/Policy

Exhibition of the draft amendment to the DCP 2013 was

consistent with Council’s obligations under the Environmental Planning

and Assessment Regulation 2021.

Impacts

on Strategic/Operational/Asset Management Plan/Risk

Strategic

Alignment

The draft amendment to the DCP 2013:

· supports the

recommendation of the Bega Valley Shire Affordable Housing Strategy to

‘open up opportunities through the market for an increase in the supply

of well-located smaller strata dwellings (Residential flat buildings and Multi

dwelling housing) through relevant amendments to its environmental planning

instruments’

· supports the

recommendation of the Bega Valley Shire Commercial Land Strategy 2040 to

‘Introduce flexible on-site car parking requirements for certain

commercial uses’

· is consistent with

achieving the planning priorities for housing and town centres of the Bega

Valley Shire Local Strategic Planning Statement 2040

· is consistent with

strategies A.9. Collaborate with relevant agencies and the private sector to

increase the diversity and affordability of new and existing housing,

particularly to meet the needs of our ageing population and B.2. Collaborate

with relevant parties and industry to promote and support opportunities to

diversify and grow our economy and provide local jobs of the Bega Valley

Shire Community Strategic Plan 2042.

Environment

and Climate Change

The proposed changes to the DCP 2013 will help to address

the impacts of climate change by including provisions that encourage cycling

and the use of scooters, e-bikes and electric vehicles.

Economic

The proposed changes to the DCP 2013 will have positive

economic impacts for the local community by incentivising the supply of diverse

housing types closer to town centres and removing potential impediments to new

residential and commercial development.

Risk

The proposed changes to the DCP

2013 will reduce the risk that desirable residential and commercial development

does not proceed in the Bega Valley Shire.

Social

/ Cultural

The

proposed changes to the DCP 2013 will have positive social impacts for the

local community by improving the supply and diversity of housing and

encouraging the provision of goods and services in our town centres.

Attachments

1⇩. Bega

Valley Development Control Plan 2013 Council requirements for off-street car

and bicycle parking

|

Council

|

16 November 2022

|

|

Item 8.2

- Attachment 1

|

Bega Valley Development Control Plan 2013 Council requirements

for off-street car and bicycle parking

|

|

Council 16

November 2022

|

Item 8.3

|

8.3. Funding for new

local infrastructure contributions plan

It is proposed to increase the

budget allocation for the development of Council’s new local

infrastructure contributions plan and planning agreement policy to include the

development of an affordable housing contributions scheme.

Director Community Environment and Planning

Officer’s

Recommendation

That Council allocate an additional $60,000 from local

infrastructure contributions to include investigation and development of an

affordable housing contributions scheme as part of the development of the new

local infrastructure contributions plan and planning agreement policy.

Executive Summary

The 2021-22 budget included $100,000 from developer

contributions to develop and deliver a new local infrastructure contributions

plan and planning agreement policy. This was subsequently carried over in the

2022-23 budget.

At the time the budget was set, the Affordable Housing

Strategy had not been adopted. The strategy was subsequently adopted including

an action to investigate and develop an affordable housing contributions

scheme.

As such, staff drafted the request for quote to include both

developing and delivering a new local infrastructure contributions plan and

planning agreement policy, and to investigate and develop an affordable housing

contributions scheme.

A request for quotation (consultancy services) 2223-001 was

issued and closed in July 2022. Responses were assessed by the evaluation panel

in accordance with the evaluation plan.

The cost of the project from the preferred tenderer exceeded

the original $100,000 budget allocated for the project as the original budget

allocation did not consider the costs associated with the investigations and

potential development of an affordable housing contributions scheme. Additional

budget is required to meet this cost and enable Council to complete the work

identified in the strategy.

The proposal to increase the budget for this project will

not impact the General Fund. Plan administration is a permissible expense under

the current local infrastructure contributions plan and the budget increase, if

supported, will be funded through local infrastructure contributions plan

revenue.

Background

The purpose of a local infrastructure contributions plan is

to authorise consent authorities or private certifiers to impose a condition

requiring a contribution under section 7.11 or a levy under section 7.12 of the

Environmental Planning and Assessment Act 1979. These contributions and

levies are for the purpose of providing, extending or augmenting local

infrastructure for the use of the community.

Local infrastructure contributions supplement Council

funding for vital community infrastructure such as cycleways, footpaths, roads,

parks, drainage and community facilities. The contributions help to ensure that

population growth and new development is accompanied with the infrastructure

capacity necessary to support it. Community infrastructure that is to be funded

through a local infrastructure contributions plan is listed in a works schedule

within the plan.

Local infrastructure contributions plans used to be known as

‘developer contributions plans’ or ‘section 94 and 94A

plans’ until recent changes to the Environmental Planning and

Assessment Act 1979 renamed them and amended the section numbers to 7.11

and 7.12.

Council’s current local infrastructure contributions

plan, the Bega Valley Section 94 and 94A Contributions Plan 2014, and

accompanying Planning Agreement Policy were adopted in 2015 and are due for

review.

Council officers prepared a request for quotation

(consultancy services) 2223-001 to develop and deliver a new local

infrastructure contributions plan and planning agreement policy. The project

scope includes:

• Developing

a framework for the efficient determination, collection and management of

contributions towards the provision of local infrastructure in the Bega Valley

Shire.

• Updating

the works schedule to specify what infrastructure will be provided and

approximately how much it will cost.

• Developing

a new planning agreement policy to guide negotiations for the provision of

infrastructure between a developer and Council in lieu of section 7.11 or 7.12

contributions.

• Completing

a detailed feasibility analysis in accordance with the NSW Department of

Planning and Environment’s viability tool and make recommendations on the

potential for an affordable housing contributions scheme; and develop an

affordable housing contributions scheme if recommended. This task is based on

actions in the Bega Valley Shire Affordable Housing Strategy.

Responses to the request for quotation closed in July 2022.

The responses were assessed by the quotation evaluation panel in accordance

with the quotation evaluation plan, however, the cost of the project from the

preferred tenderer exceeded the allocated $100,000 budget for the project.

It is noted that the Bega Valley Shire Affordable Housing

Strategy was not drafted at the time that Council resolved to prepare a new

local infrastructure contributions plan and the original budget was allocated.

As such, the additional costs associated with the investigations and potential

development of an affordable housing contributions scheme were not considered

at the time of the budget estimate.

This report requests that Council authorise the allocation

of additional funds so that the preferred tenderer may be engaged to undertake

the project. This will help Council meet one of the actions identified in the

Affordable Housing Strategy.

Options

1. Council could resolve to allocate additional funds from

developer contributions towards the project to ensure the project is delivered

in its entirety by the preferred tenderer. This is the recommended option.

2. Council could resolve to engage the preferred contractor

to deliver the project without the affordable housing contributions scheme

component. This would require Council to consider allocating approximately

$60,000 in the 2023/24 financial year to complete this component of the

project, however any economies of scale from undertaking this work at the same

time as the development of the local infrastructure contributions plan would be

lost.

Community

and Stakeholder Engagement

Engagement undertaken

No community or stakeholder engagement has been held to

date.

Engagement planned

A community and stakeholder engagement plan will be

developed and implemented as part of the project. The final draft documents

will also be formally exhibited in accordance with legislative requirements and

Council’s Community Engagement Strategy.

Financial

and Resource Considerations

The project commenced in the 2021/22 Operational Plan with a

budget of $100,000 from income received from contributions under the Bega

Valley Section 94 and 94A Contributions Plan 2014. The project continued in

the 2022/23 Operational Plan and the budget allocation was carried over.

Annual income received under the Bega Valley Section 94

and 94A Contributions Plan 2014 is variable. In 2020/21 Council received

$2,216,000 in contributions. Income received from contributions is restricted

and can only be spent on items listed within the plan – this includes

plan administration. The proposal to increase the budget for this project will

not impact the General Fund. The additional $60,000 will be funded from

contributions received.

|

Item

|

$ Excl GST

|

|

Expenditure

Detail

|

|

|

Develop and deliver a new

local infrastructure contributions plan and planning agreement policy,

including investigation and development of an affordable housing

contributions scheme

|

$160,000

|

|

|

|

|

Total

Expenditure

|

$160,000

|

|

|

|

|

Source

of Funds

|

|

|

Approved budget 2022/23 -

Developer Contributions

|

$100,000

|

|

|

|

|

Total

income available

|

$100,000 * total income = total project cost

|

|

|

|

|

Project

Funding Shortfall

Proposed

to be funded from Developer Contributions- Permissible plan administration

expense

|

$60,000

|

Legal

/Policy

Local infrastructure contributions are levied under section

7.11 or section 7.12 of the Environmental Planning and Assessment Act 1979.

Income received from contributions is restricted and can

only be spent on items listed within the plan – this includes plan

administration.

Impacts

on Strategic/Operational/Asset Management Plan/Risk

Strategic

Alignment

The project aligns with the following strategic objectives

of the Bega Valley Community Strategic Plan 2042:

• Our

public and private infrastructure and community services meet community needs.

• Our

community has access to good quality open space, recreation and sporting

facilities that support health and wellbeing.

• Council

has strong organisational practices to ensure a viable organisation that

delivers services and facilities to meet community needs.

The project will deliver the following actions from the Bega

Valley Shire Affordable Housing Strategy:

• Strategy

12: Council will develop a Planning Agreement Policy under section 7.4 of the

Act, whereby Council can capture part of the uplift associated with land value

uplift arising from Planning Proposals to amend LEP provisions, and/or proposed

variations to planning controls.

• Strategy

17: In conjunction with any proposed rezoning … conduct further detailed

investigations into the viability of a Housing SEPP 2021 Affordable housing

contributions scheme

The project aligns with the following key response areas of

the Bega Valley Shire Climate Resilience Strategy:

• Natural

systems

• Preparing

for natural hazards

• Liveable

and connected places

• Safe,

healthy and inclusive community

Income received under the new local infrastructure

contribution plan will assist with the delivery of aspects of Council’s

Delivery Program and Operational Plan, Long Term Financial Plan and Asset

Management Plans.

Environment

and Climate Change

The new local infrastructure contribution plan will help to

ensure that well planned and resilient infrastructure is provided to support

new development and the future population. The plan will make the shire and our

community more resilient through incorporating elements of the Bega Valley

Shire Climate Resilience Strategy to create liveable and connected places

and a safe, healthy and inclusive community while protecting natural systems

and preparing for hazards through the planning and funding of future

infrastructure.

Economic

The new local infrastructure contribution plan will provide

the framework for the efficient determination, collection and management of

contributions towards the provision of local infrastructure. The plan will

ensure that developers make a reasonable contribution to the provision of local

infrastructure so that the existing or future community is not burdened by the

cost of providing new or upgraded infrastructure that is required a result of

new development.

Risk

The new local infrastructure contribution plan will ensure

that Council has an up-to-date contributions plan that is prepared in

accordance with current legislative requirements and best practice.

Social

/ Cultural

The new local infrastructure

contribution plan will assist with the funding of vital community

infrastructure such as cycleways, footpaths, roads, parks, drainage and

community facilities that will be required by the community as a result of new

development. The plan may also provide a source of funding for affordable

housing projects.

Attachments

Nil

|

Council 16

November 2022

|

Item 8.4

|

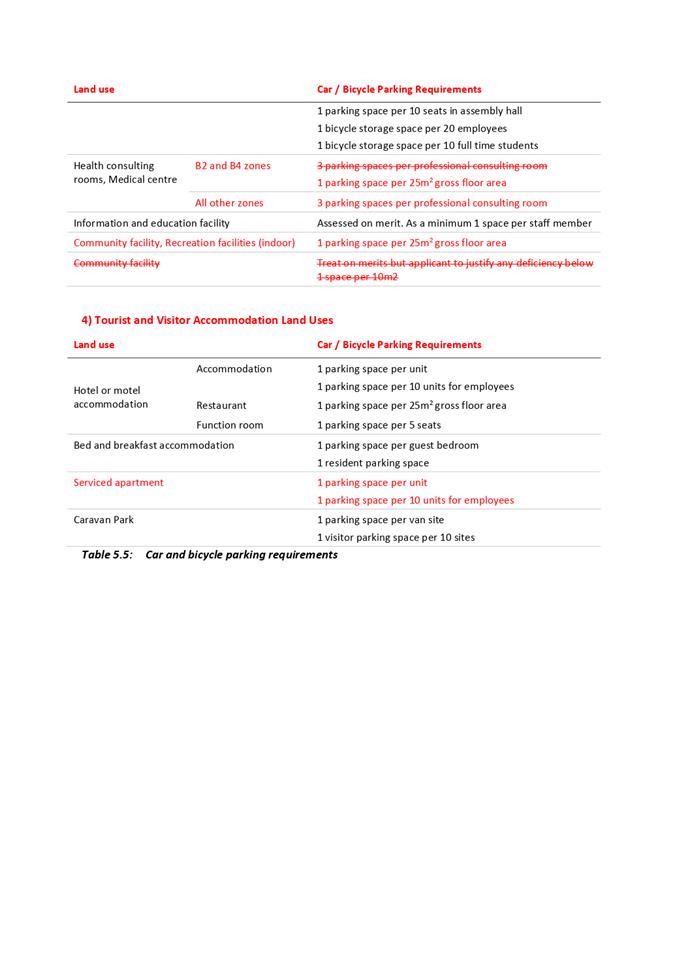

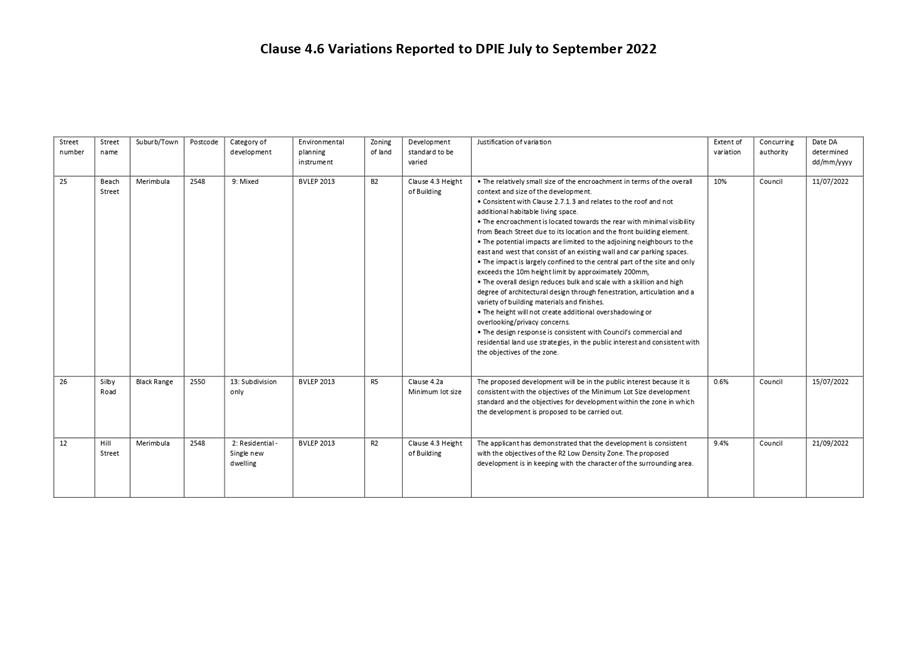

8.4. Clause 4.6

Variations to Development Standards Approved by Council for July to September

2022

Under Clause 4.6 of the Bega

Valley Local Environment Plan 2013 and Clause 65A of the

Bega Valley Local Environmental Plan 2002 Council is allowed some

flexibility when applying planning controls to certain developments (described

as Clause 4.6 variations). The following information forms part of

Council’s quarterly reporting requirements for Clause 4.6 variations, in

addition to quarterly reporting to the Department of Planning and Environment.

Director Community Environment and Planning

Officer’s

Recommendation

That Council

note the Clause 4.6 variations approved by Council (Attachment 1) for the

period July 2022 to September 2022.

Executive Summary

This report lists the development applications (DAs)

approved with Clause 4.6 variations that have been reported to the NSW

Department of Planning and Environment (DPE) for the July to September 2022

quarter, for information only.

Three DAs with Clause 4.6 variations were approved within the

quarter and were determined under staff delegation. These are listed at

Attachment 1.

Background

The NSW planning system provides flexibility in planning

controls by providing the ability for a Council to vary development standards

in certain circumstances.

Development standards are a means to achieving an

environmental planning objective and can be numerical or performance based.

Some developments may achieve planning objectives despite not meeting the

required development standards. The planning system provides flexibility to

allow these objectives to be met by varying development standards in

exceptional cases.

If an applicant wishes to vary a development standard

contained within an environmental planning instrument, such as the Bega

Valley Local Environmental Plan 2002 (BVLEP 2002) or the Bega Valley

Local Environmental Plan 2013 (BVLEP 2013), their development application

needs to be supported by a written application outlining why compliance with

the relevant development standard is unreasonable or unnecessary in the

circumstances of the case. Depending on the extent of the variation

sought, and assuming the concurrence of the Director-General of DPE, the

Council or delegated Council officers may approve such a development.

There are a number of procedural and reporting requirements

for councils to ensure transparency and integrity in the planning framework. This

report details the Clause 4.6 variations considered by Council and Council

officers during the reporting period.

Options

This report is for noting only. There are no options

associated with the recommendation of this report.

Community

and Stakeholder Engagement

Community and stakeholder engagement for DAs involves public

exhibition and notification to adjoining neighbours of the proposed

development. Reporting of Clause 4.6 Variations to Development Standards

to DPE and Council is required on a quarterly basis.

Proposed variations to development standards cannot be

considered without a written application objecting to the development standard

and dealing with the matters required to be addressed by the relevant

instrument.

A publicly available online register of all variations to

development standards approved by the consent authority (in this case Council)

or its delegates (Council officers) is to be established and maintained. This

register, which is available on Council’s website (Clause 4.6 variations – Bega

Valley Shire Council (nsw.gov.au)), must include the DA number and

description, the property address, the standard to be varied and the extent of

the variation.

Engagement undertaken

Engagement for these DAs was undertaken in accordance with

Council’s 3.01 Development Administration Policy and Community

Engagement Strategy. Additional reporting requirements are undertaken in

accordance with DPE’s Planning Circular PS 20-002 – Variation to

Development Standards, which include reporting Clause 4.6 variations to DPE

quarterly.

Engagement planned

There is no further engagement planned for this reporting

period. Quarterly reports will continue to be provided to DPE and Council for

information.

Financial

and Resource Considerations

Staff and administrative

resources to complete required reporting are available within Council’s

adopted budget. There are no other associated reporting costs. The processing

of Clause 4.6 variations, including notification to the public, is undertaken

as part of Council’s regular work program and within the adopted 2022-23

budget.

Legal

/Policy

The Environmental Planning and Assessment Act 1979 (EP&A

Act) sets out the planning framework in NSW and includes provision for

Local Environmental Plans to guide local development.

The Standard Local Planning Instrument includes a clause

(Clause 4.6 of BVLEP2013 and Clause 65A of BVLEP 2002) which provides the ability

to vary development standards contained within an environmental planning

instrument. This clause is included in both the BVLEP 2002 and BVLEP

2013.

A variation to a development standard approved under Clause

4.6 of BVLEP 2013 or Clause 65A of BVLEP 2002 requires concurrence with

the Director-General. This concurrence may be assumed where the development

meets the criteria described in Planning Circular PS 20-002 –

Variation to Development Standards. A meeting of the full Council is

required to determine Clause 4.6 variations where the extent of the variation

is greater than 10%. Where the assessing officer is satisfied that the

application to vary a development standard is less than 10% variation and

concurrence with the Director-General is achieved, the Clause 4.6 variation may

be approved under staff delegation.

Impacts

on Strategic/Operational/Asset Management Plan/Risk

Strategic

Alignment

This report achieves the reporting requirements described in

Planning Circular PS 20-002 – Variation to Development Standards and

aligns with Goal C.2 of Bega Valley Community Strategic Plan 2042:

Ensure land use planning and resource use supports

sustainable growth whilst protecting the quality of the natural environment and

our rural landscapes.

Environment

and Climate Change

There are no direct environmental or climate change impacts

to consider as part of this report. The environmental impacts of the proposed

developments were considered as part of the assessment of each development.

Economic

There are no direct economic impacts to consider as part of

this report. Development within the shire generates economic activity and the

specific economic impacts of that activity are considered as part of the

development assessment process.

Risk

There are implications for non-compliance of reporting

requirements. DPE carry out random audits of compliance to the reporting

requirements. This report contributes to Council’s reporting

requirements.

Social

/ Cultural

There are no direct social or cultural benefits or impacts

as part of this report. The direct social and cultural impacts of development

are considered through the development assessment process.

Attachments

1⇩. Clause

4.6 Variations Reported to DPE July to September 2022

|

Council

|

16 November 2022

|

|

Item 8.4

- Attachment 1

|

Clause 4.6 Variations Reported to DPE July to September 2022

|

|

Council 16

November 2022

|

Item 8.5

|

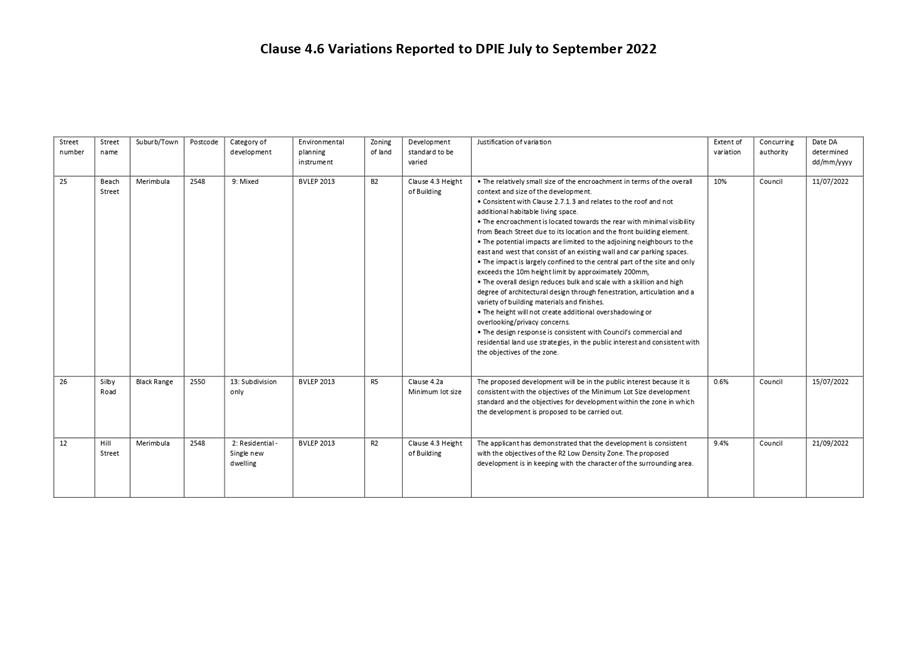

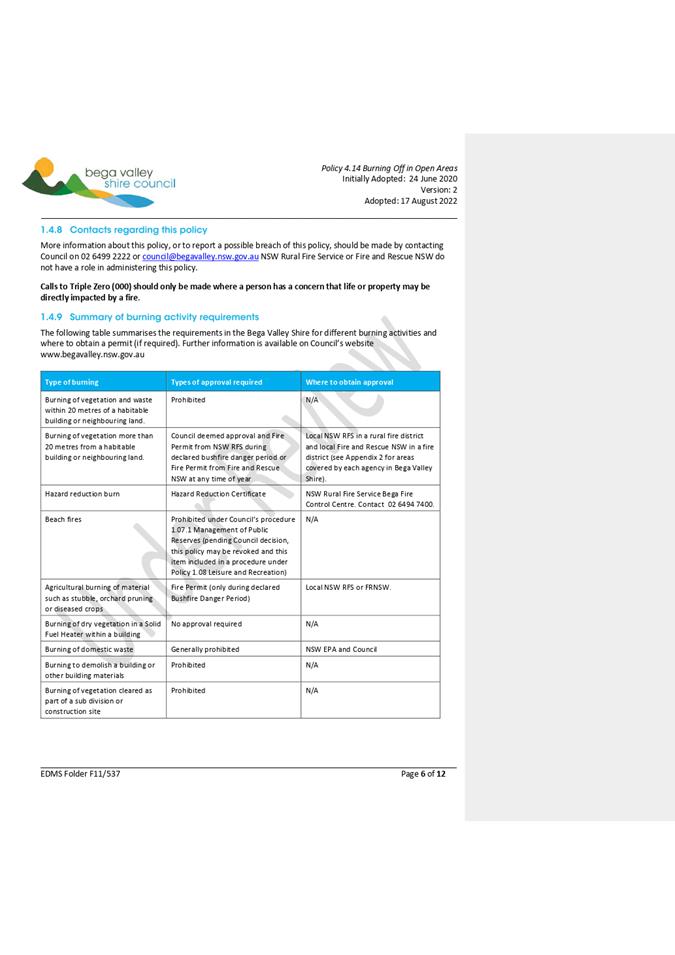

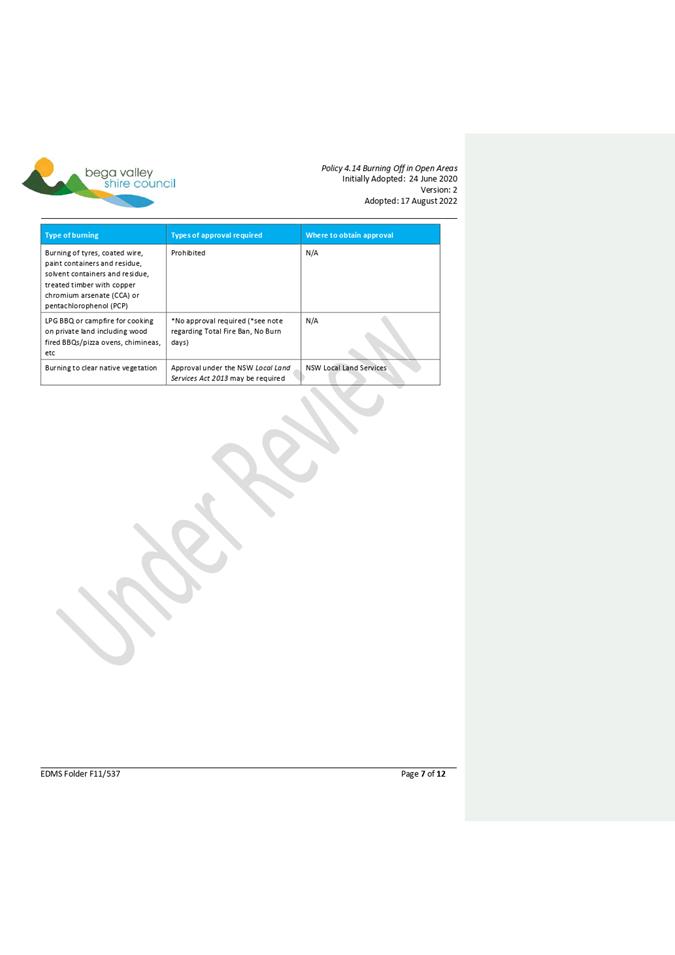

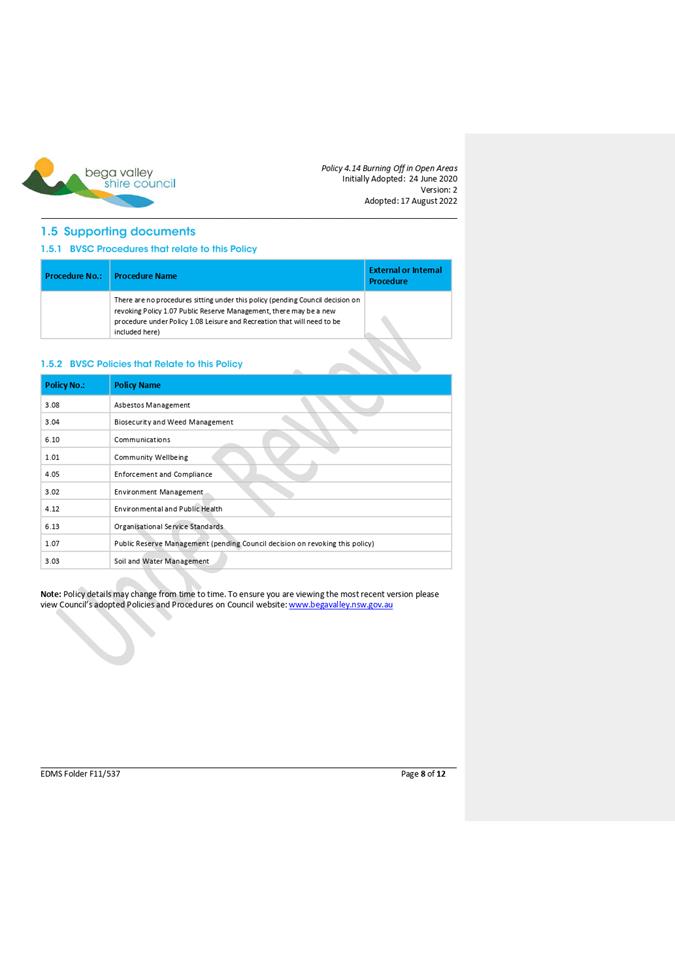

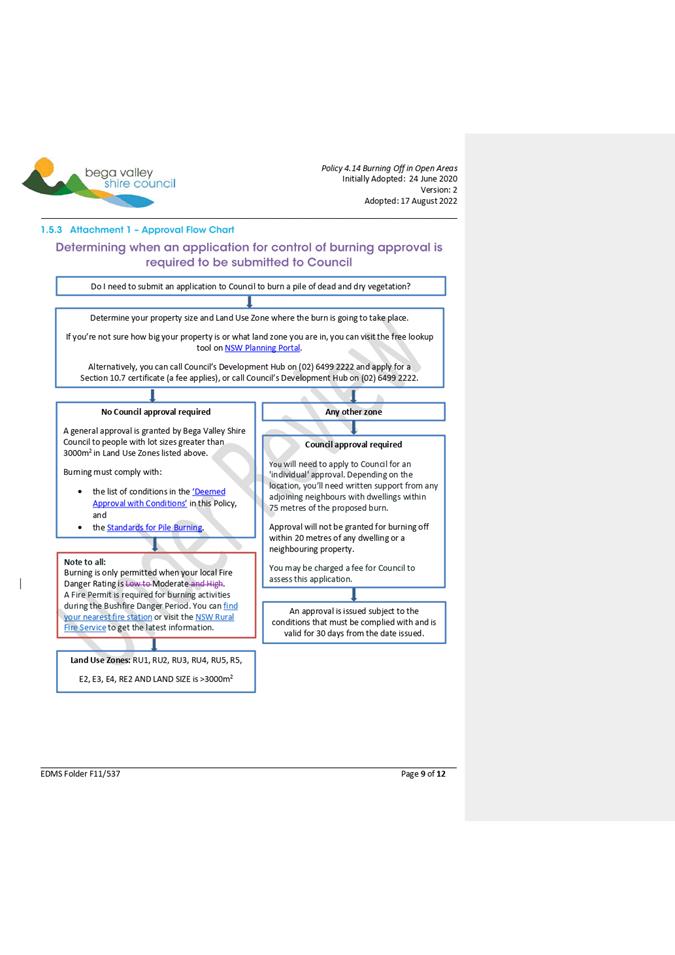

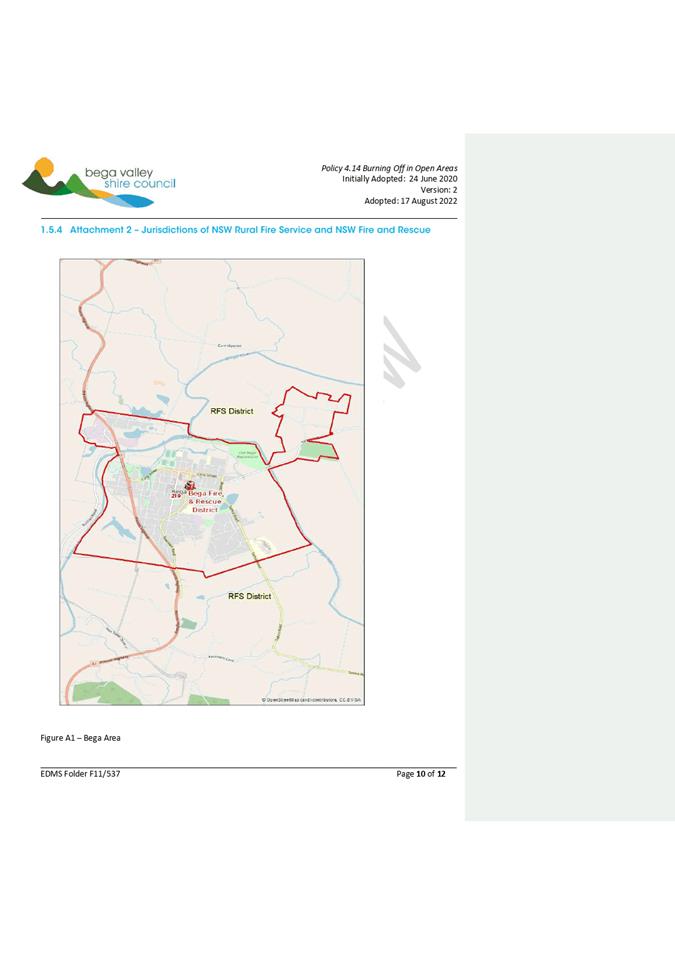

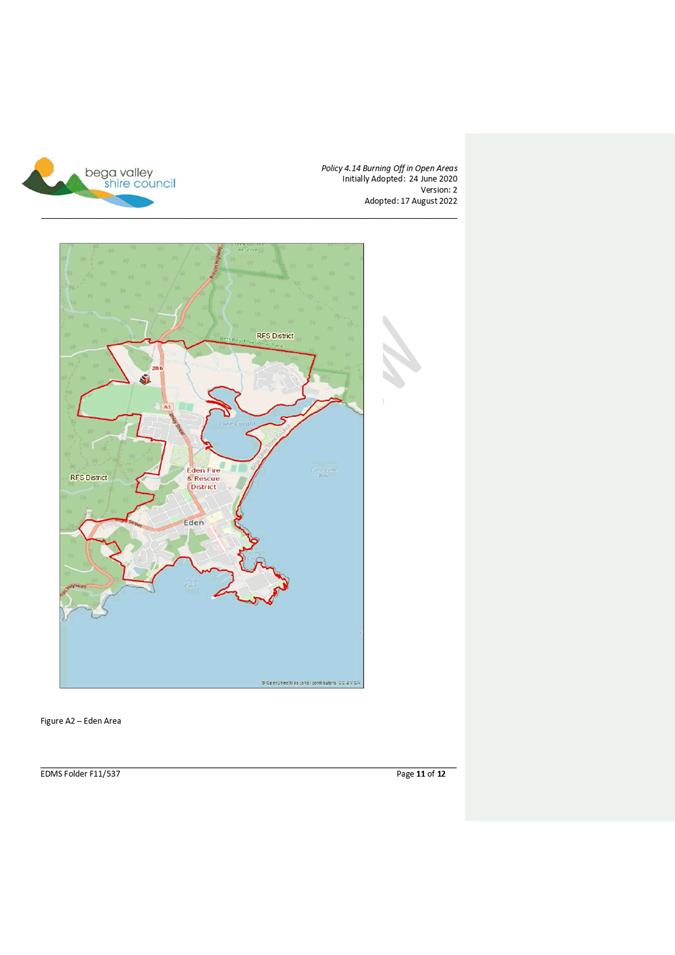

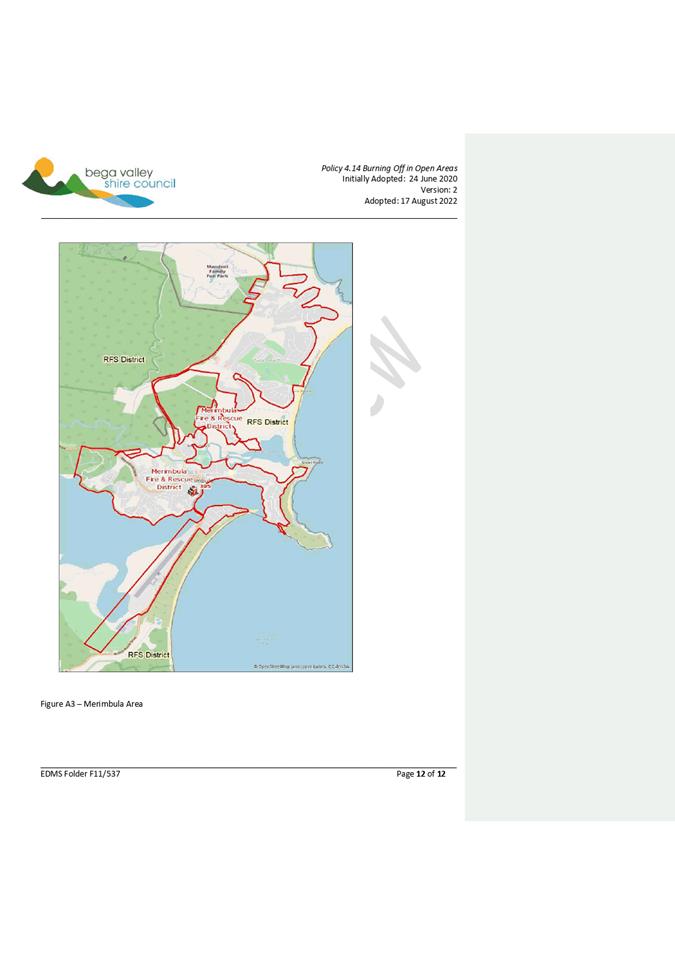

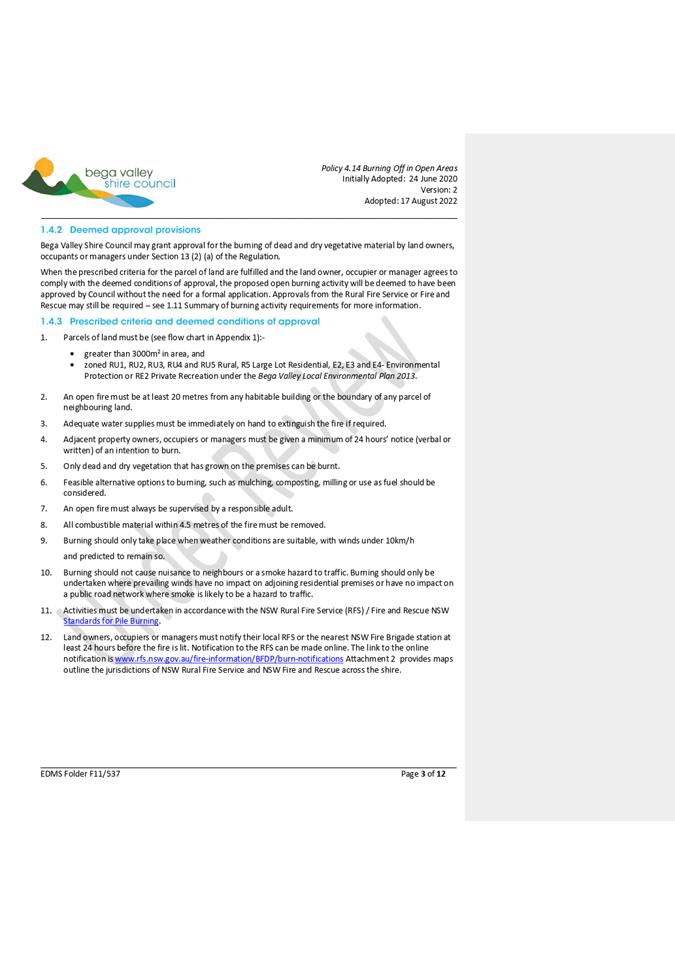

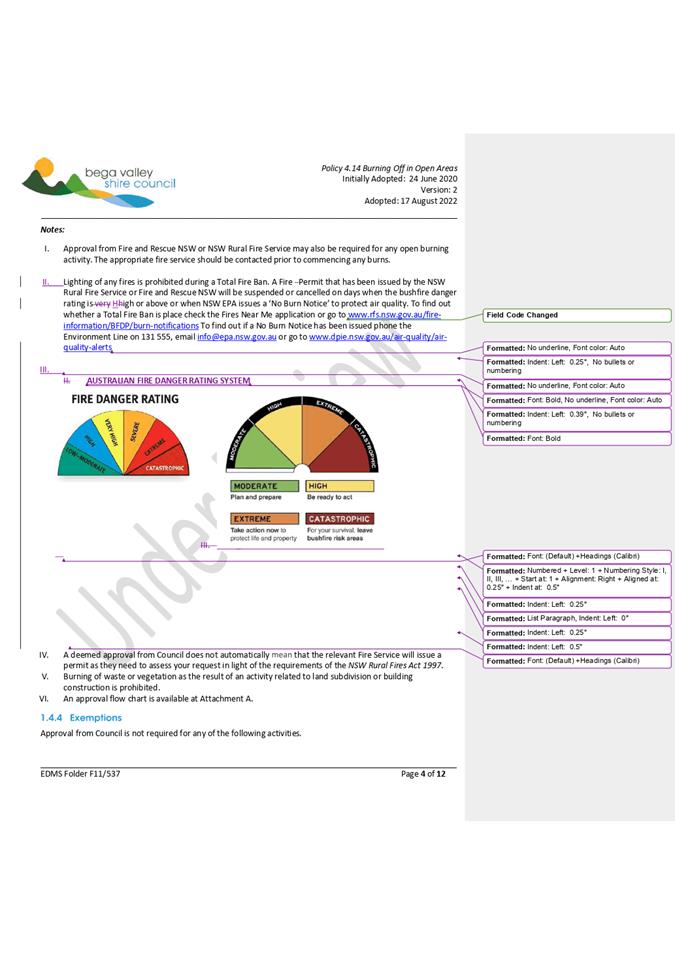

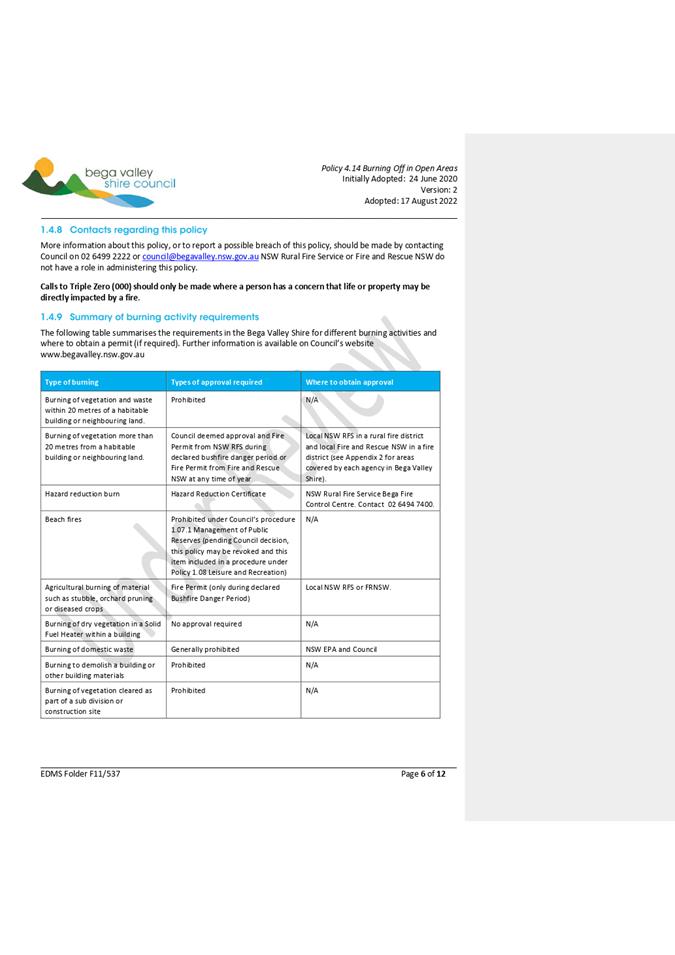

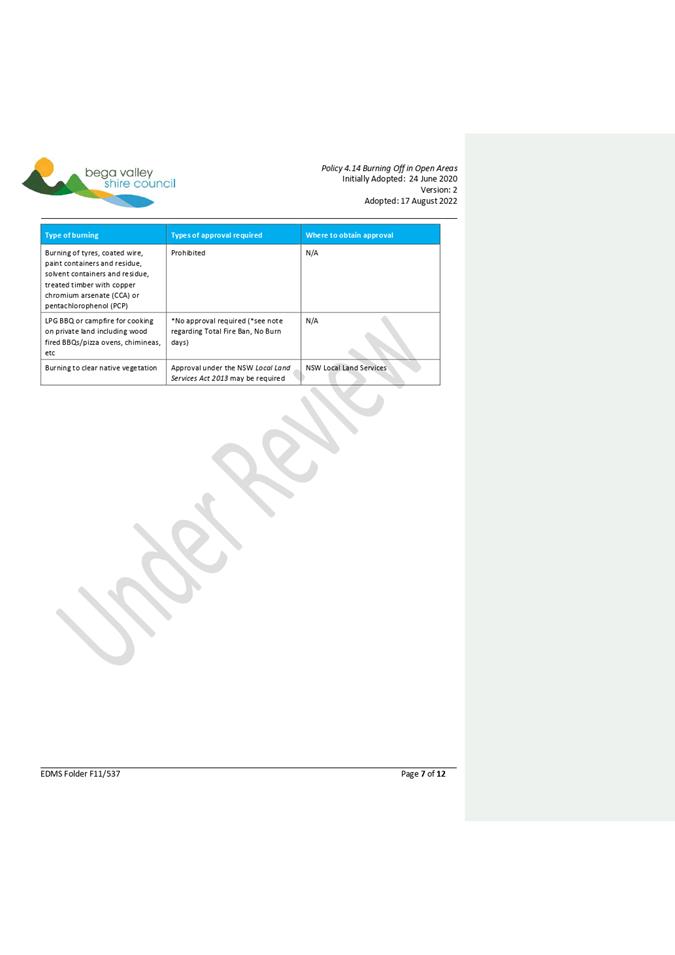

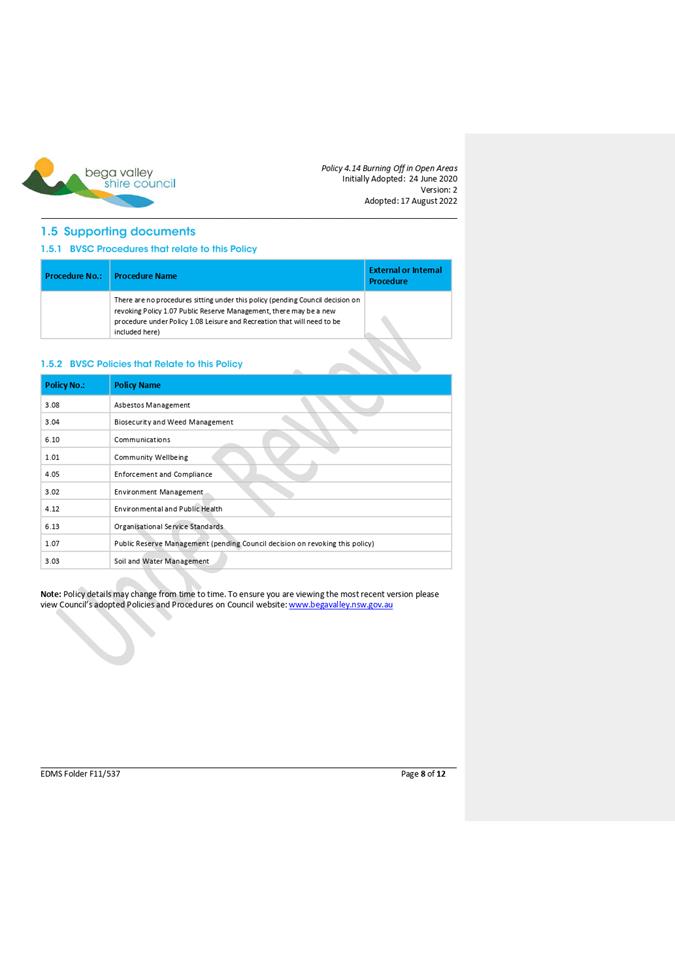

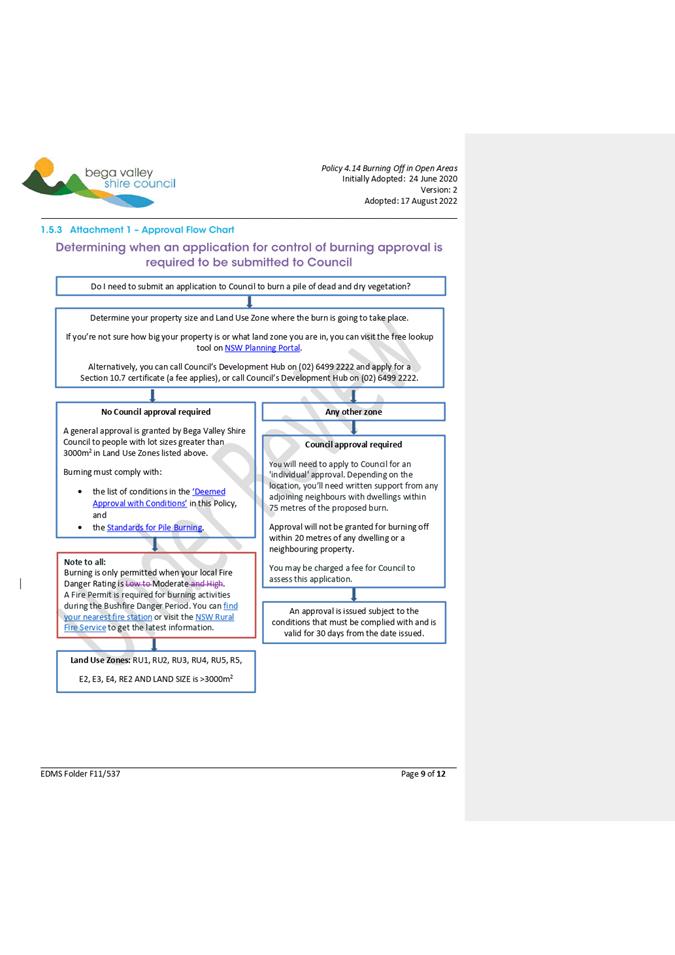

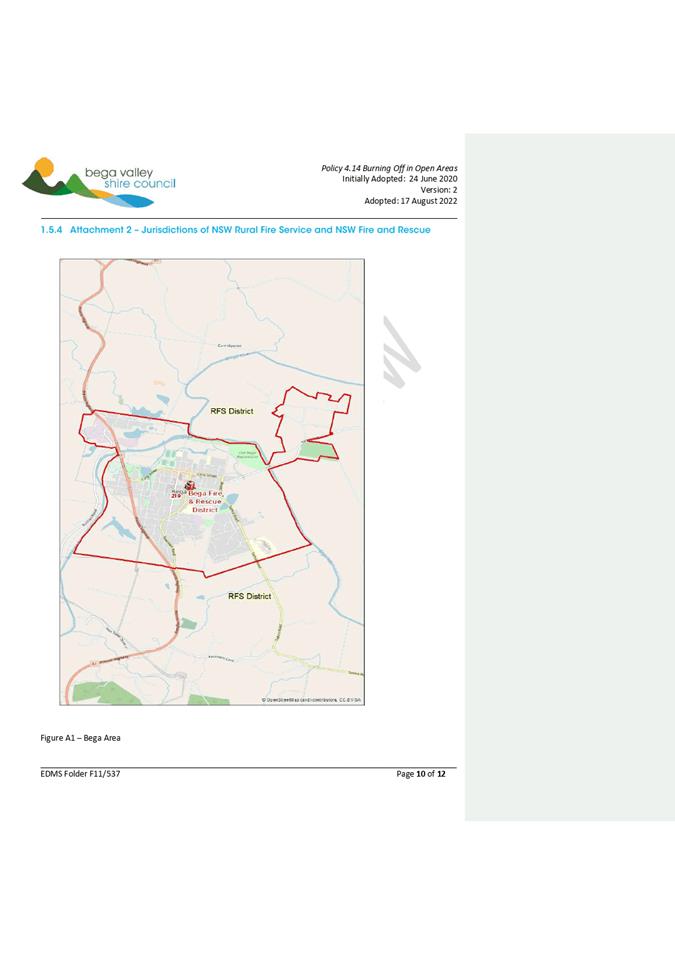

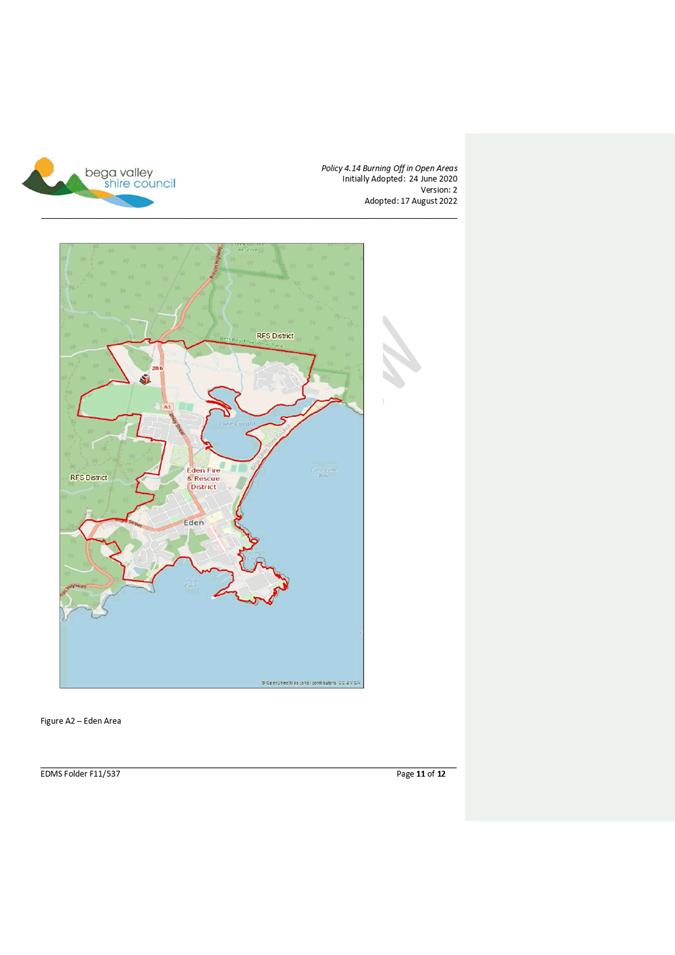

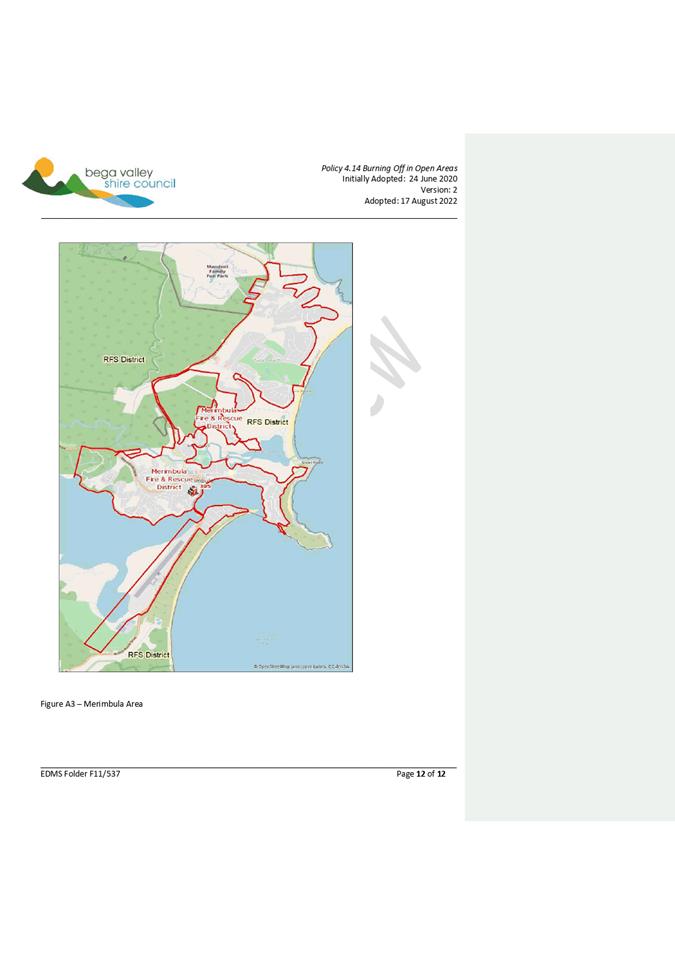

8.5. Policy 4.14

Burning off in open areas

This report seeks Council's approval to publicly exhibit

amendments to Policy 4.14 Burning off in open areas.

Director Community Environment and Planning

Officer’s

Recommendation

1. That Council

endorse the proposed changes in Policy 4.14 and exhibit for public submission

for a minimum of 28 days, with submissions accepted for 42 days.

2. That if

submissions are received a further report be presented to Council.

3. That if no

submissions are received the Policy be adopted and published on Council’s

website.

Executive Summary

Earlier this year Council undertook a formal review of its

policy documents under a staged schedule. Following a public consultation

period Policy 4.14 Burning off in open areas was adopted by Council on 17

August 2022.

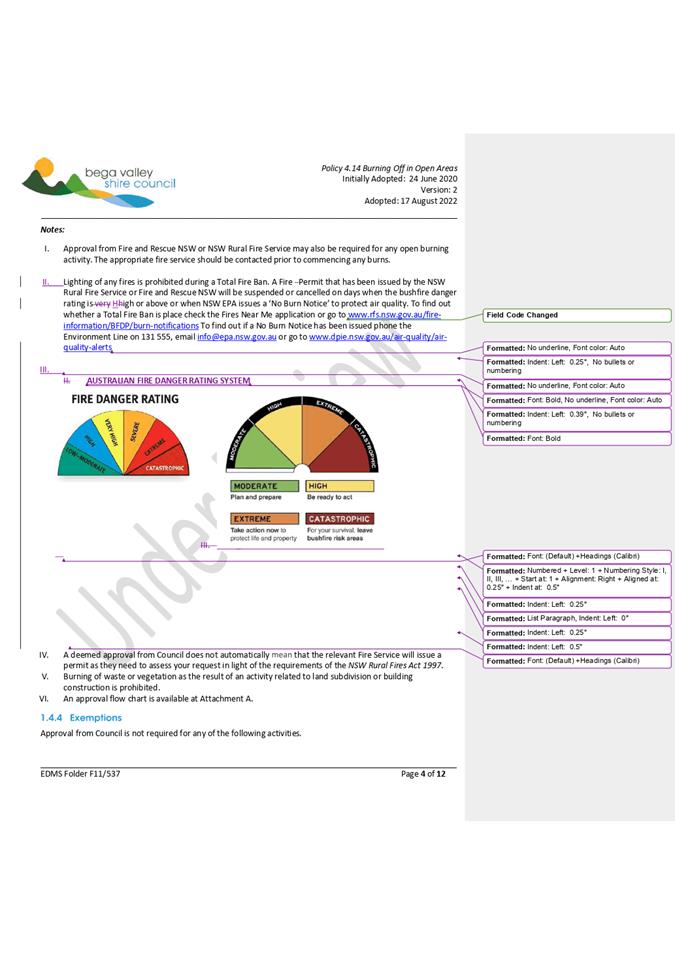

Since adoption of the policy there has been an update to the

Australian fire danger rating system administered by the National Council for

Fire and Emergency Services. These changes are documented in the draft Policy 4.14

Burning off in open areas at Attachment 1. No other changes have been

proposed.

Background

Council is

required under Section 165 of the Local Government Act 1993 to review

and adopt its ‘local approvals and orders policies’ (its

‘policies’) within 12-months of the local government

election.

Earlier this year, staff reviewed

and proposed some changes to Policy 4.14 Burning off in open areas to provide

greater clarity. Following public consultation, the revised policy was endorsed

by Council and updated on our website.

Since adoption of the policy there

has been an update to the Australian fire danger rating system administered by

the National Council for Fire and Emergency Services. This further update to

Policy 4.14 is to incorporate these changes.

Options

Options available to Council are to:

1. Adopt

the recommendation to publicly exhibit the draft Policy (Attachment 1). This is

the recommended option.

2. Retain

the current Policy without proposed amendments, noting this would create

inconsistency between Council’s adopted policy and the new fire danger

rating system.

Community

and Stakeholder Engagement

Engagement undertaken

Relevant Council staff were consulted as part of the review

of the policy following the change in the fire danger rating system, and they

endorsed the proposed updates to the policy through Council’s internal

review process.

Engagement planned

In accordance with Section 165 of the Local Government

Act 1993, Council will place the draft policy on public exhibition for the

required 28-day period. Members of the community will be invited to make

submissions on the draft policies for a period of 42 days.

Submissions received during the public exhibition period

will be considered when presenting the final version of policies to Council for

adoption.

Financial

and Resource Considerations

There are no financial or resource considerations associated

with the recommendation of this report. The update and public exhibition

process will be managed with current resourcing and staffing levels.

Legal

/Policy

The proposed updates are in accordance with Section 165 of

the Local Government Act 1993 and seek to align the policy with the new

fire danger rating system determined by the National Council for Fire and

Emergency Services.

Impacts

on Strategic/Operational/Asset Management Plan/Risk

Strategic

Alignment

Policy reviews ensure Council meets its obligations within

its Community Strategic Plan specifically relating to:

· E.6 Council

decision making seeks to optimise environmental, social and economic

outcomes for our community, while mitigating financial,

legal, environmental,

reputational and safety risks.

· E.8 Council has a

governance framework that promotes and guides accountability and

transparency.

Environment

and Climate Change

There are no direct environmental

or climate change impacts associated with the recommendations of this report.

Economic

There are no economic and climate change matters relating to

the content of this report.

Risk

There are no risks associated with the recommendations of

this report. The update will ensure Council’s policy is in line with the

recent changes to the Australian fire danger rating system.

Social

/ Cultural

Policy reviews allow council to meet its social and cultural

obligations by providing opportunity for internal and external stakeholders to

contribute to the review of its policy content. There are no direct social or

cultural impacts associated with the recommendations of this report.

Attachments

1⇩. DRAFT

Burning off in open areas policy 4.14

|

Council

|

16 November 2022

|

|

Item 8.5

- Attachment 1

|

DRAFT Burning off in open areas policy 4.14

|

Staff Reports

– Assets and Operations

16 November 2022

9.1 Bega

Valley Local Traffic Committee................................................................... 53

9.2 RFT

2223-015 Construction of Kiah & Wandella Community Halls.................... 99

9.3 RFT

2223-030 Kameruka Lane upgrade............................................................ 104

9.4 RFT

2122-094 Construction of Bermagui Harbour and Pambula Lake Boat Ramps and

Pontoons........................................................................................................... 109

9.5 Sportsground

Volunteer Site Committee Nominations.................................... 115

|

Council 16

November 2022

|

Item 9.1

|

9.1. Bega Valley

Local Traffic Committee

This report recommends that Council

adopt the recommendations of the Bega Valley Local Traffic Committee from the

meeting held on 5 October 2022.

Director Assets and Operations

Officer’s

Recommendation

That Council adopt the

recommendations of the Bega Valley Local Traffic Committee minutes dated 5

October 2022 and tabled at the 16 November 2022 Council meeting.

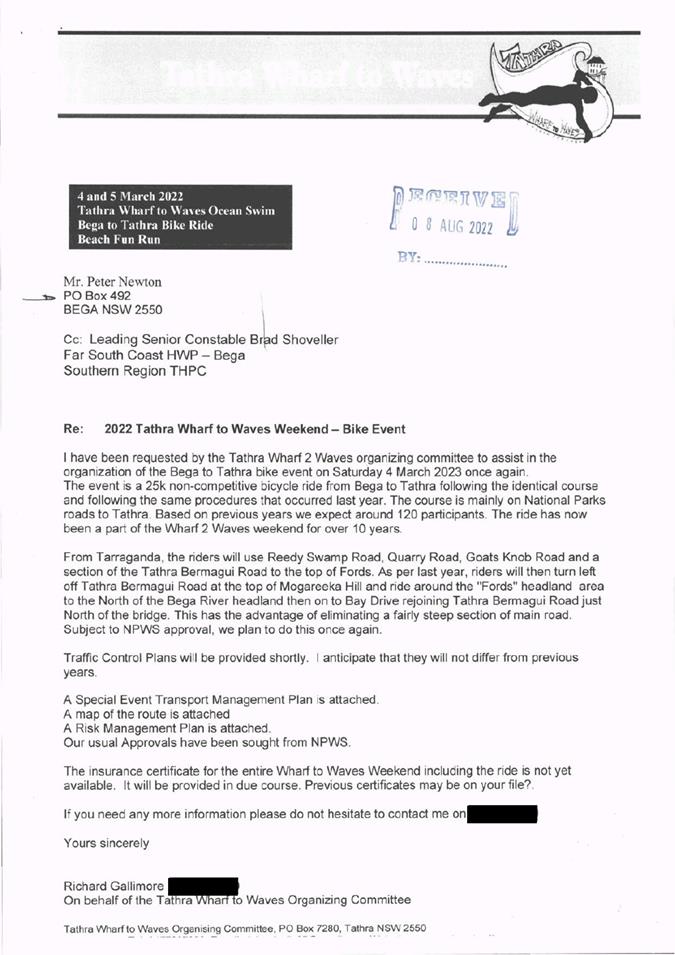

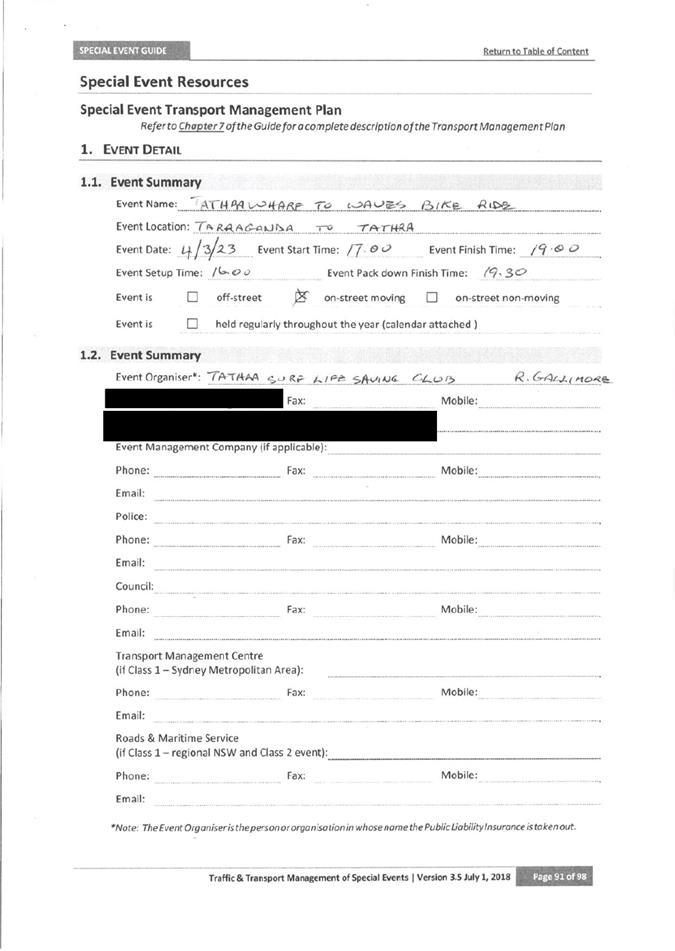

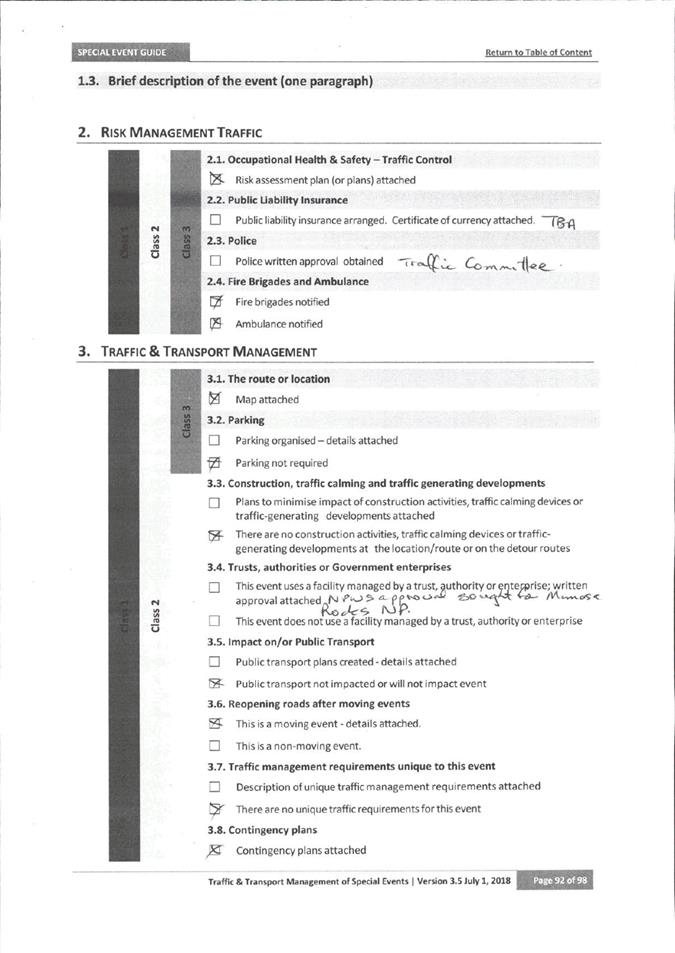

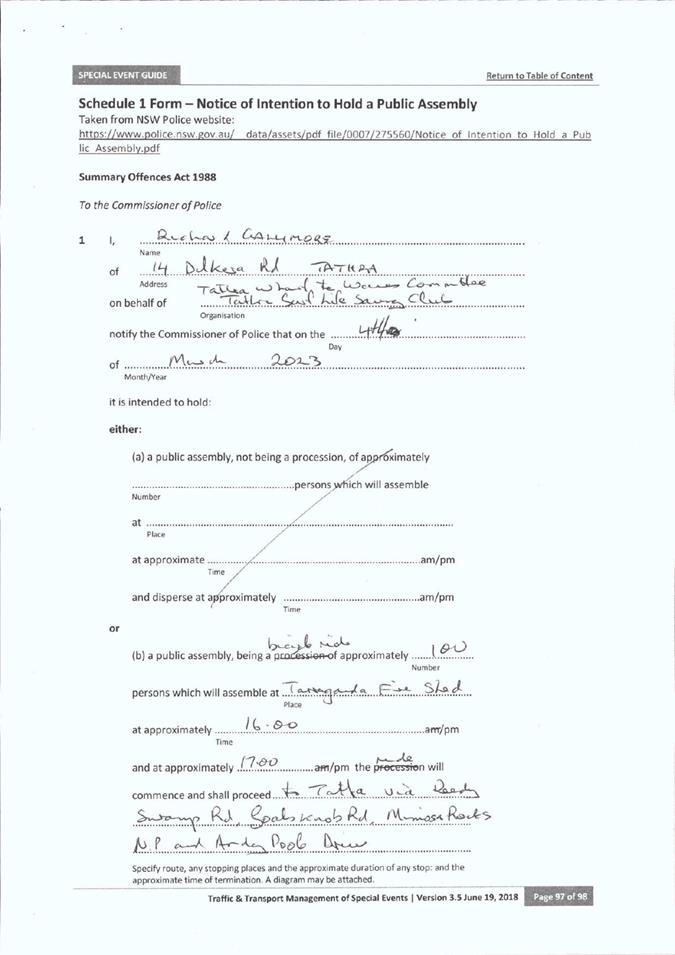

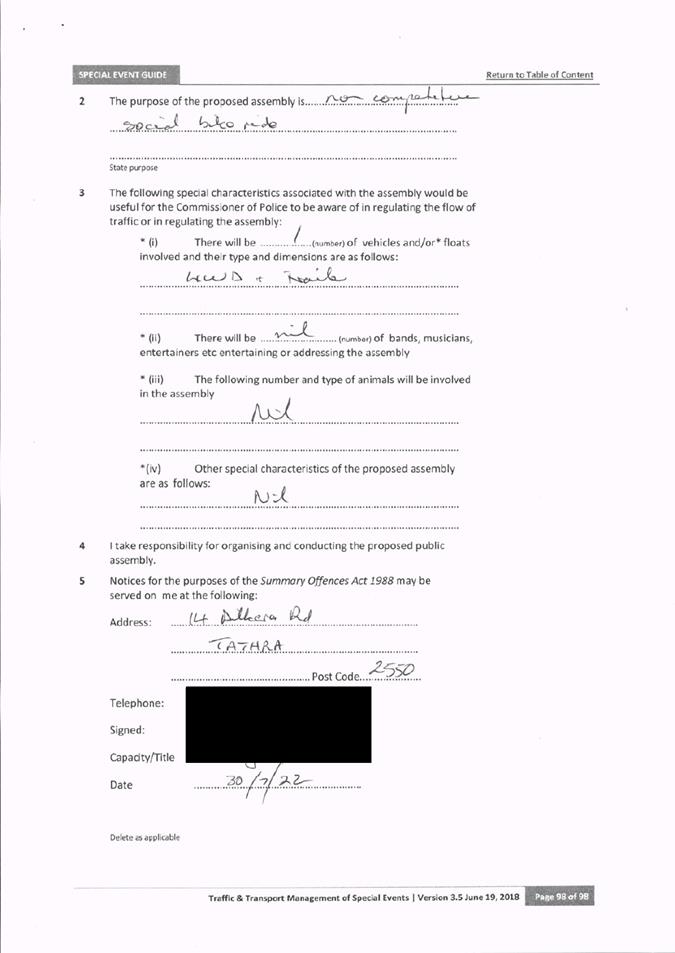

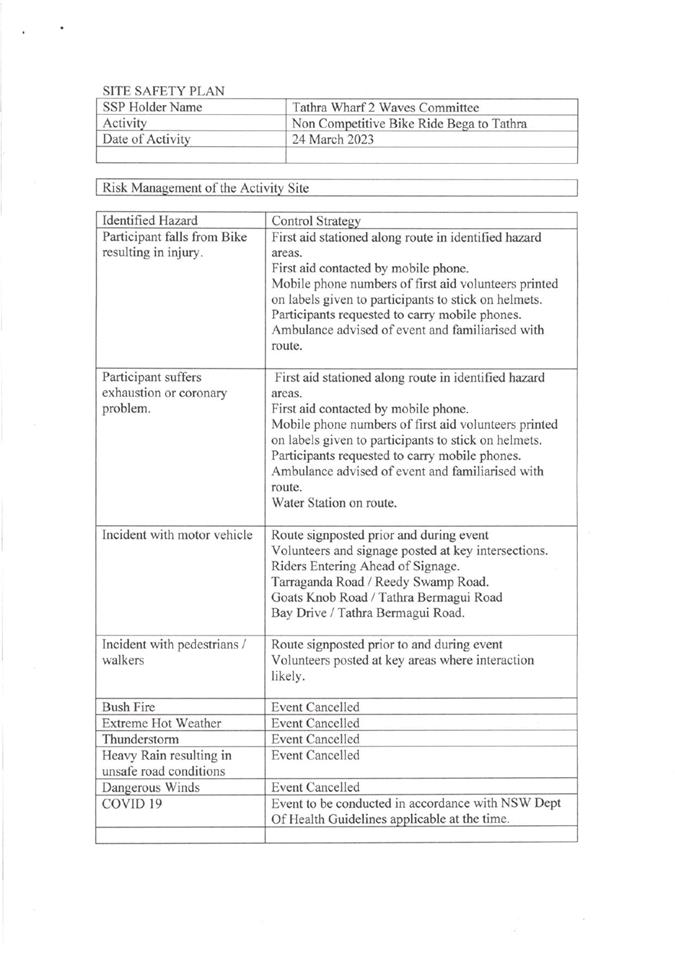

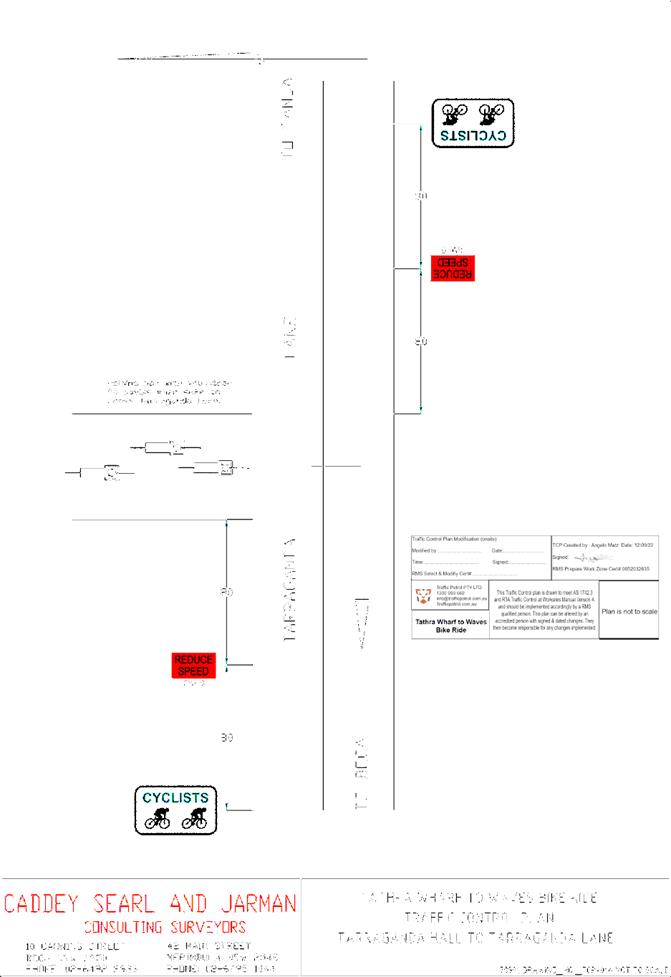

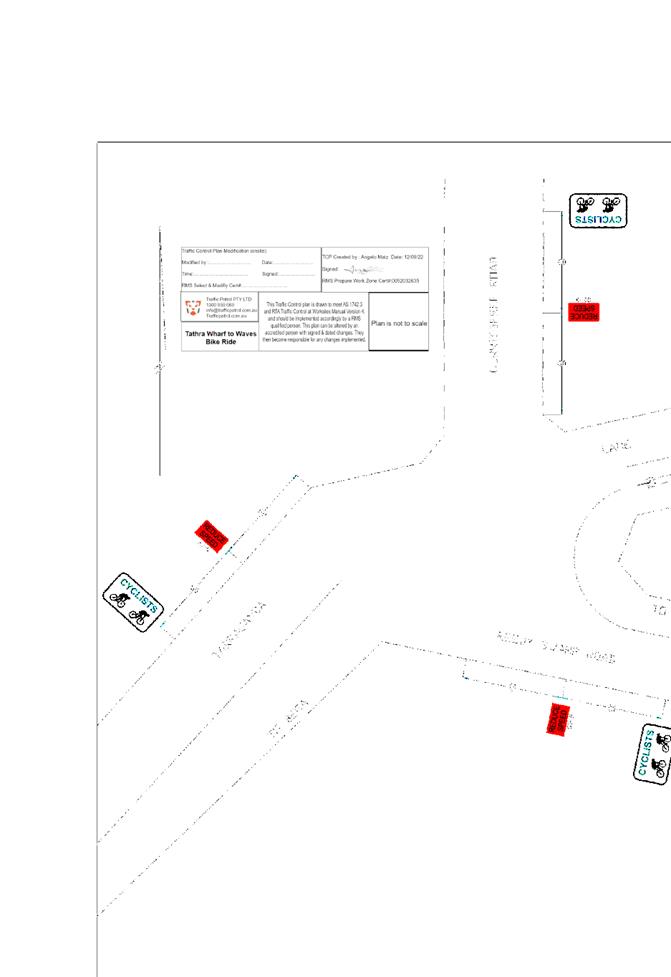

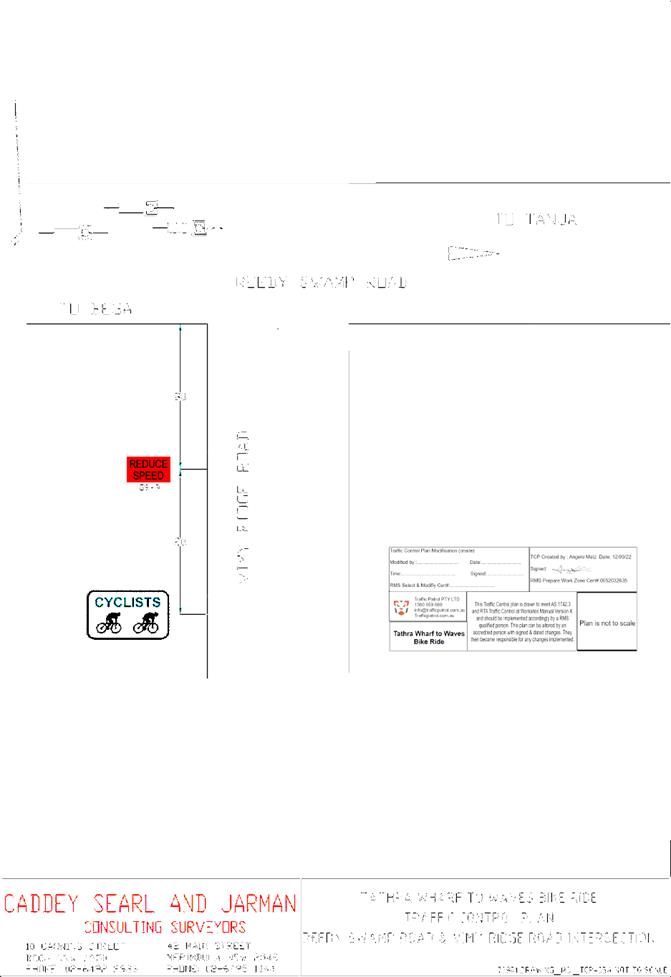

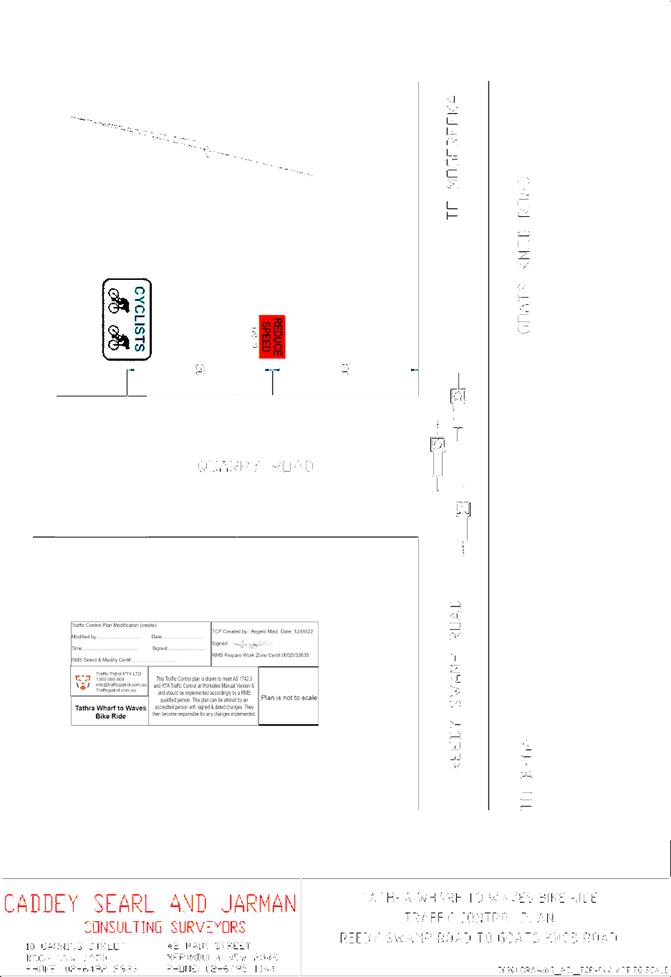

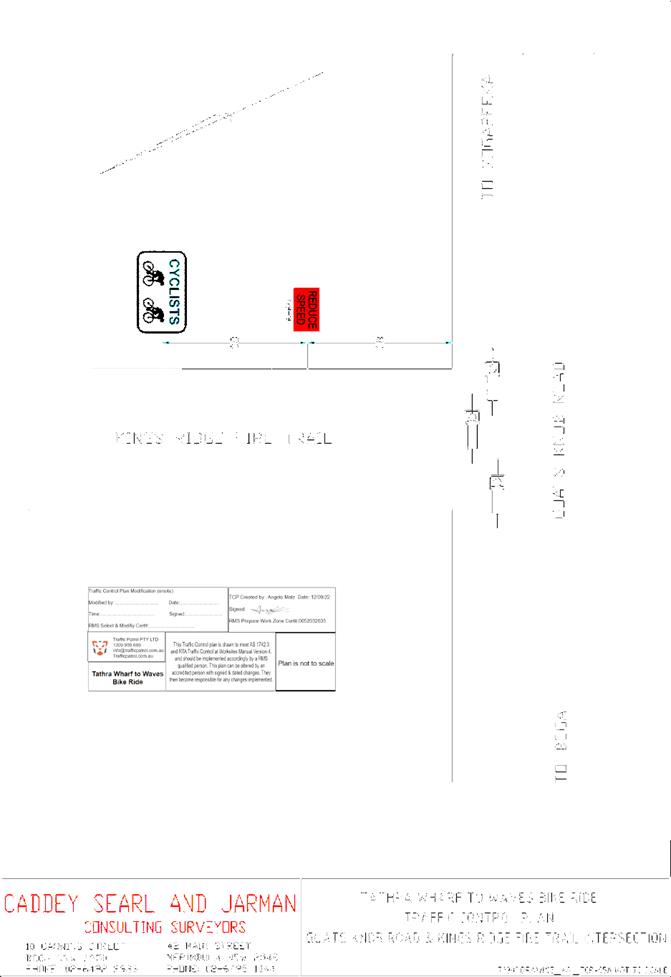

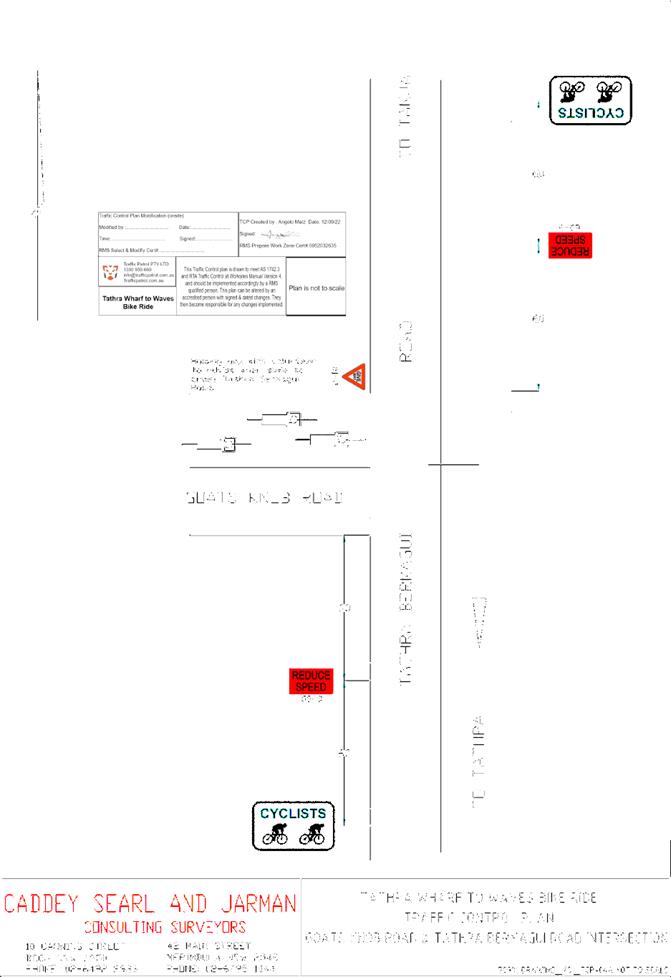

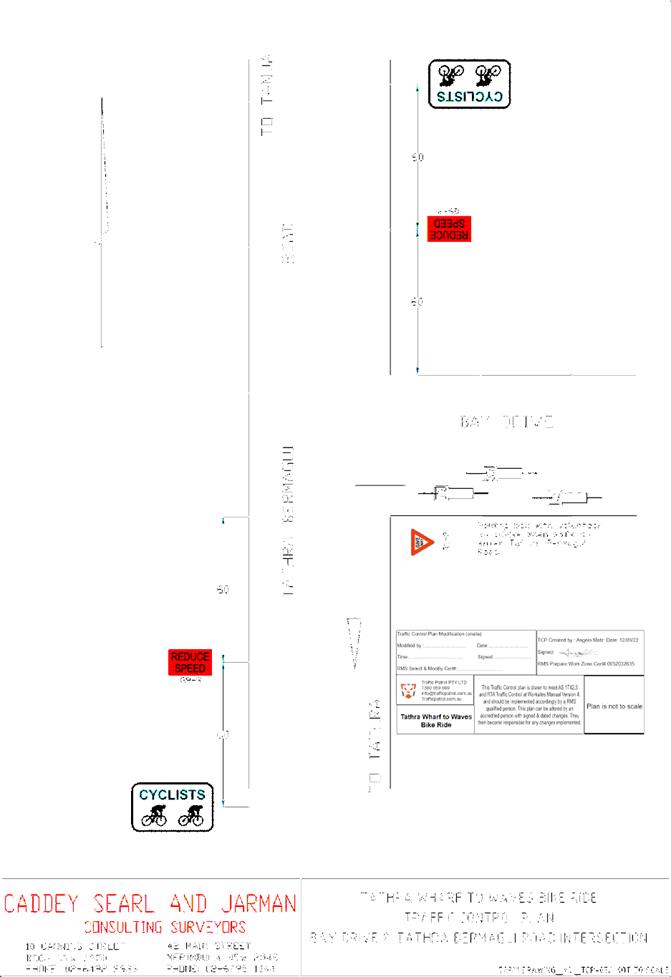

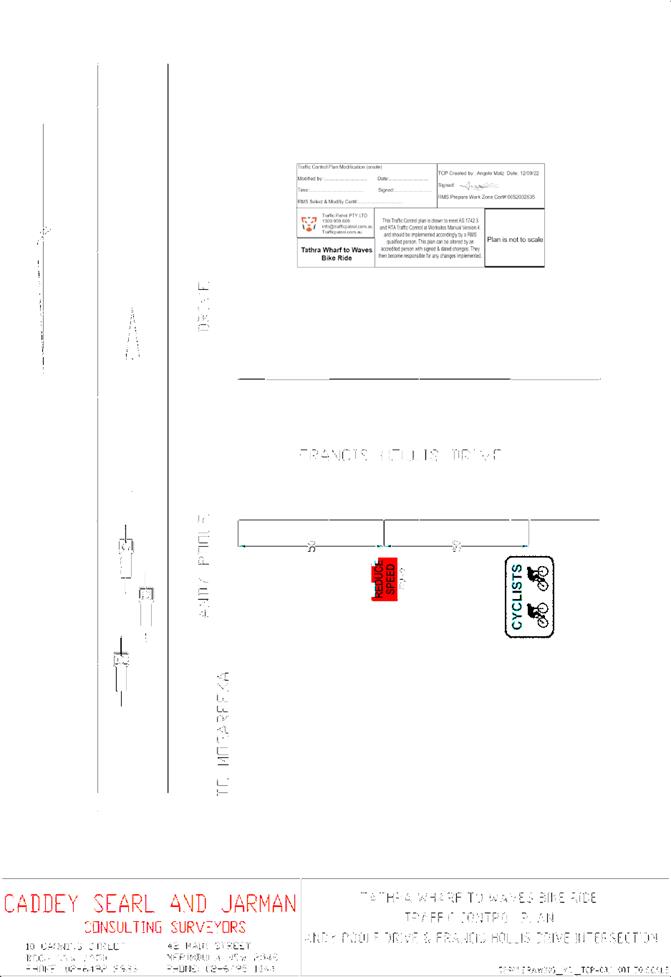

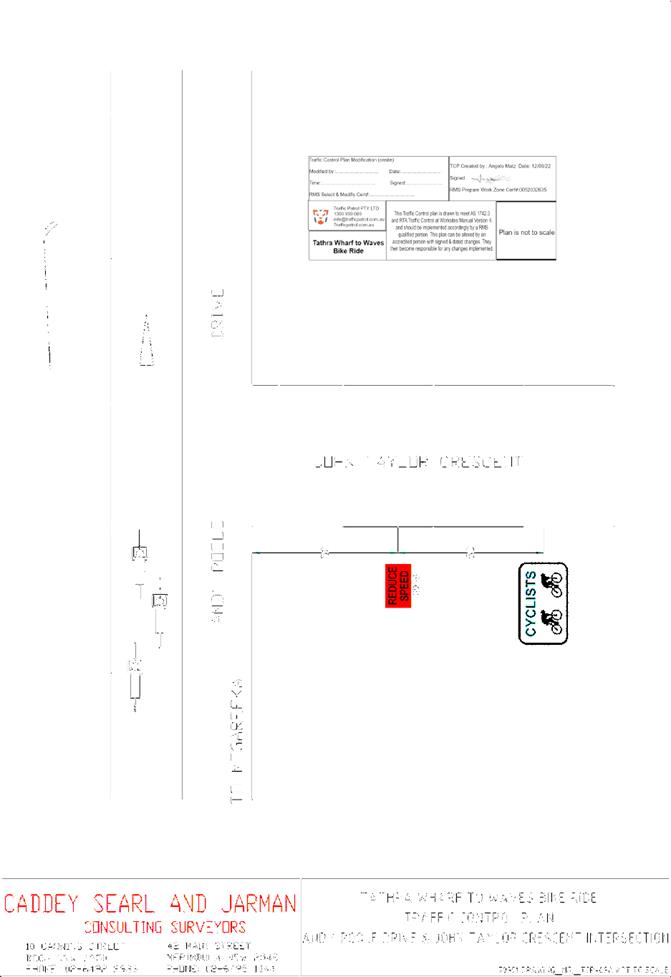

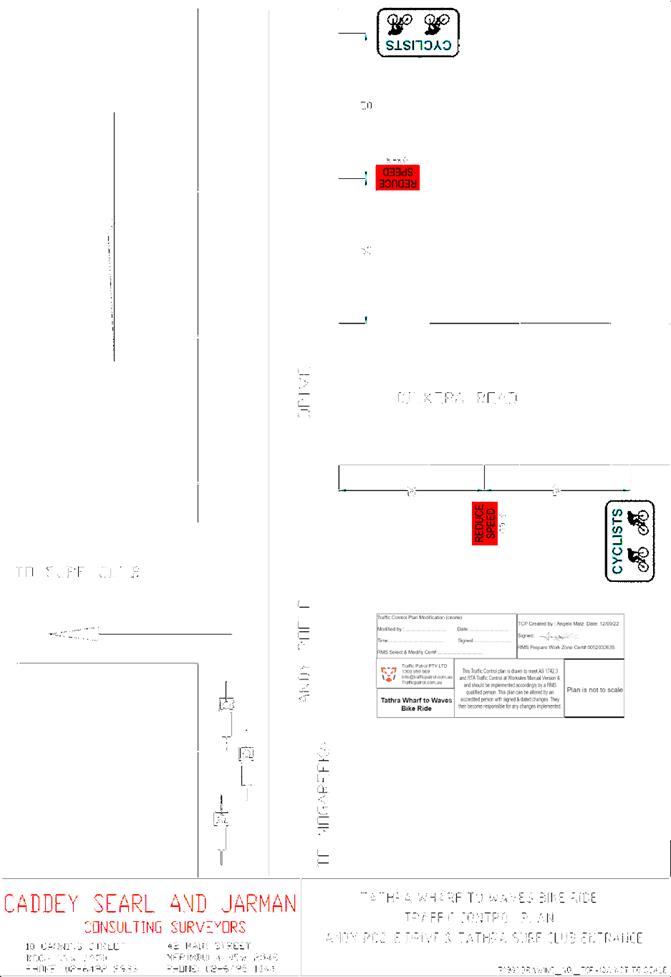

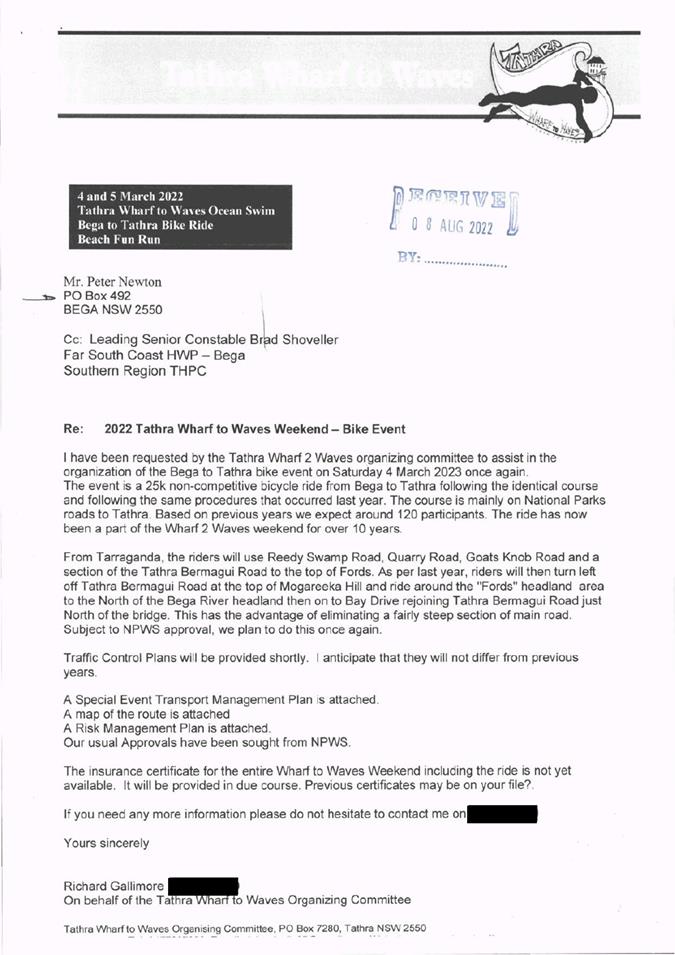

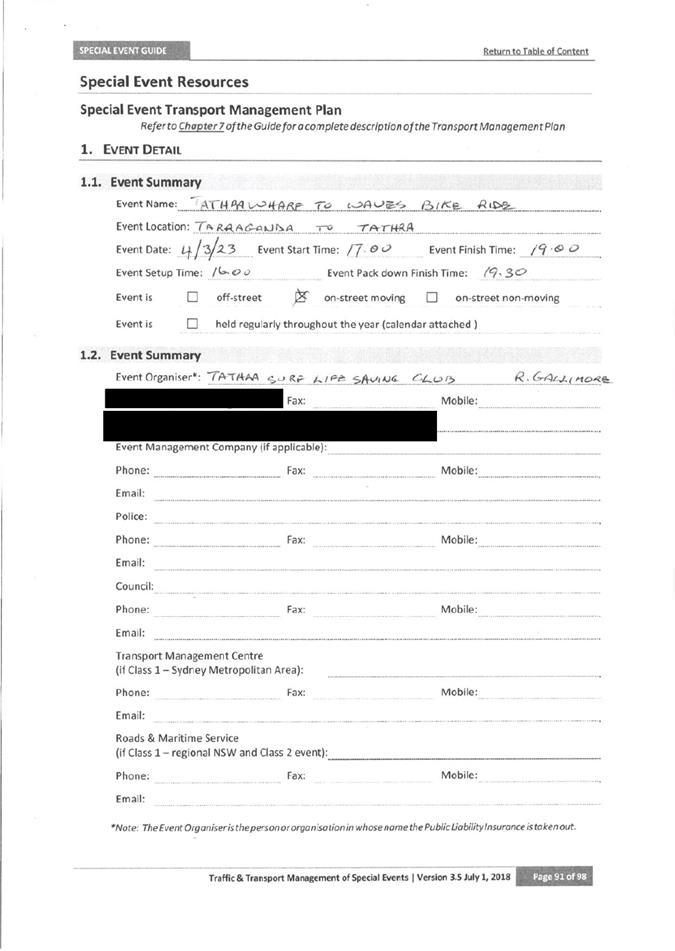

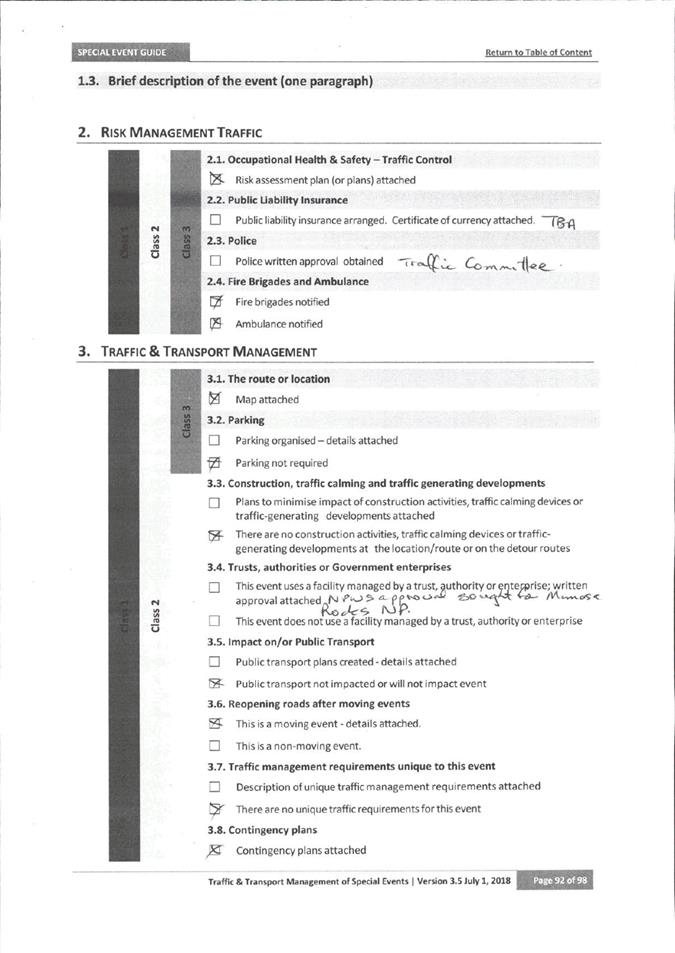

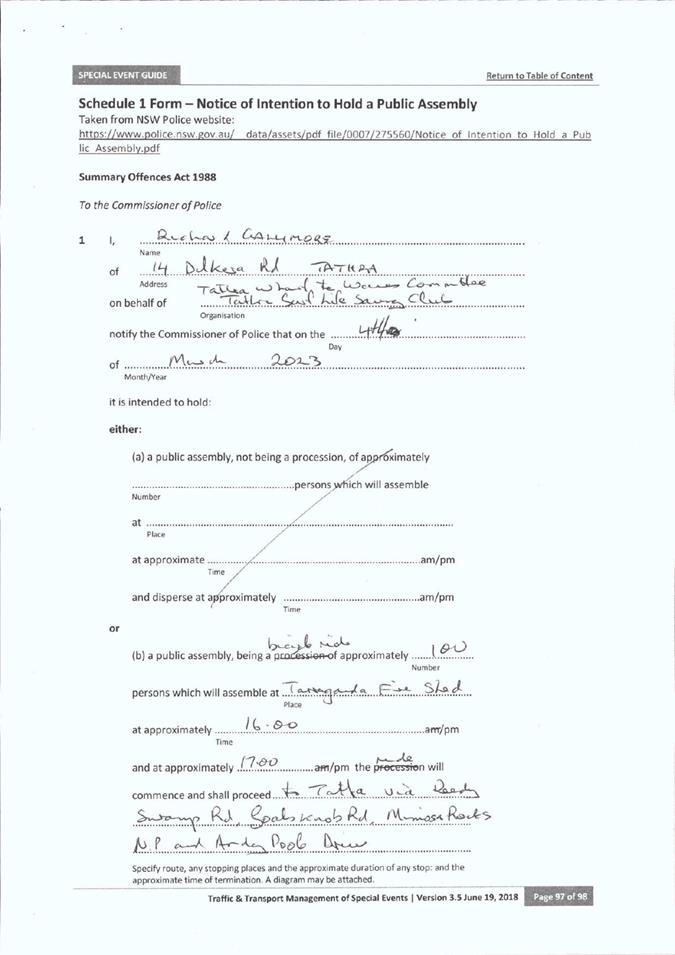

1. Tathra Wharf to

Waves – Bike Event – Saturday, 4 March 2023

1. That subject to

conditions, the on-road components of the Tathra Wharf to Waves Bike Ride on

Saturday, 4 March 2023 be approved.

2. That the proposed

traffic arrangements for the Tathra Wharf to Waves Bike Ride on Saturday, 4

March 2023 be deemed a Class 2 special event and be conducted under an approved

Traffic Control Plan in accordance with the Transport for NSW (TfNSW) Traffic

Control Manual.

3. That persons

involved in the preparation and implementation of the Traffic Guidance Scheme

must hold the appropriate SafeWork NSW accreditation.

4. That organisers

fully implement an approved Special Event Transport Management Plan.

5. That organisers

have approved public liability insurance of at least $20 million indemnifying

Bega Valley Shire Council, NSW Police Force and TfNSW by name for the event.

6. That prior to

conducting the event, organisers have written approval from NSW Police Force

and NSW National Parks and Wildlife Service.

7. That as a

prerequisite of road closures, the event organisers must notify all, local and

interstate bus services along with local taxi services, emergency services and

other affected stakeholders of alternative routes including pick-up/drop-off

points, including point to point transport.

8. That after the

event, organisers are to clean up any rubbish or waste left behind.

9. That approval is

conditional on current COVID19 rules and regulations being followed.

2. Request

for removal of timed car space – Carp and Auckland Street - Bega

That

Council approve the removal of one car space directly in front of L J Hooker -

Bega, as it is outside the legislated 20m from the intersection. A “No

Stopping” sign to be installed in its place.

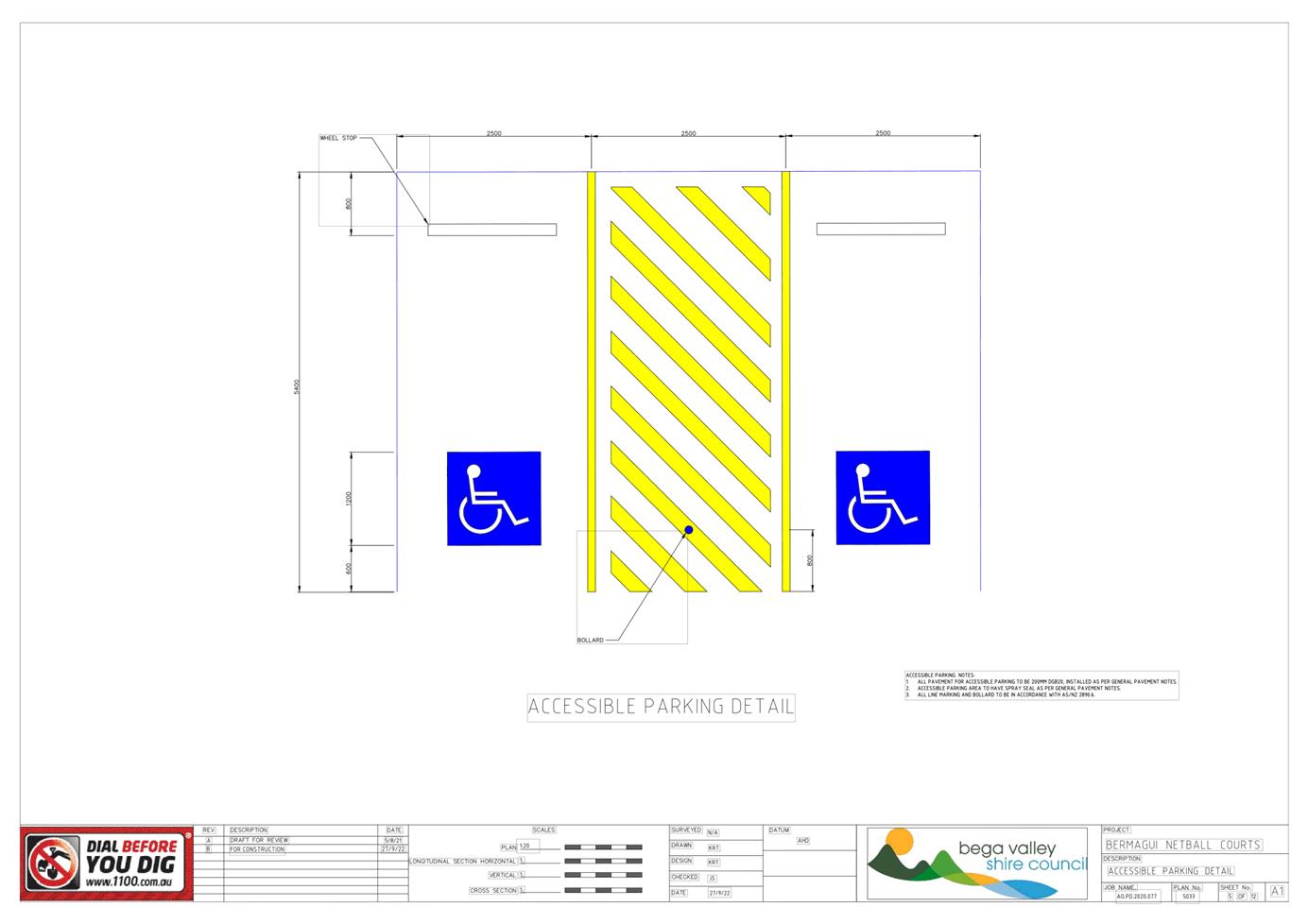

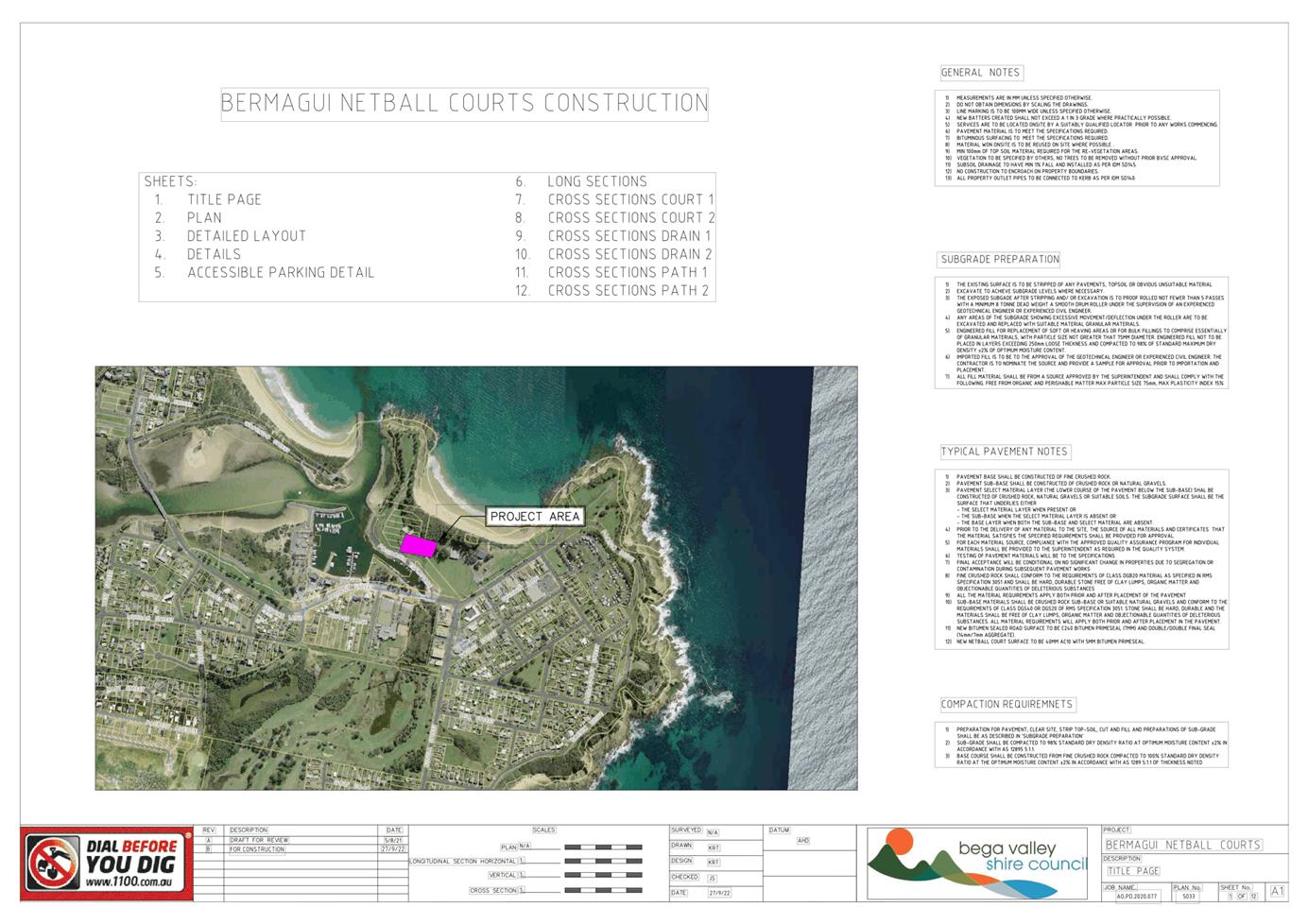

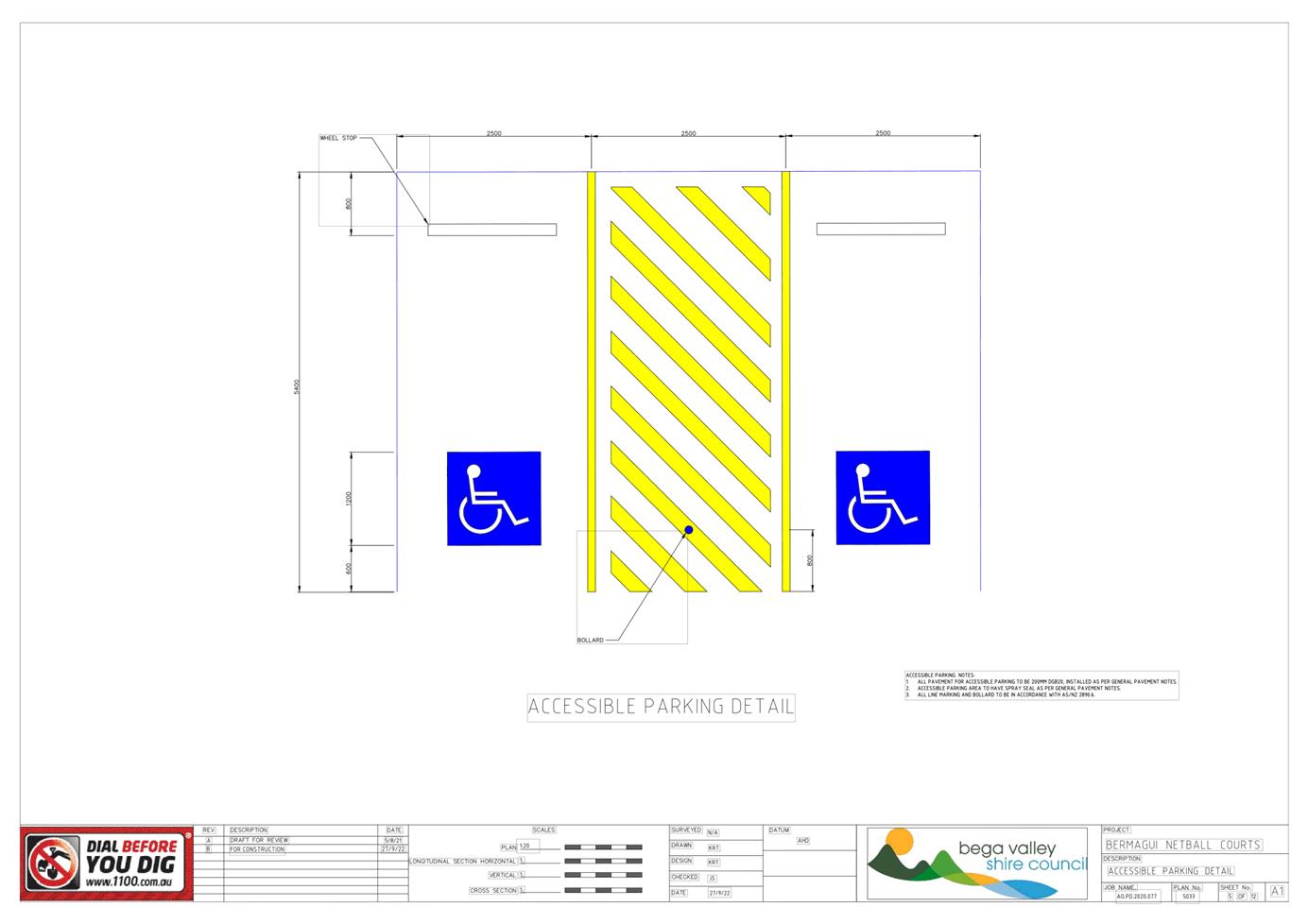

3. Bermagui

Netball Courts – Accessible parking space

That

Council approve the installation of two accessible car spaces

and shared zones, at the Bermagui Netball Courts adjoining Dickenson Oval, in

accordance with the Design Plan Rev B.

Executive Summary

The Local Traffic Committee is primarily a technical review

committee and is not a Committee of Council. Local Traffic Committees operate

under delegation from TfNSW who are responsible for traffic control on all NSW

roads. Their role is to advise Council on traffic control matters that relate

to prescribed traffic control devices or traffic control facilities for which

Council has delegated authority.

It is a requirement for Council to formally adopt the

recommendations from this Committee prior to action being taken.

Background

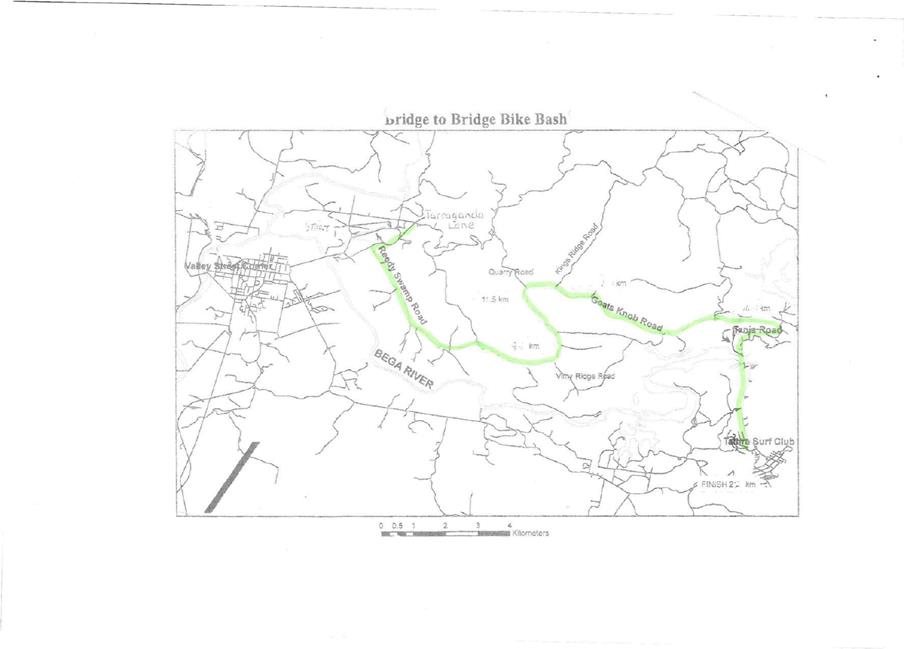

Tathra

Wharf to Waves – Bike Event – Saturday, 4 March 2023

Tathra Wharf to Waves is a 25 km non-competitive bicycle

ride predominately on National Parks managed land from Bega to Tathra. The ride

is part of the Wharf to Waves weekend conducted in accordance with DA 2011.382.

The bike ride will run from at 4.00pm until 7.30pm via Reedy

Swamp Road, Quarry Road, Goats Knob Road, and a section of the Tathra Bermagui

Road to the top of Fords. The riders will then turn left off Tathra Bermagui

Road at the top of Mogareeka Hill and ride around the “Fords”

Headland area to the North of the Bega River Headland, then onto Bay Drive re-joining

Tathra Bermagui Road north of the bridge.

Request

for removal of timed car space – Carp and Auckland Street - Bega

Council received the following request:

I would like to bring to the

attention of the committee, a timed parking space placed in a prohibited parking

area.

The space is on the corner of

Auckland Street and Carp Street, Bega. It is located within 20 Metres of

traffic lights on the corner.

Can arrangements be made for

this to be converted into a no stopping zone please.

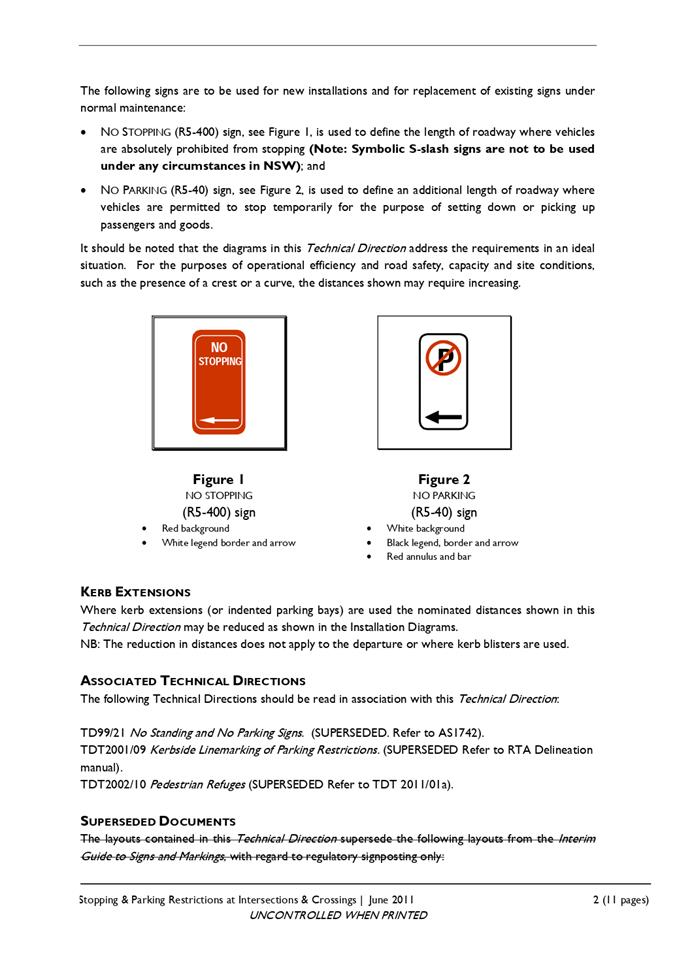

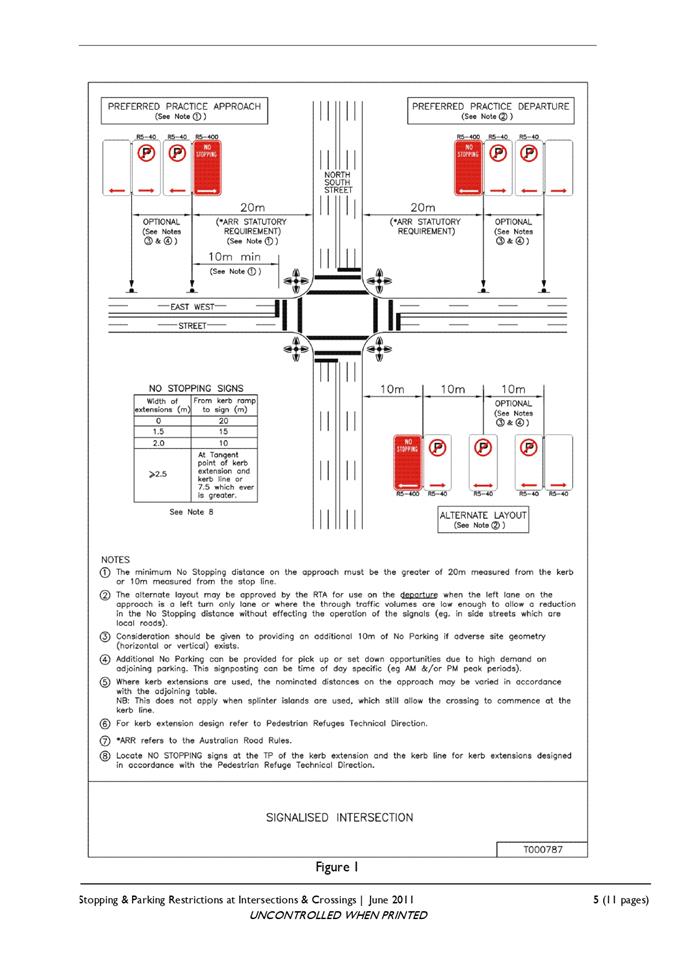

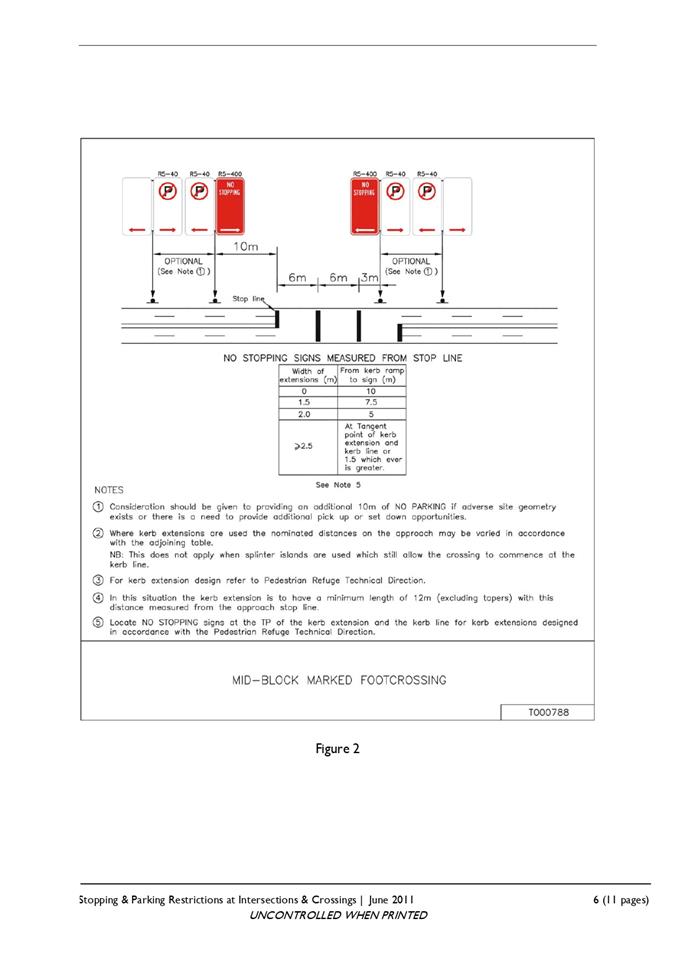

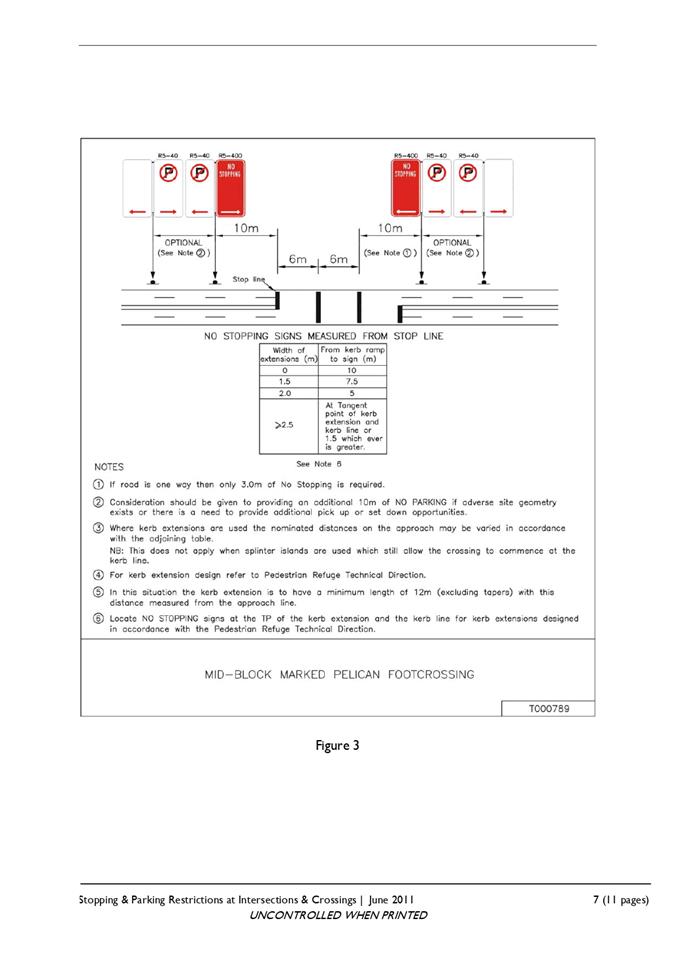

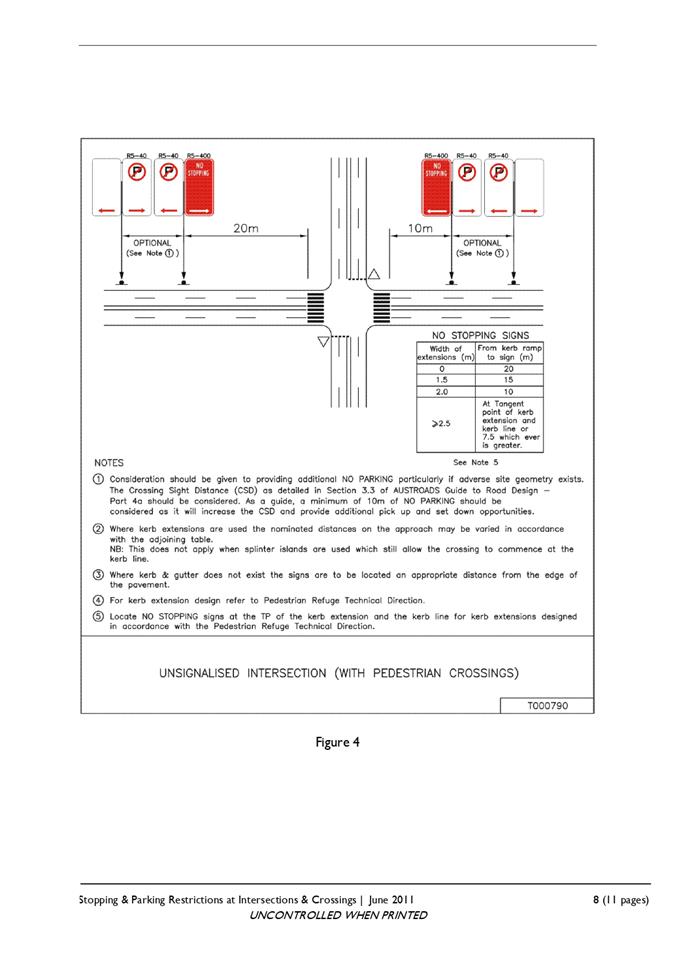

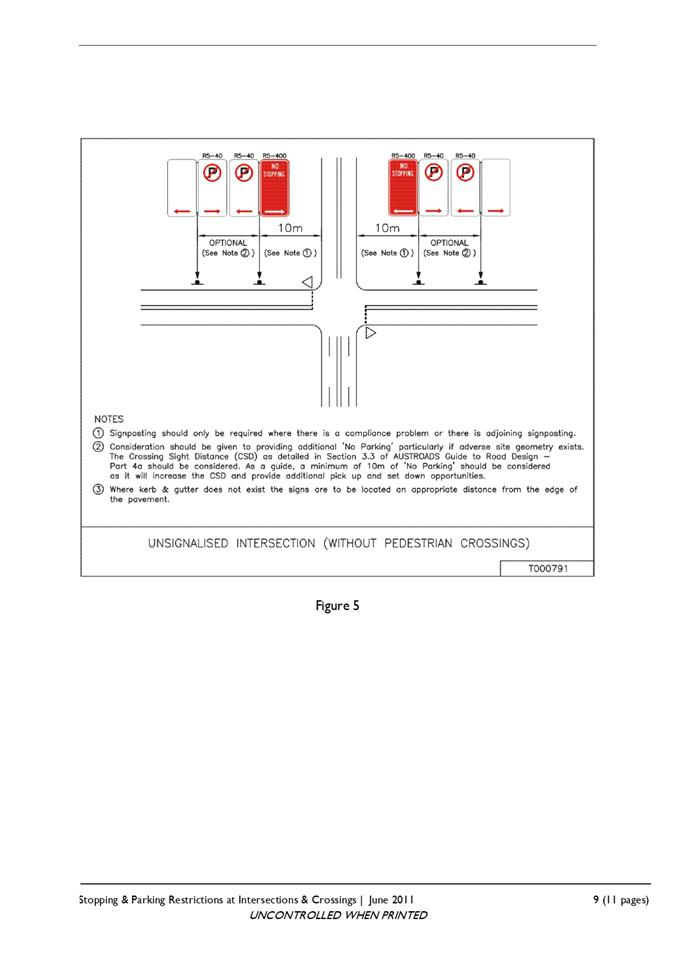

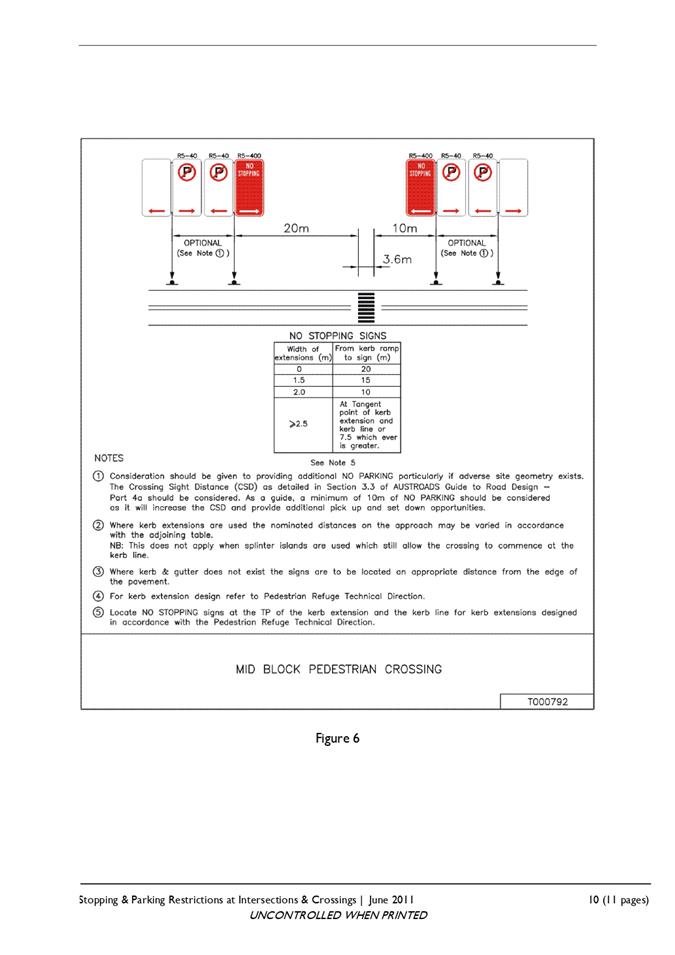

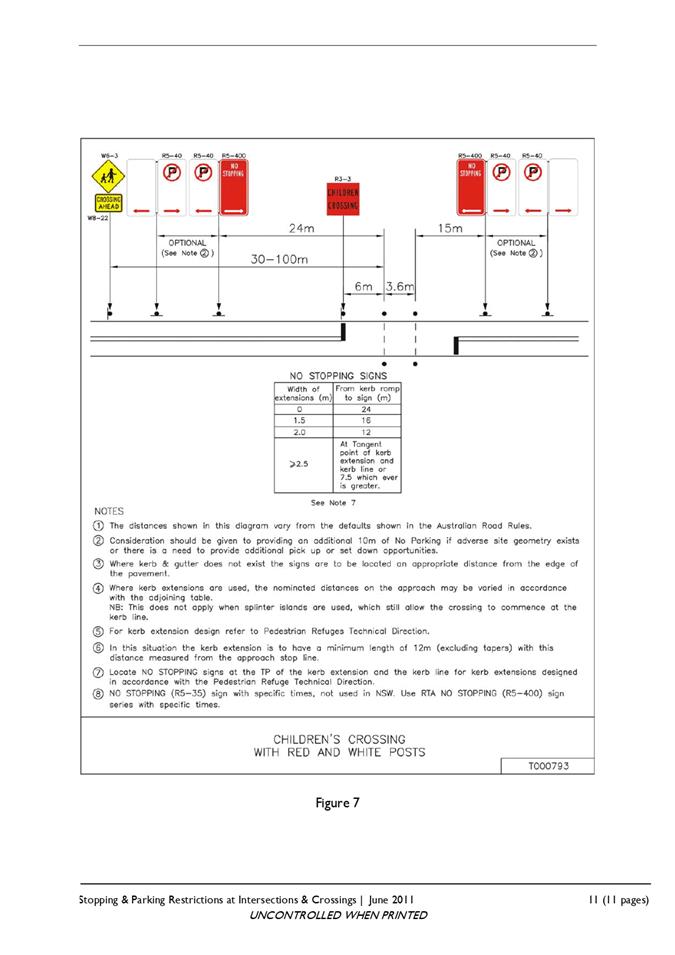

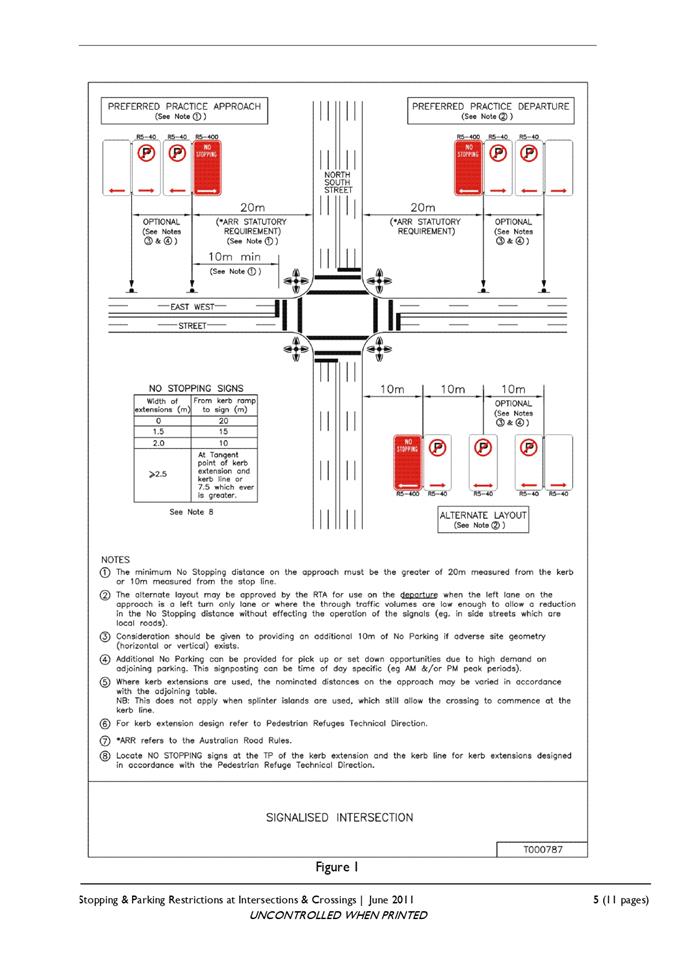

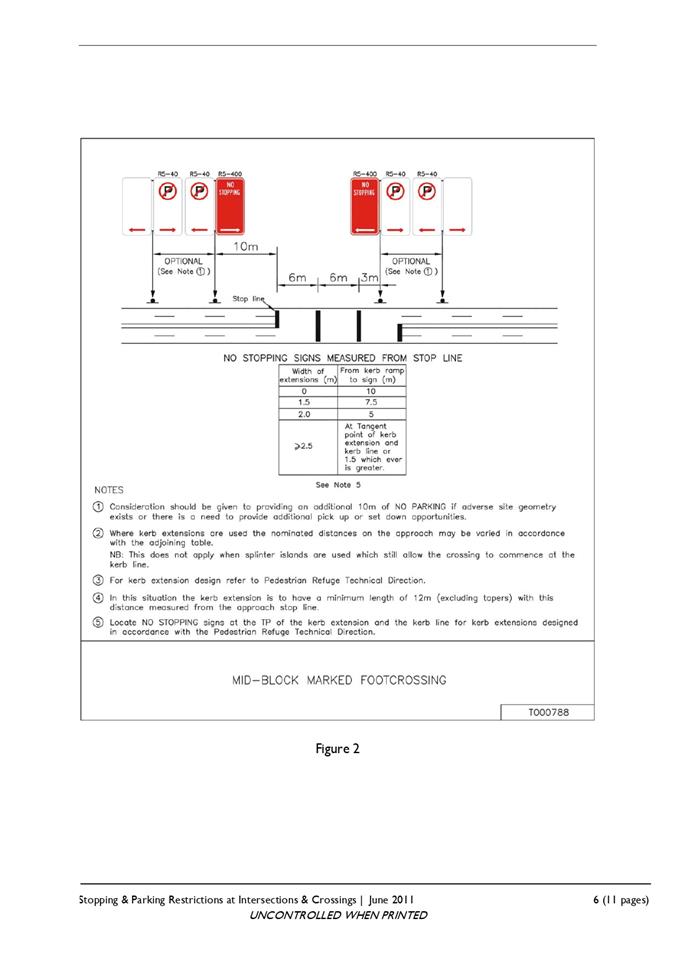

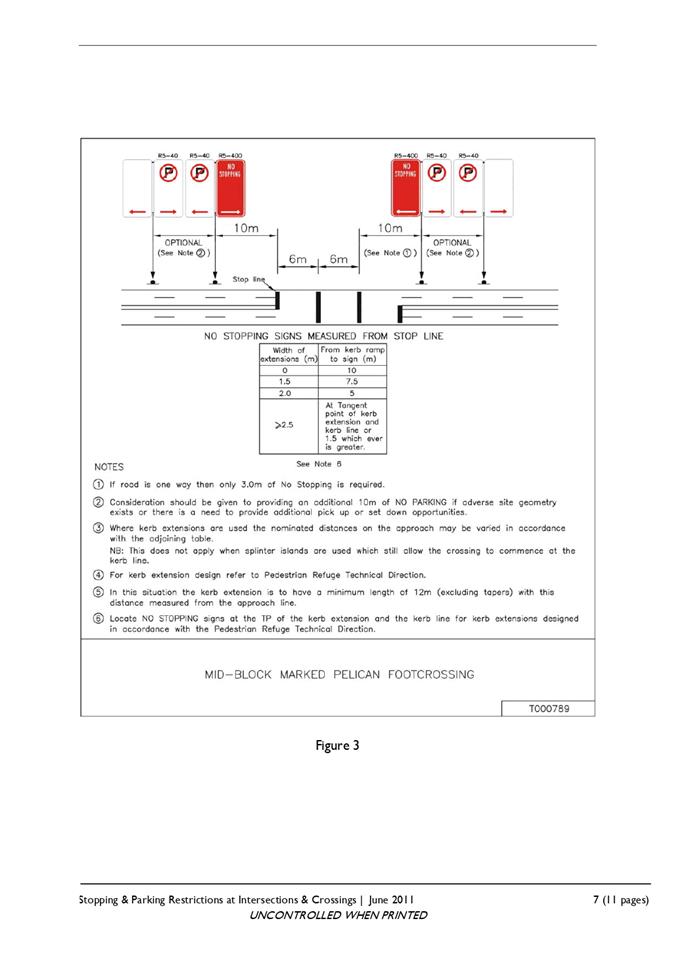

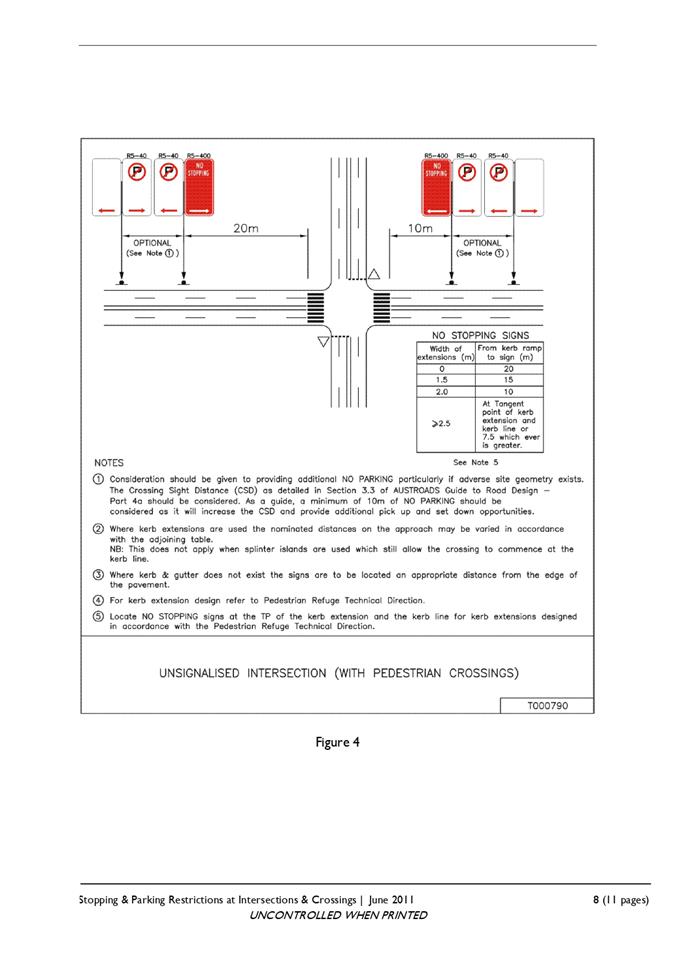

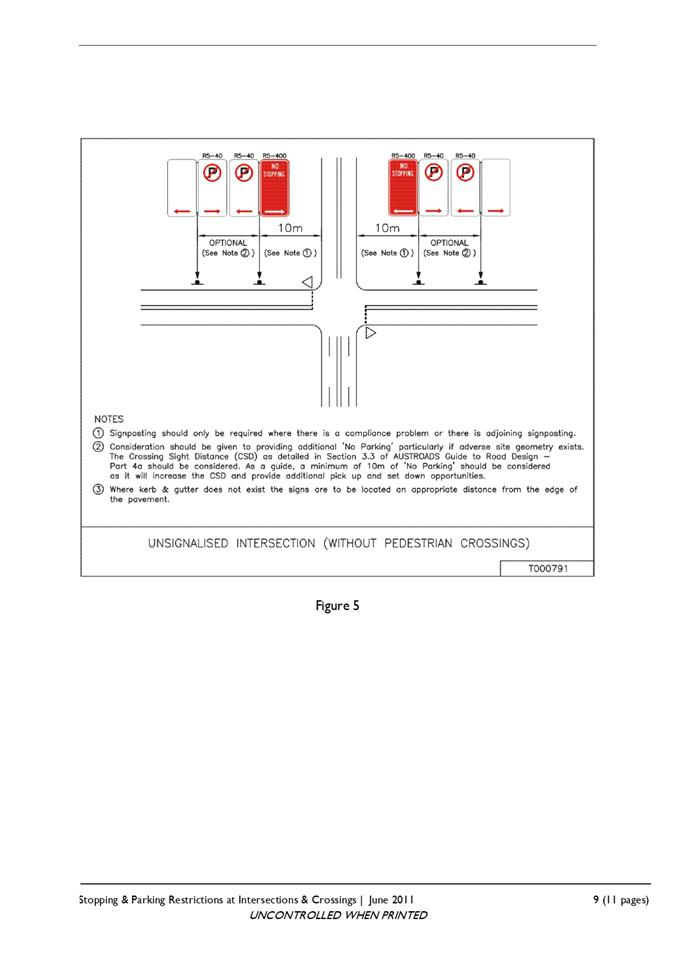

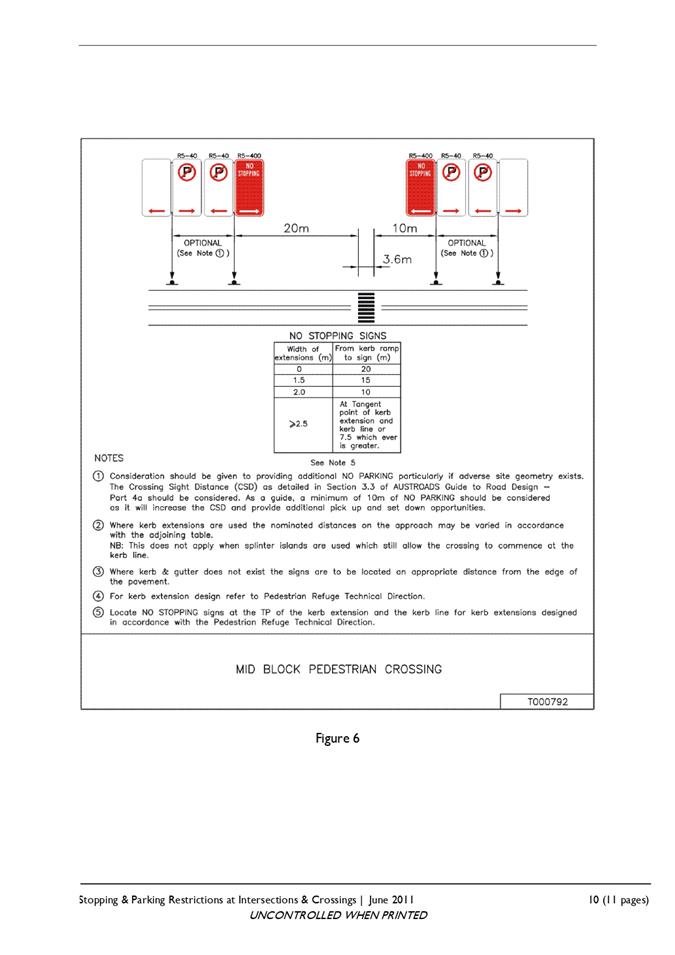

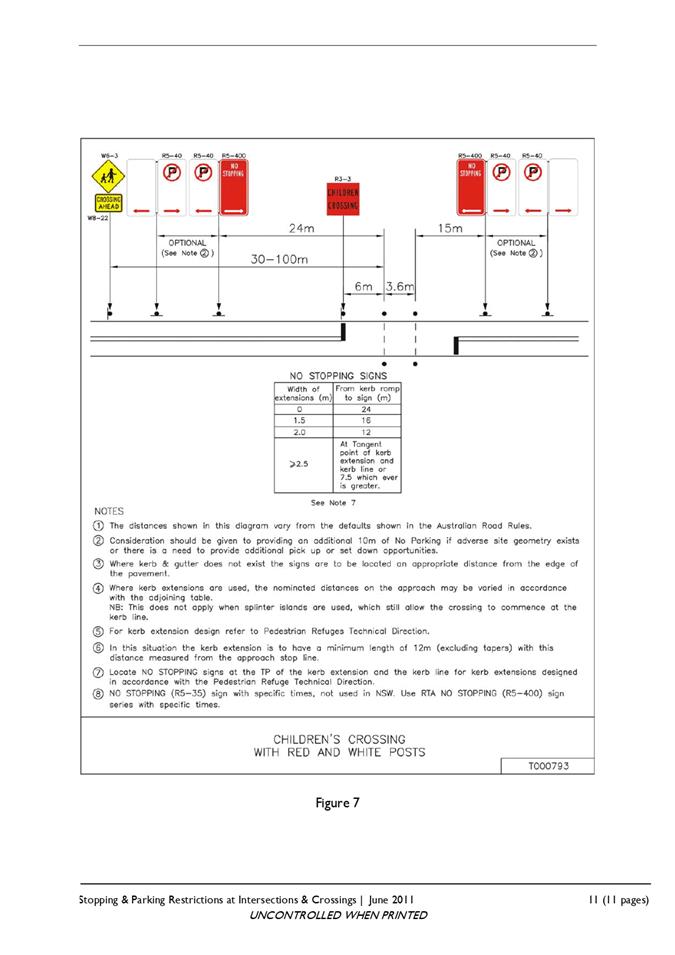

LTC representatives viewed photos of this intersection along

with the current version of the “Stopping and Parking Restrictions at

Intersections and Crossings” and raised concerns with this vehicle

parking space not being in accordance with the Technical Directions. There was

a noted conflict with vehicles reversing from the car space into the pedestrian

crossing at the intersection. Due to this risk and the fact the car space was

not in accordance with the current Technical Directions, the members of the

committee are of the opinion this one car space should be removed.

Although one of the car spaces in front of the Grand

Hotel’s Carp Street frontage was also not ideal, it did not pose the same

risk to pedestrians and therefore could stay until such time as council

undertake any Carp Street on street parking or street scape review.

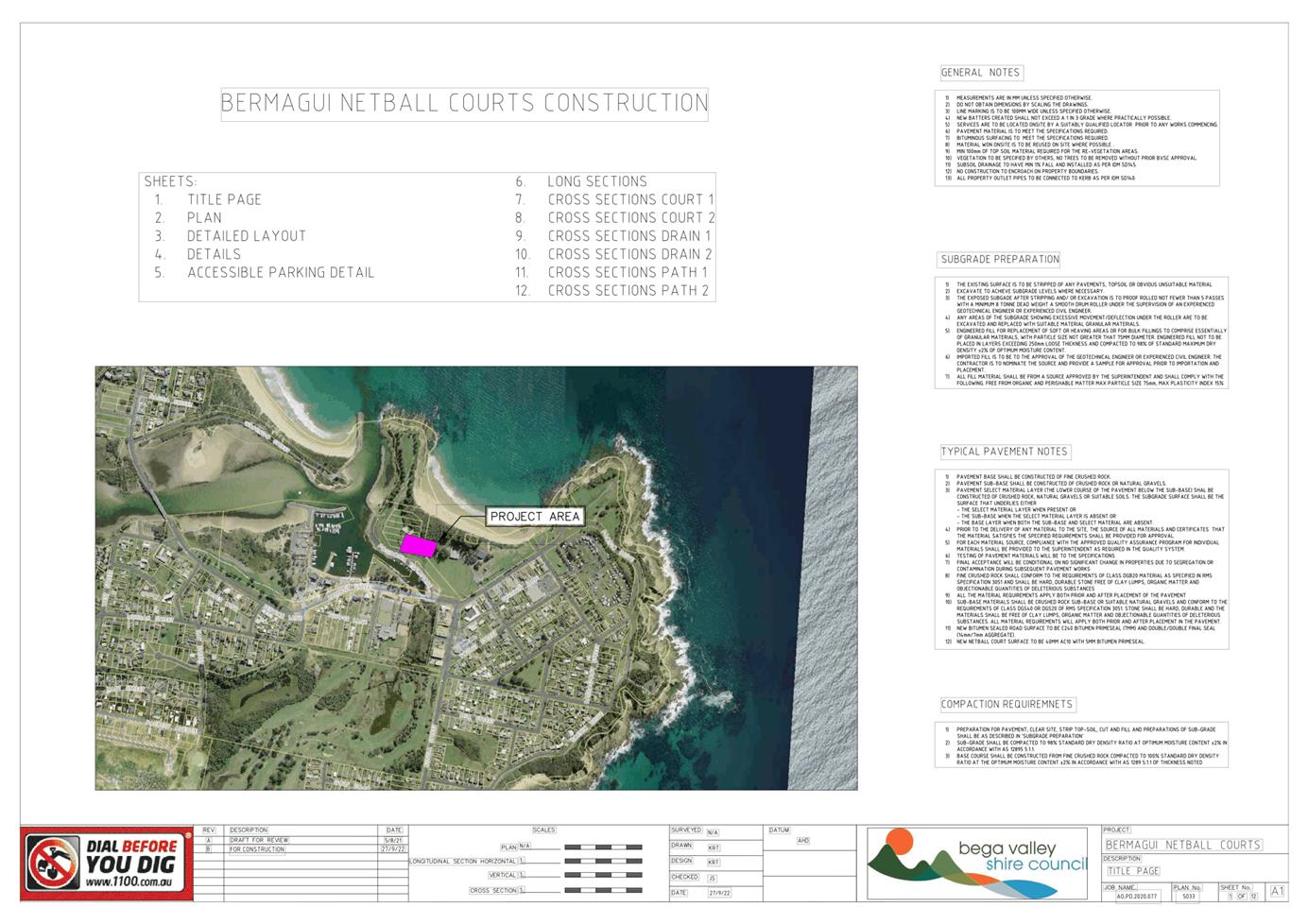

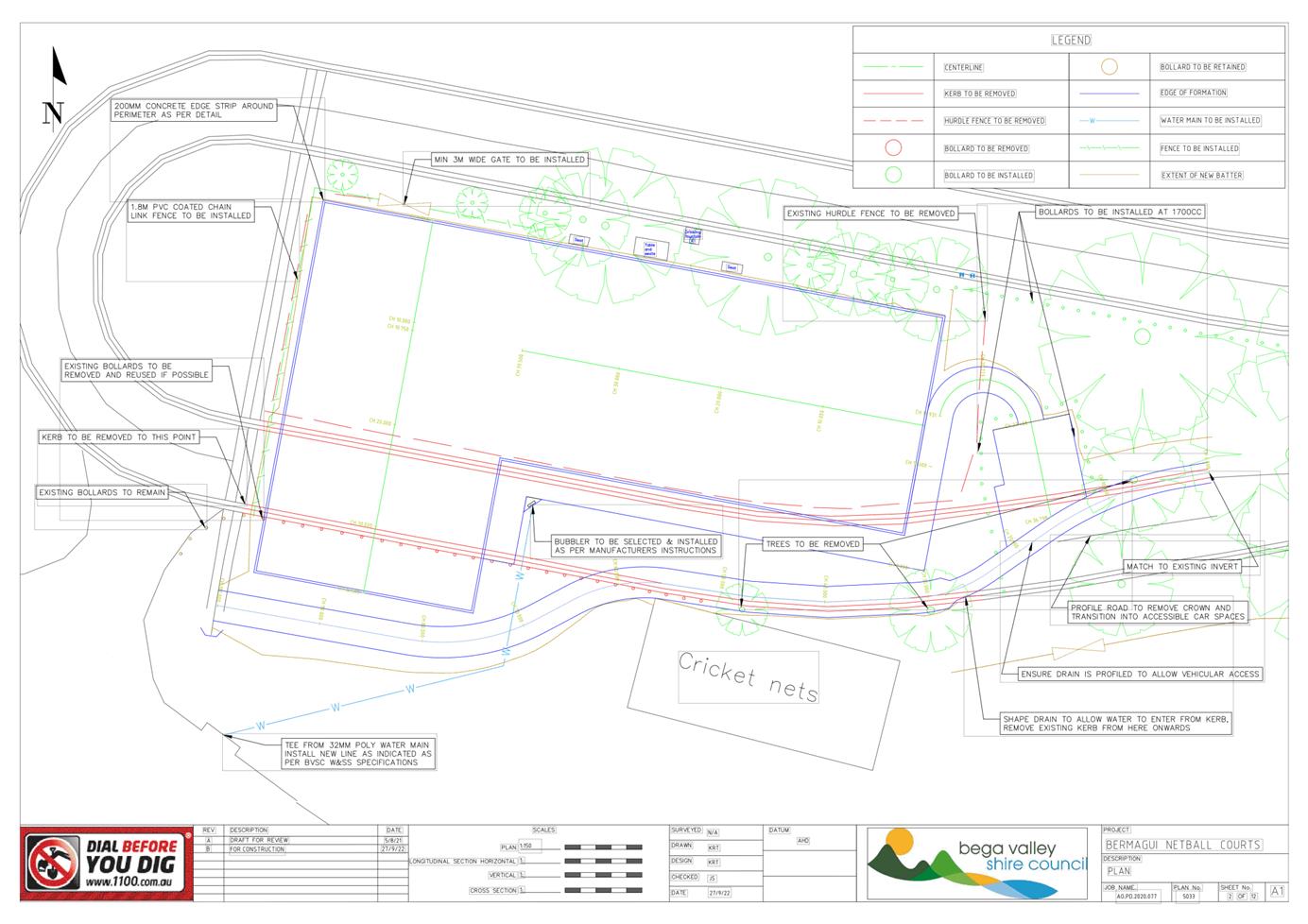

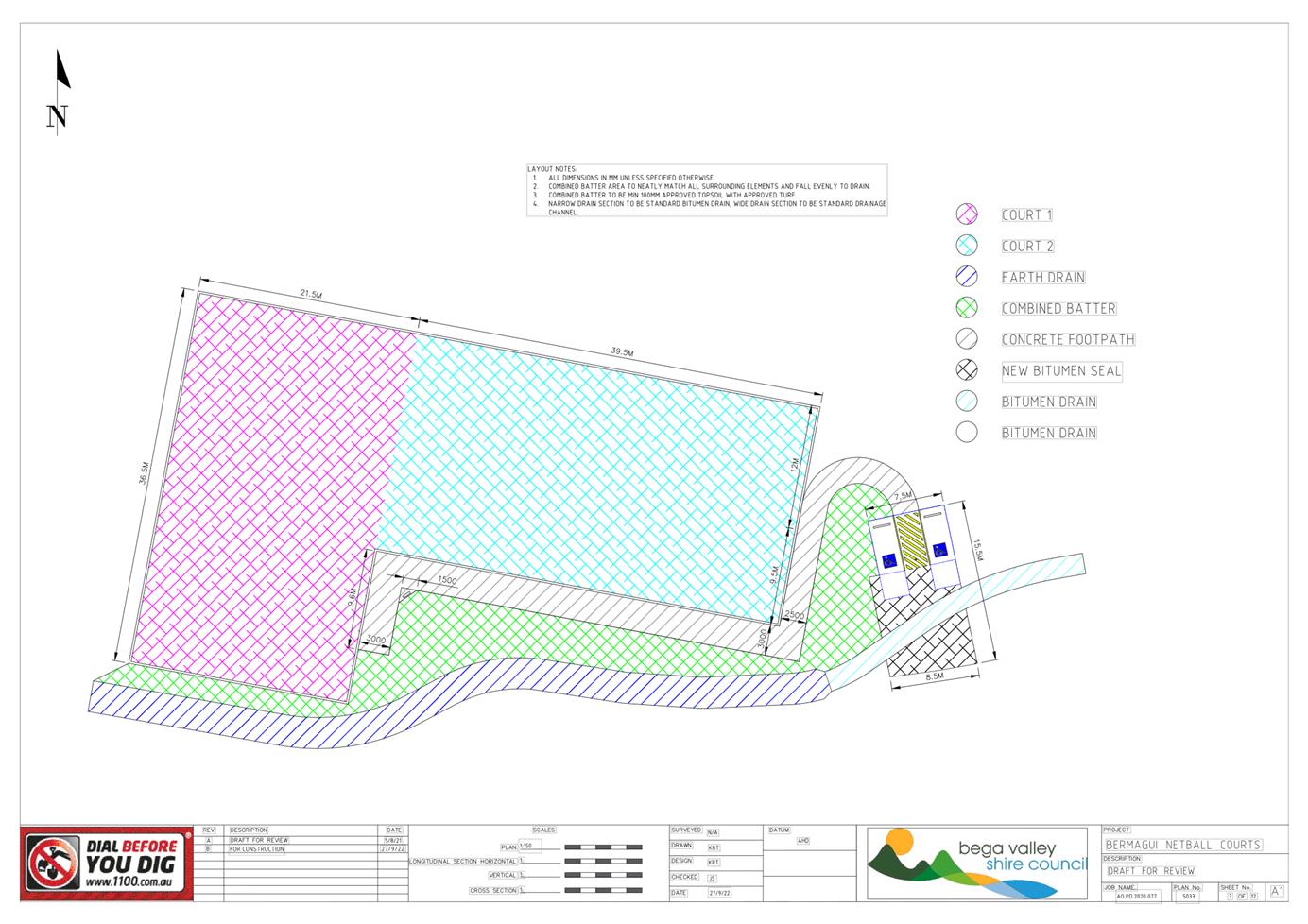

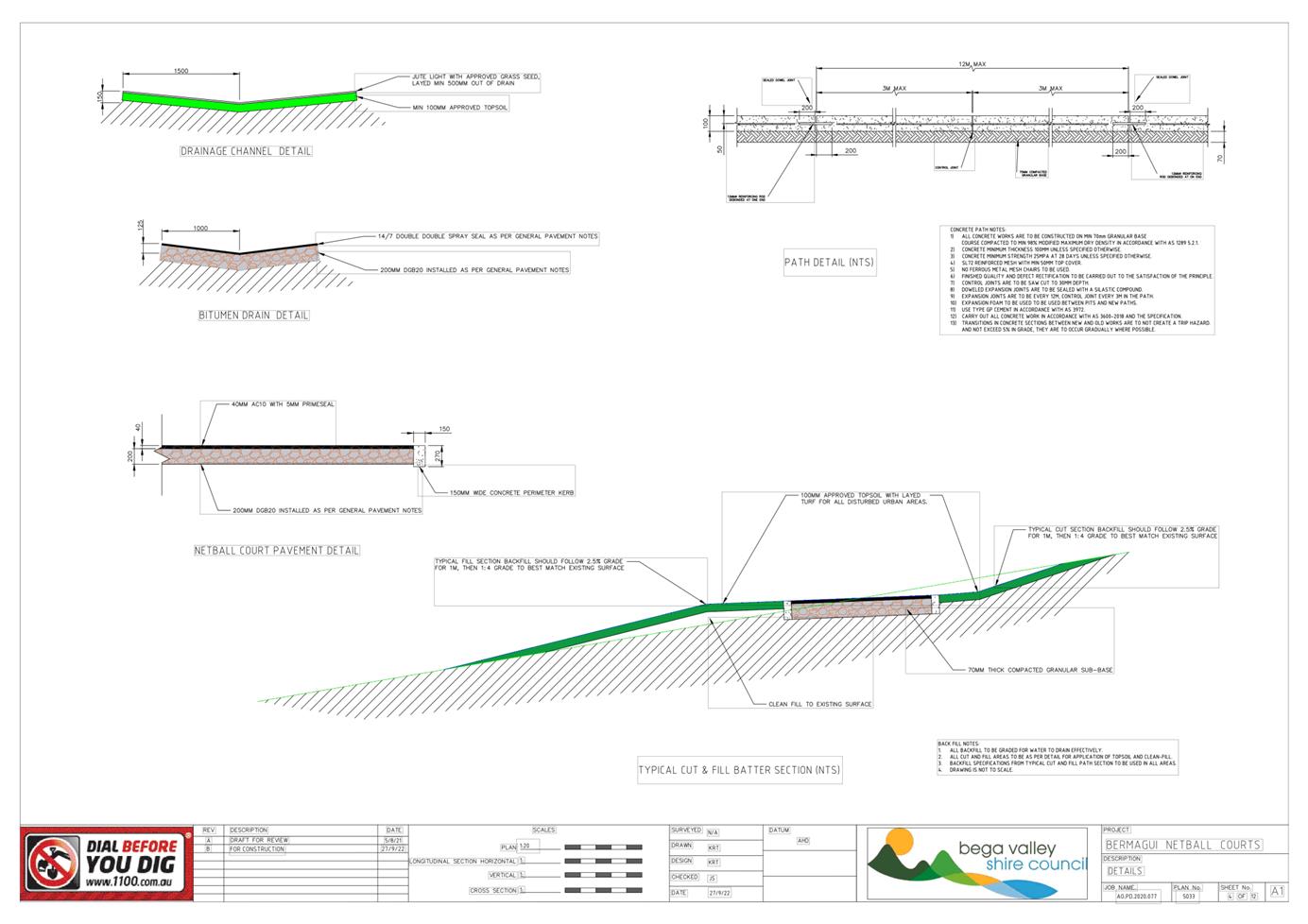

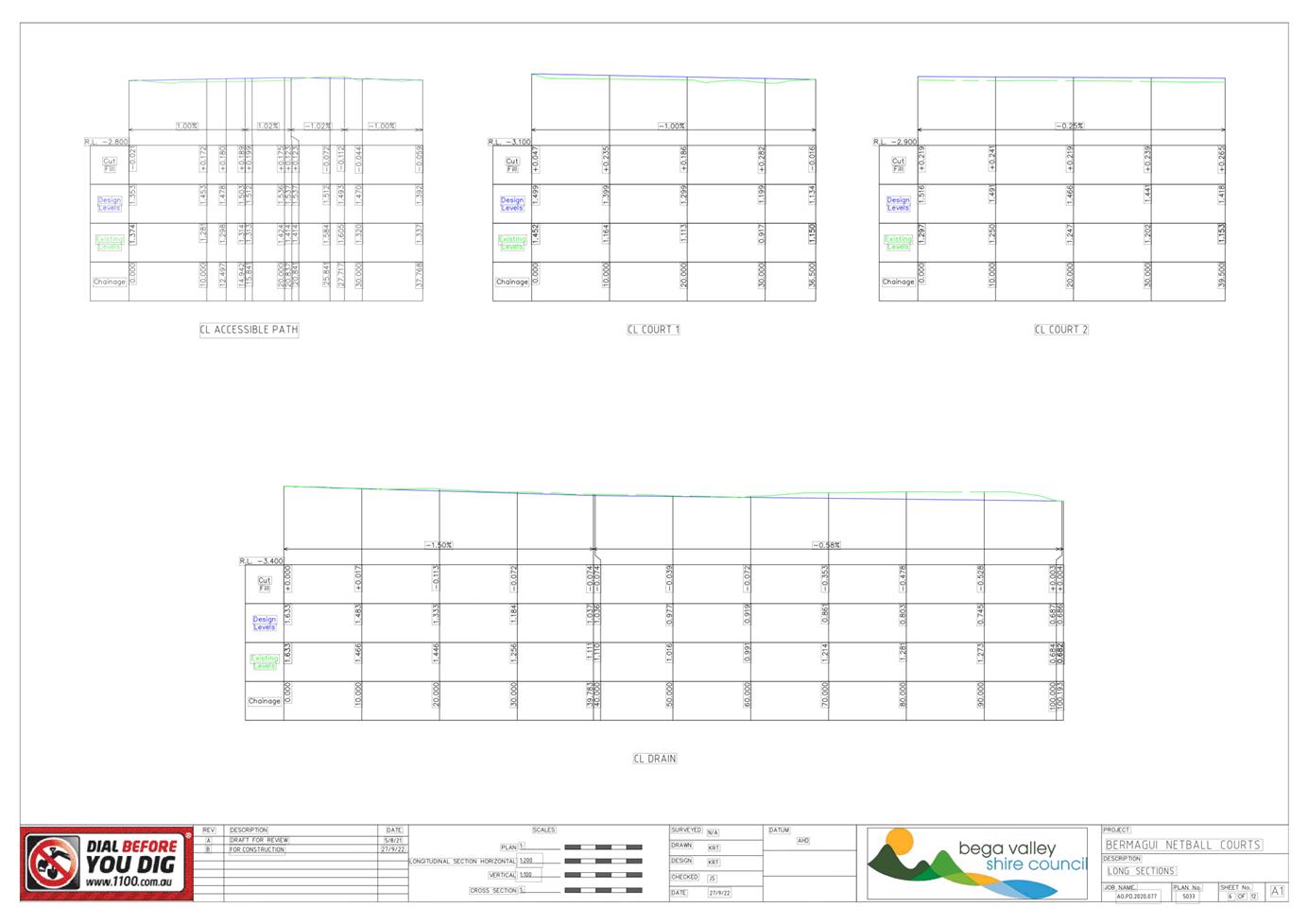

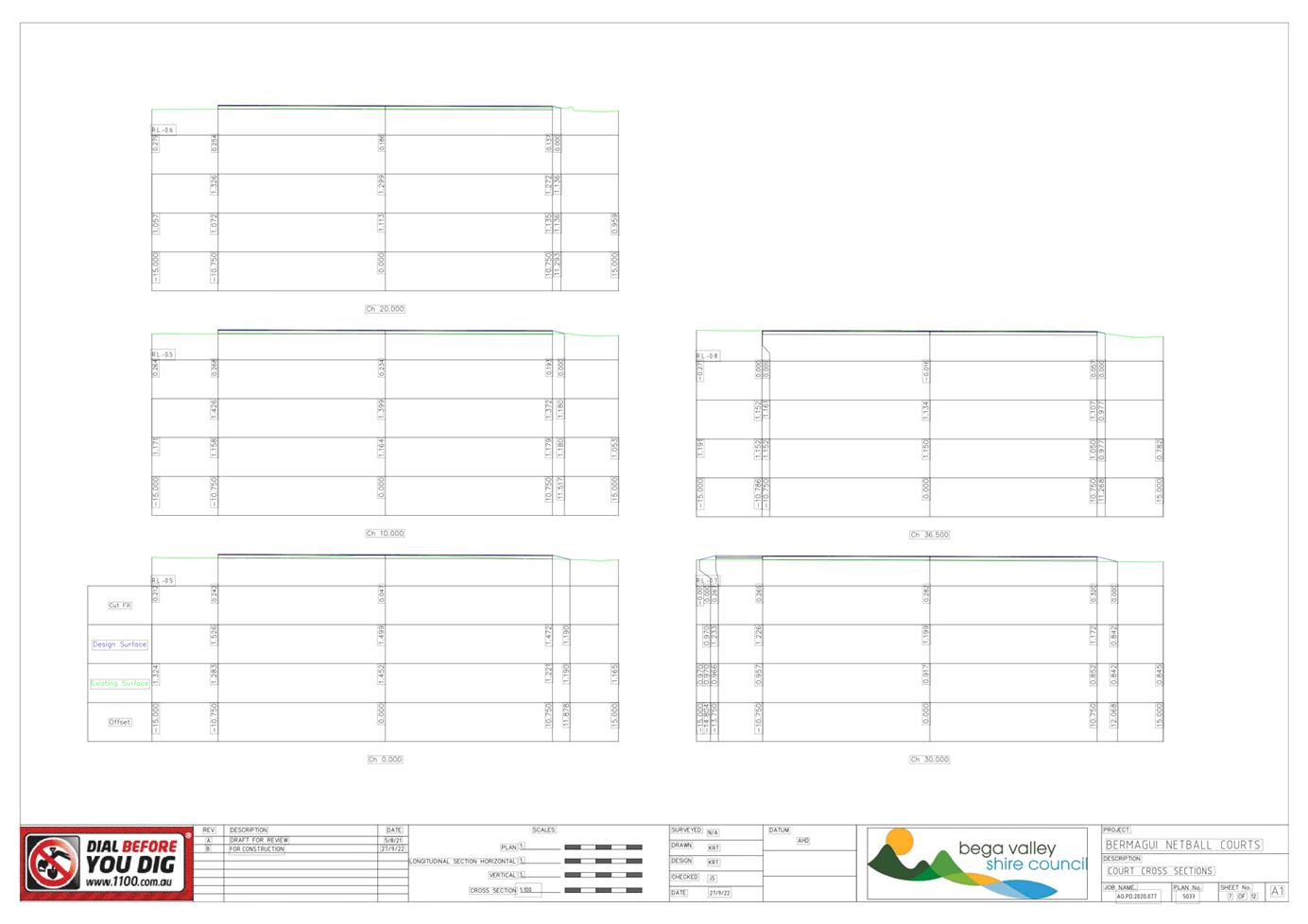

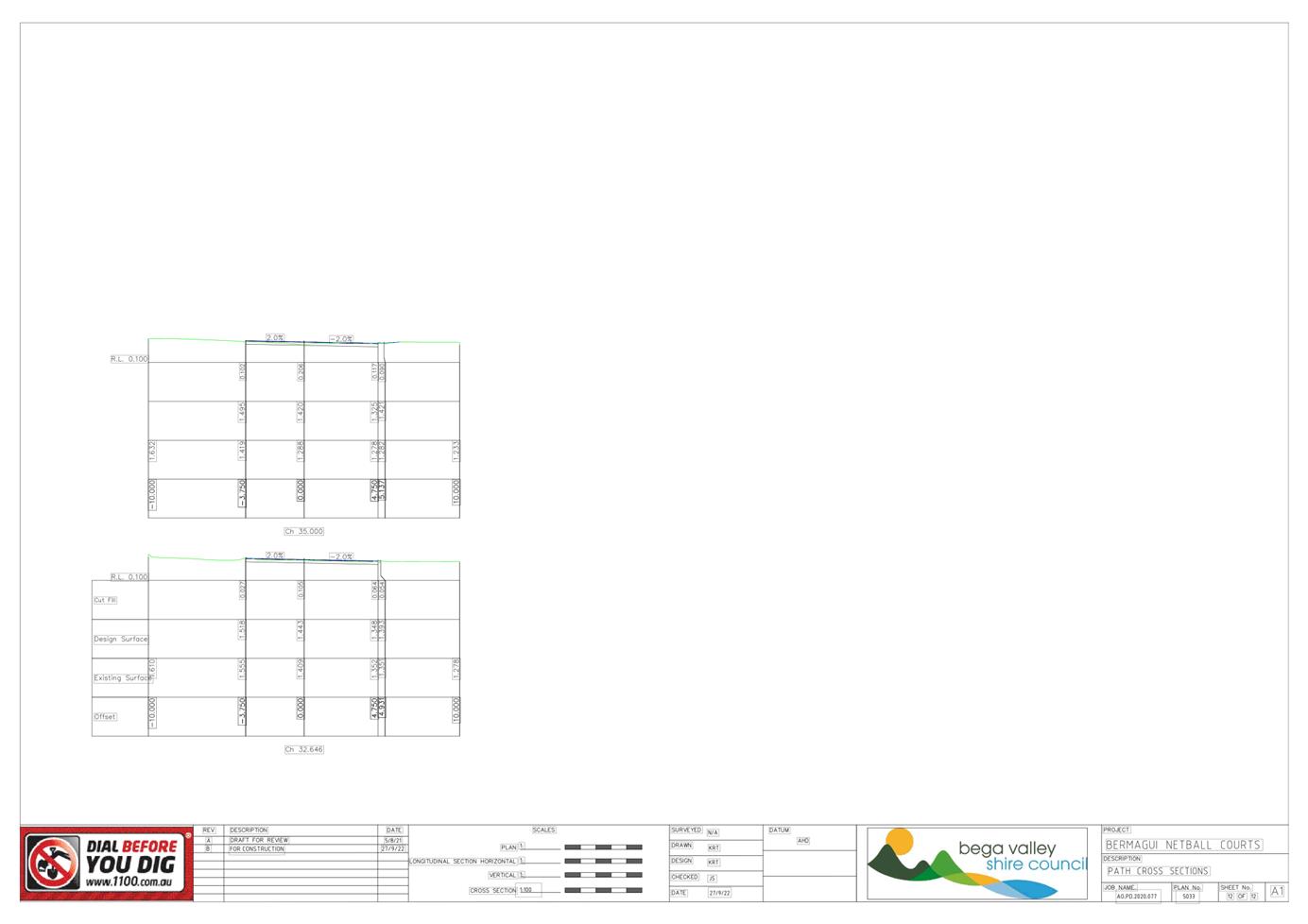

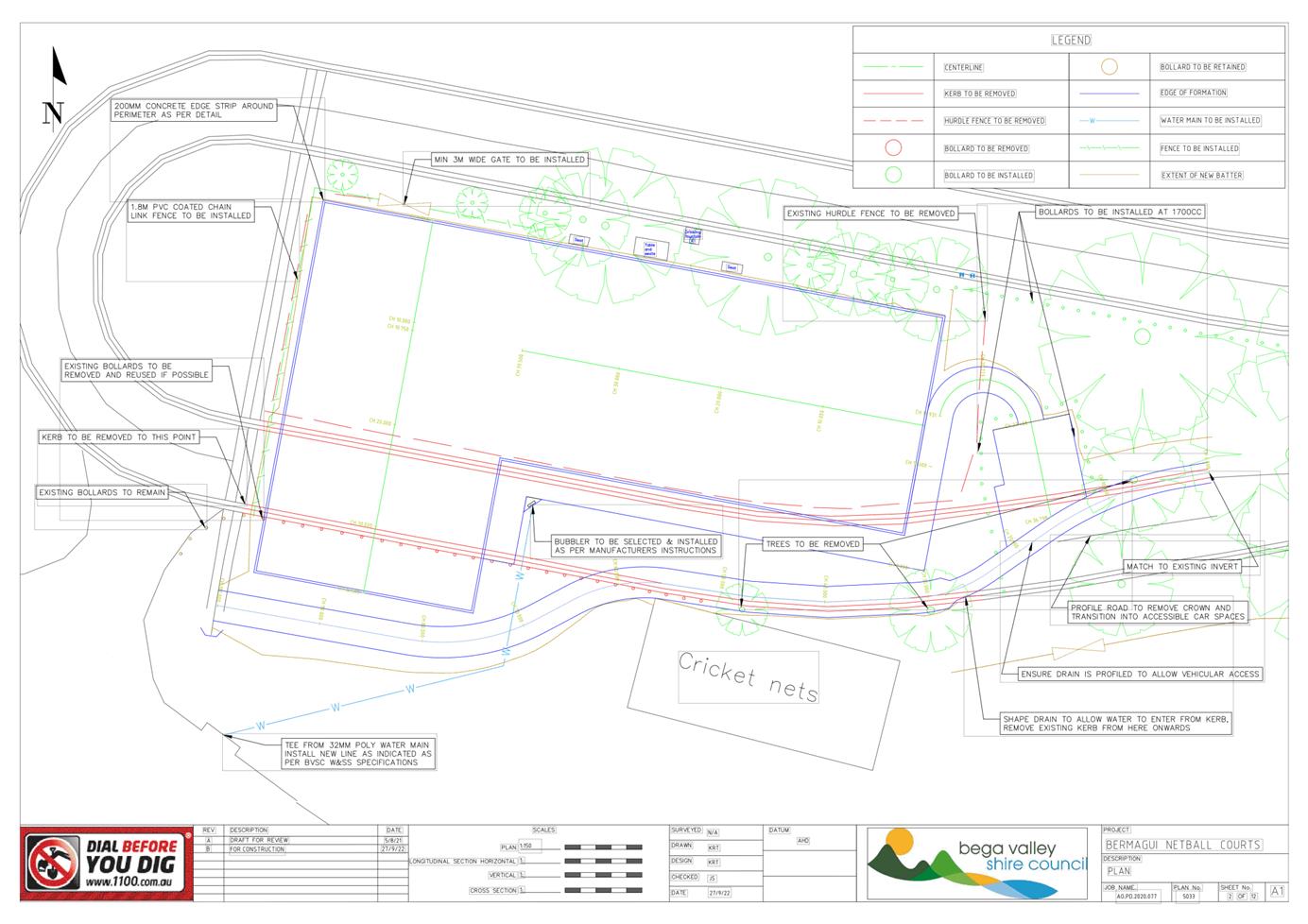

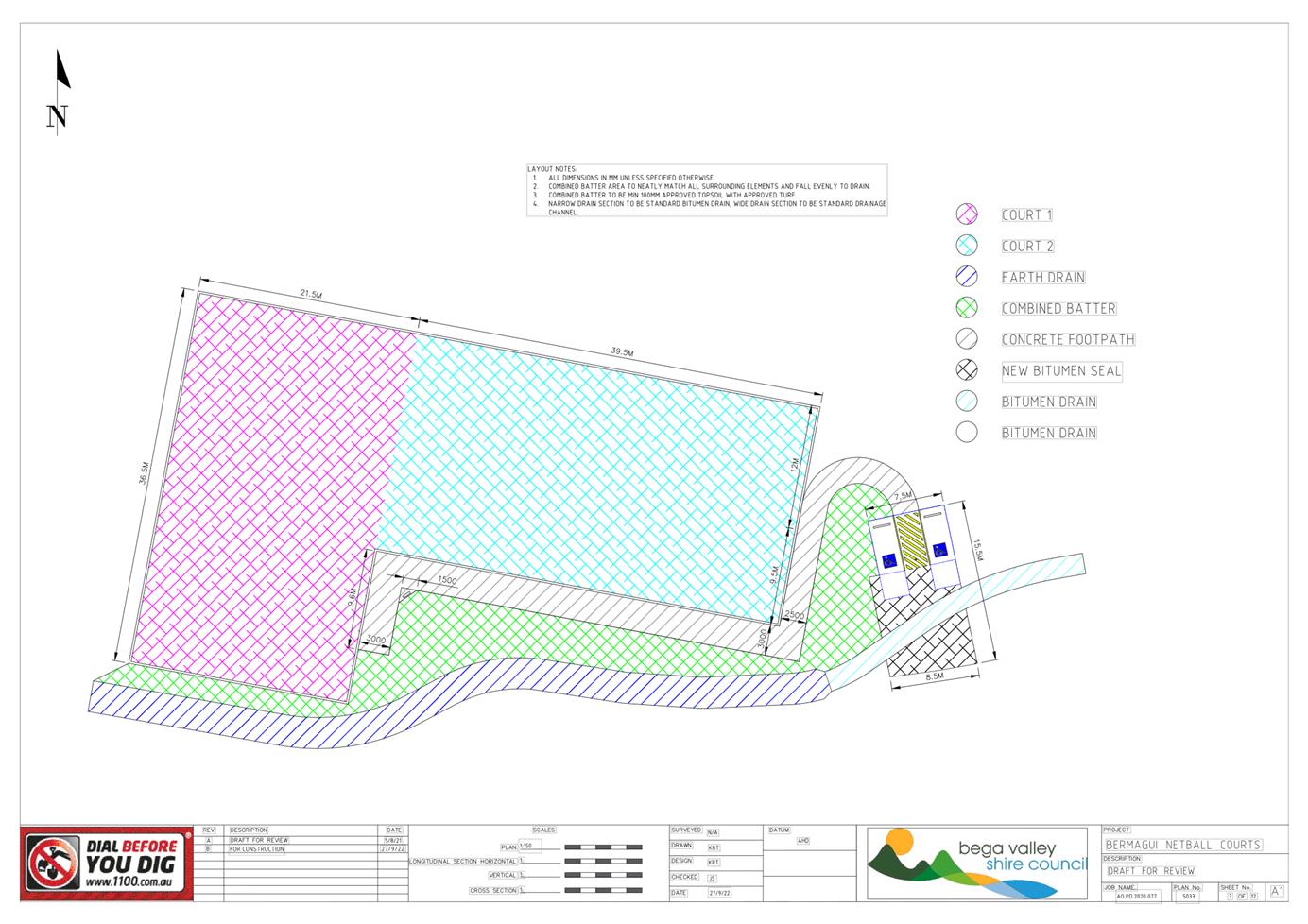

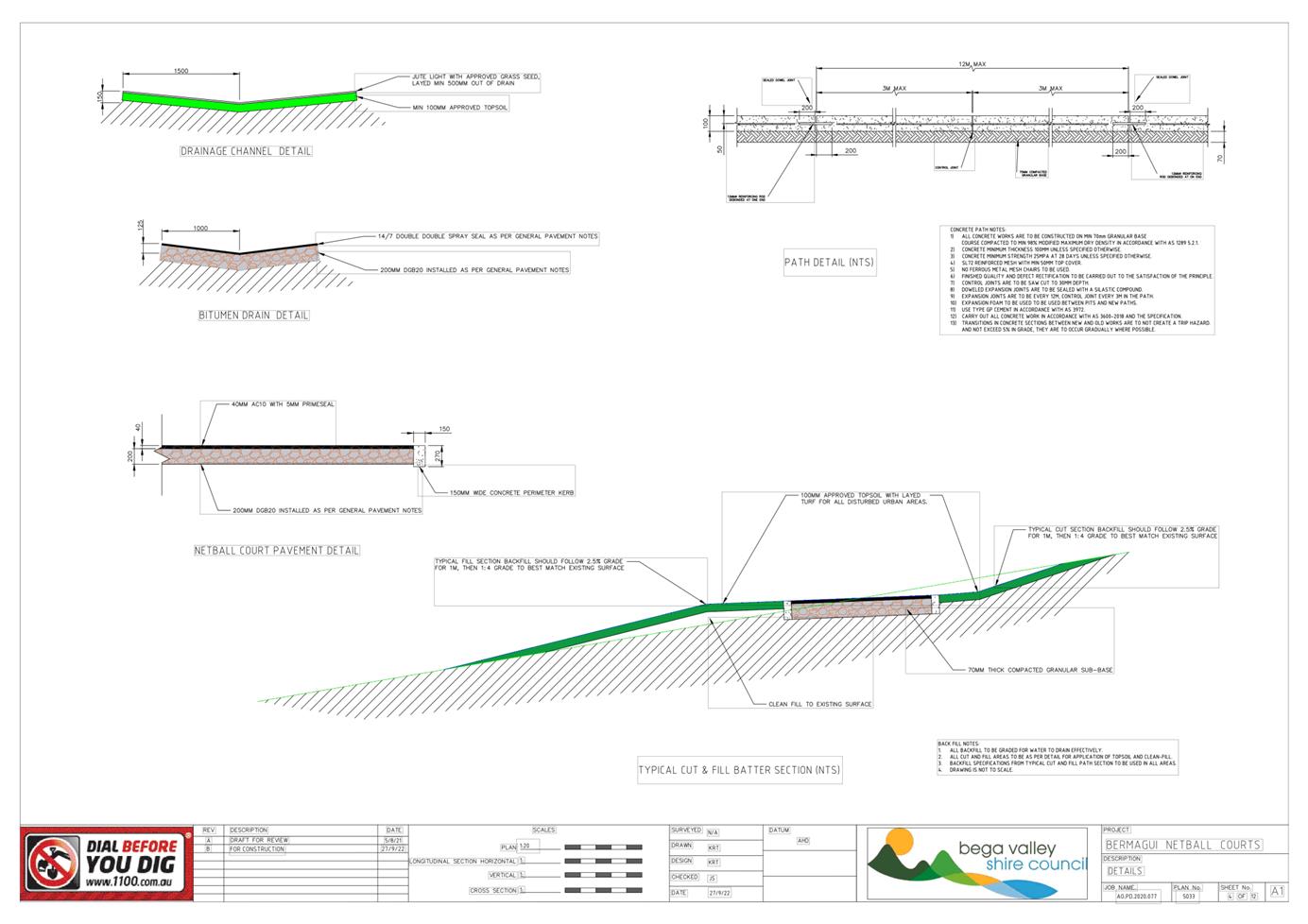

Bermagui

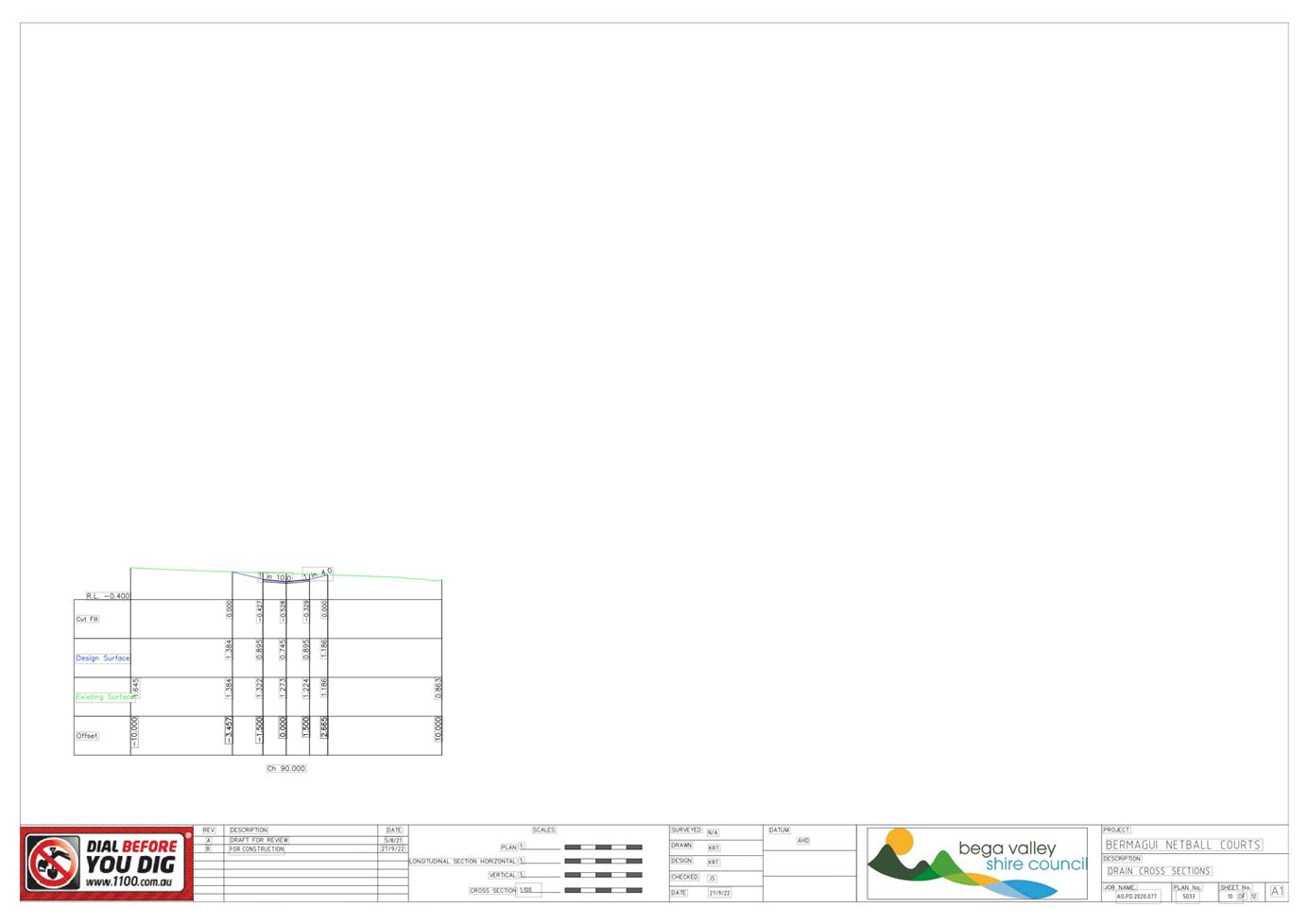

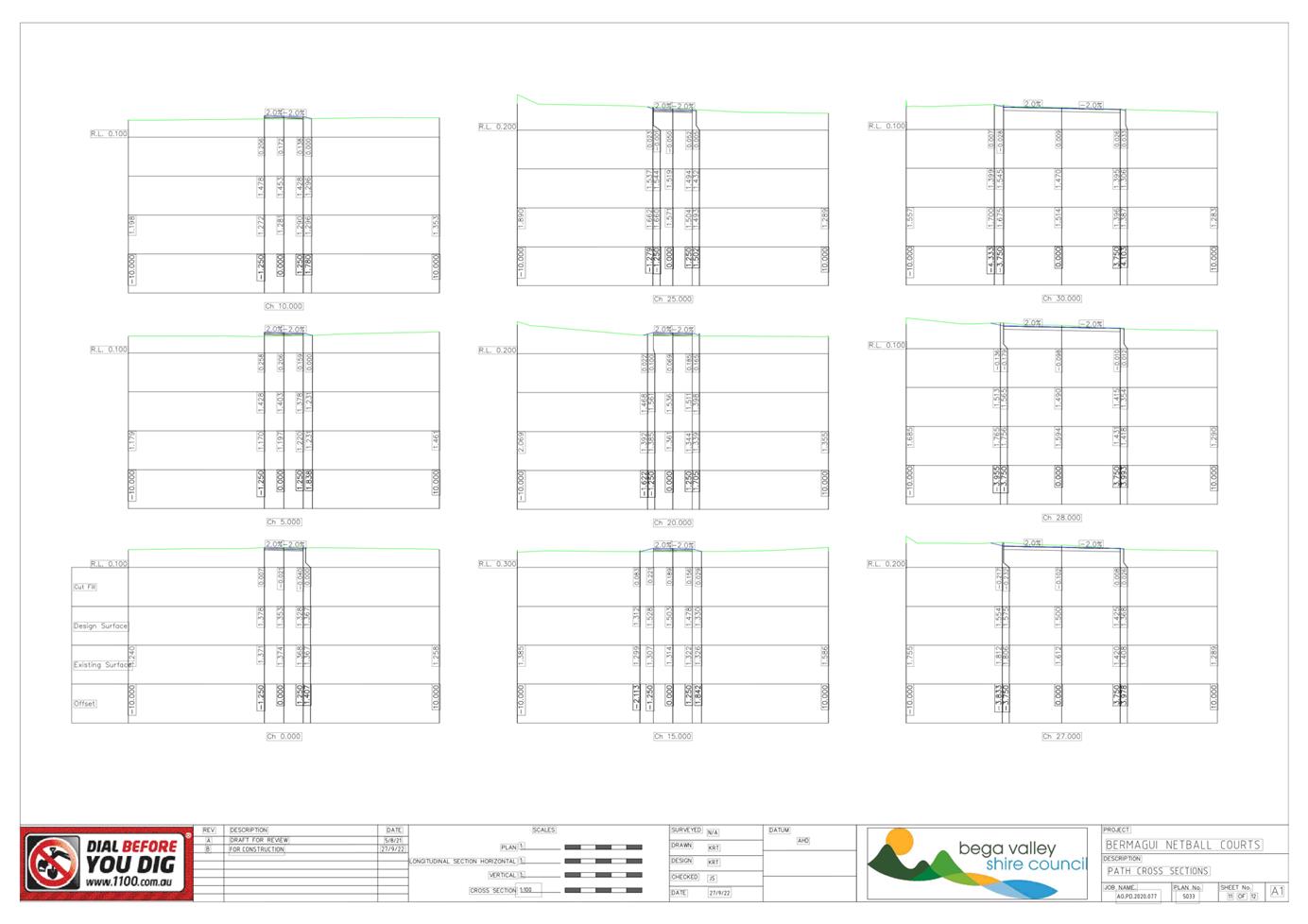

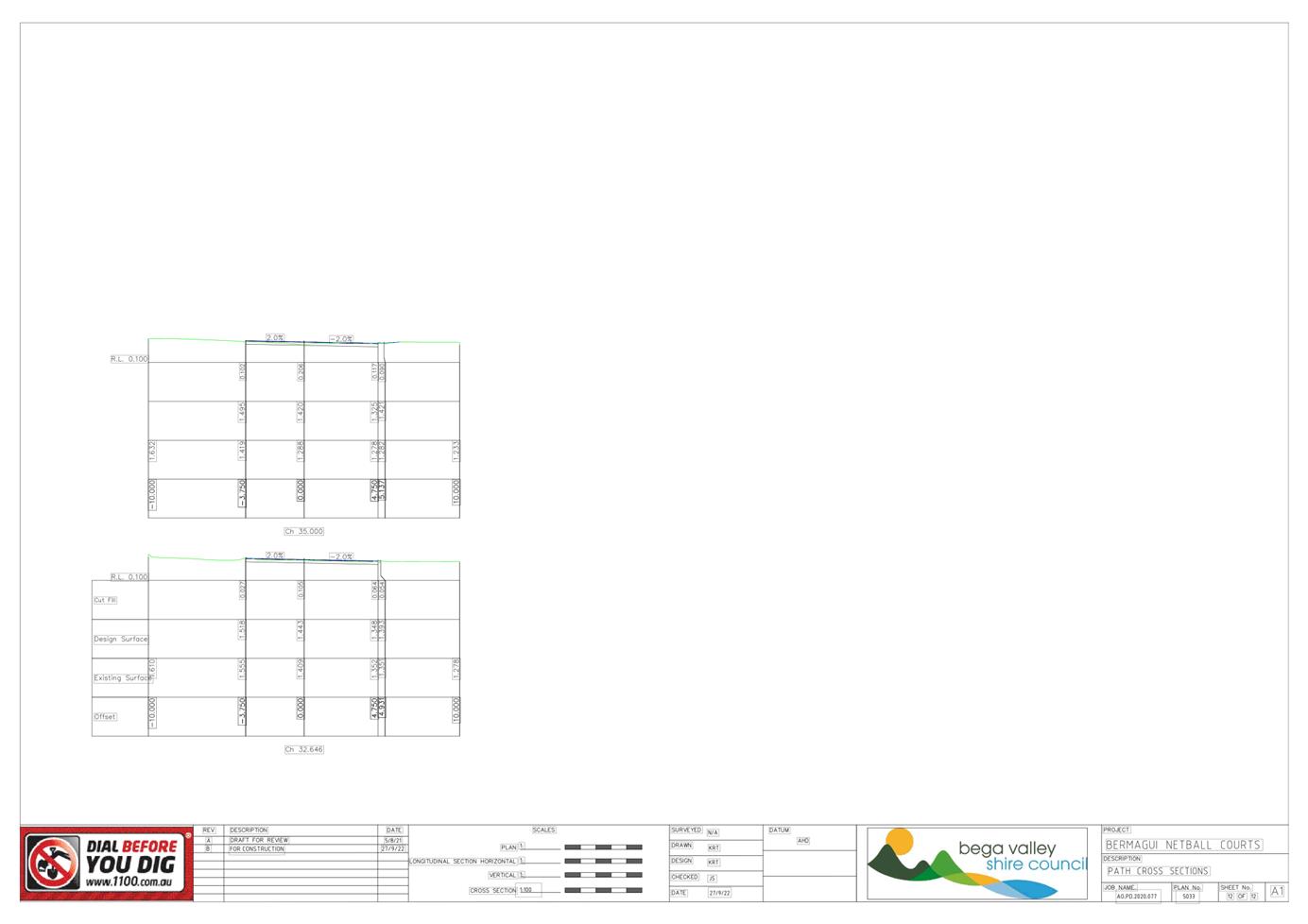

Netball Courts - Accessible parking space

The following request has been received from staff for the

approval of accessible car parks at the Bermagui Netball Courts:

Please see design plans - Bermagui

Netball courts: This project is to construct

upgraded netball courts in Bermagui

at the location dictated in the attached plan. There is

currently no formalised accessible

infrastructure for this community sporting venue and as such the design plans

incorporate two compliant parking bays and an accessible path of travel to

access the venue.

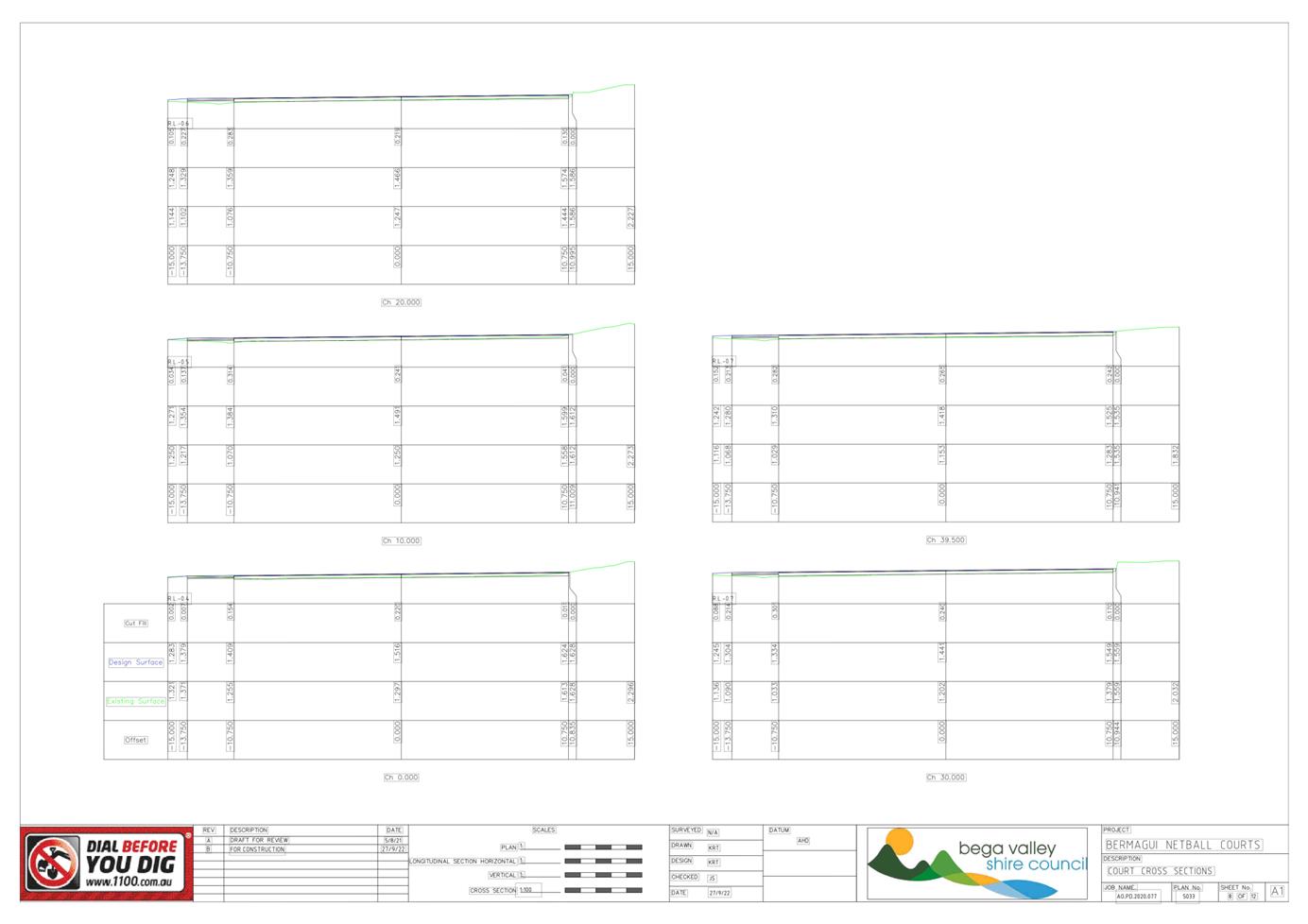

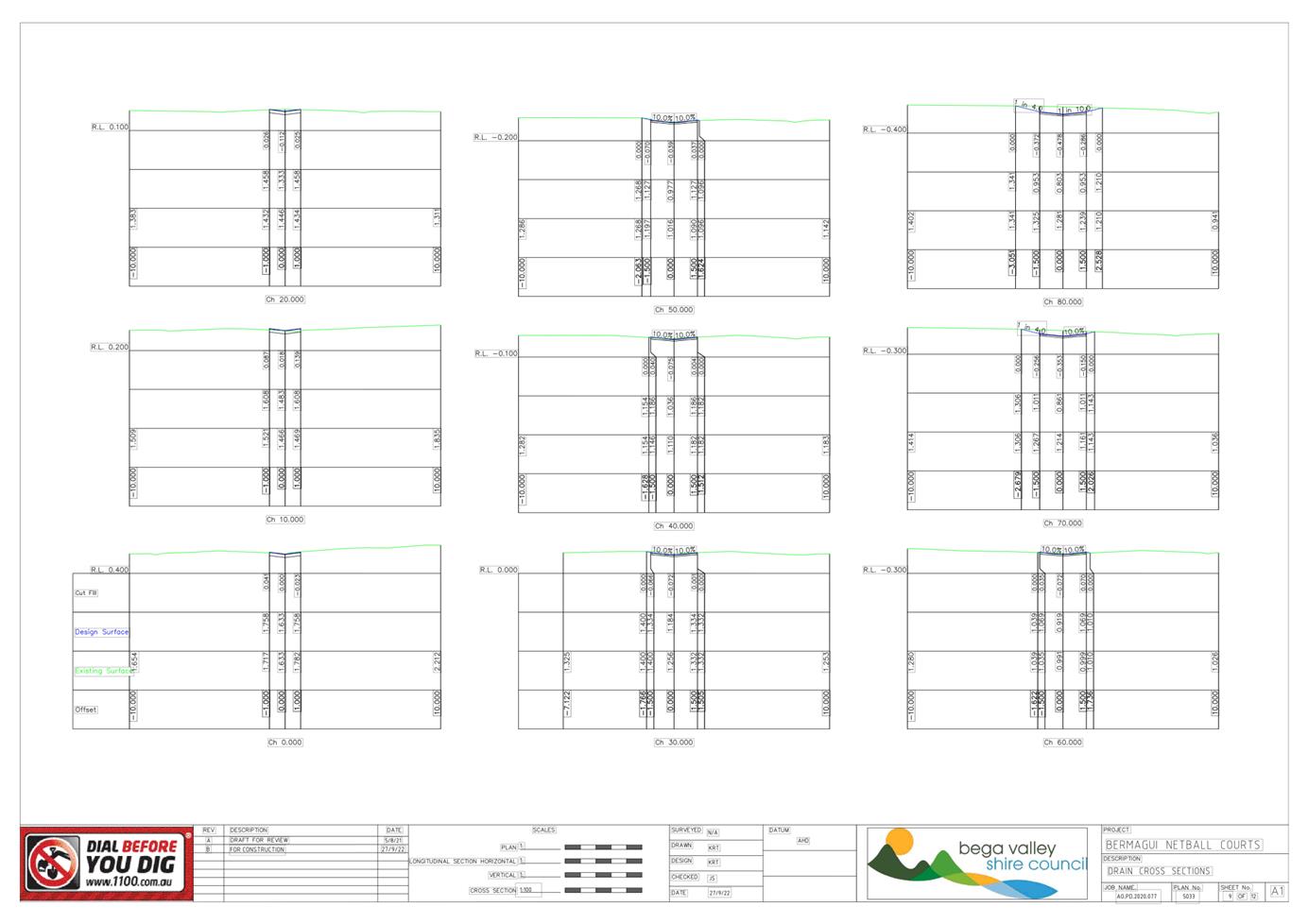

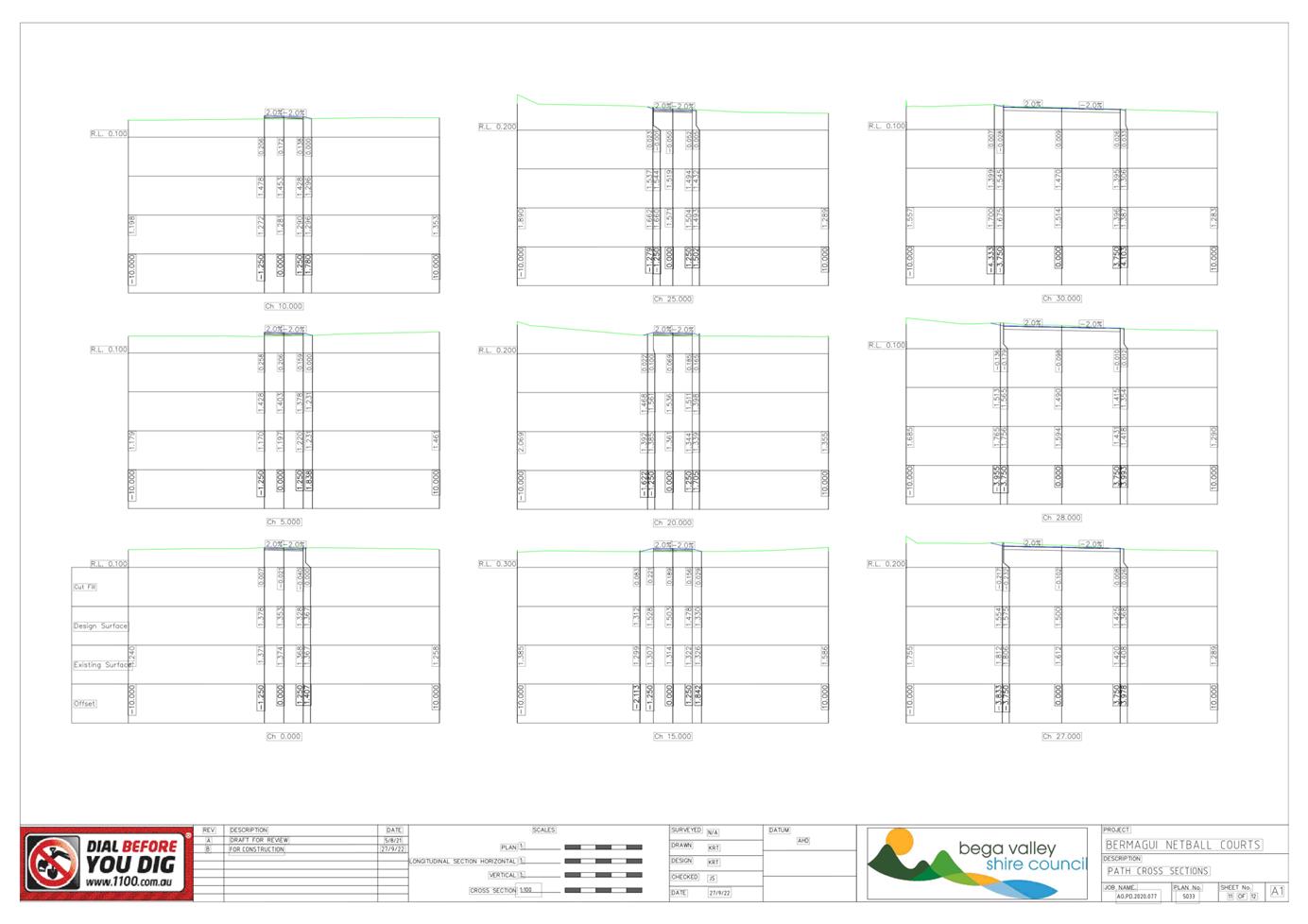

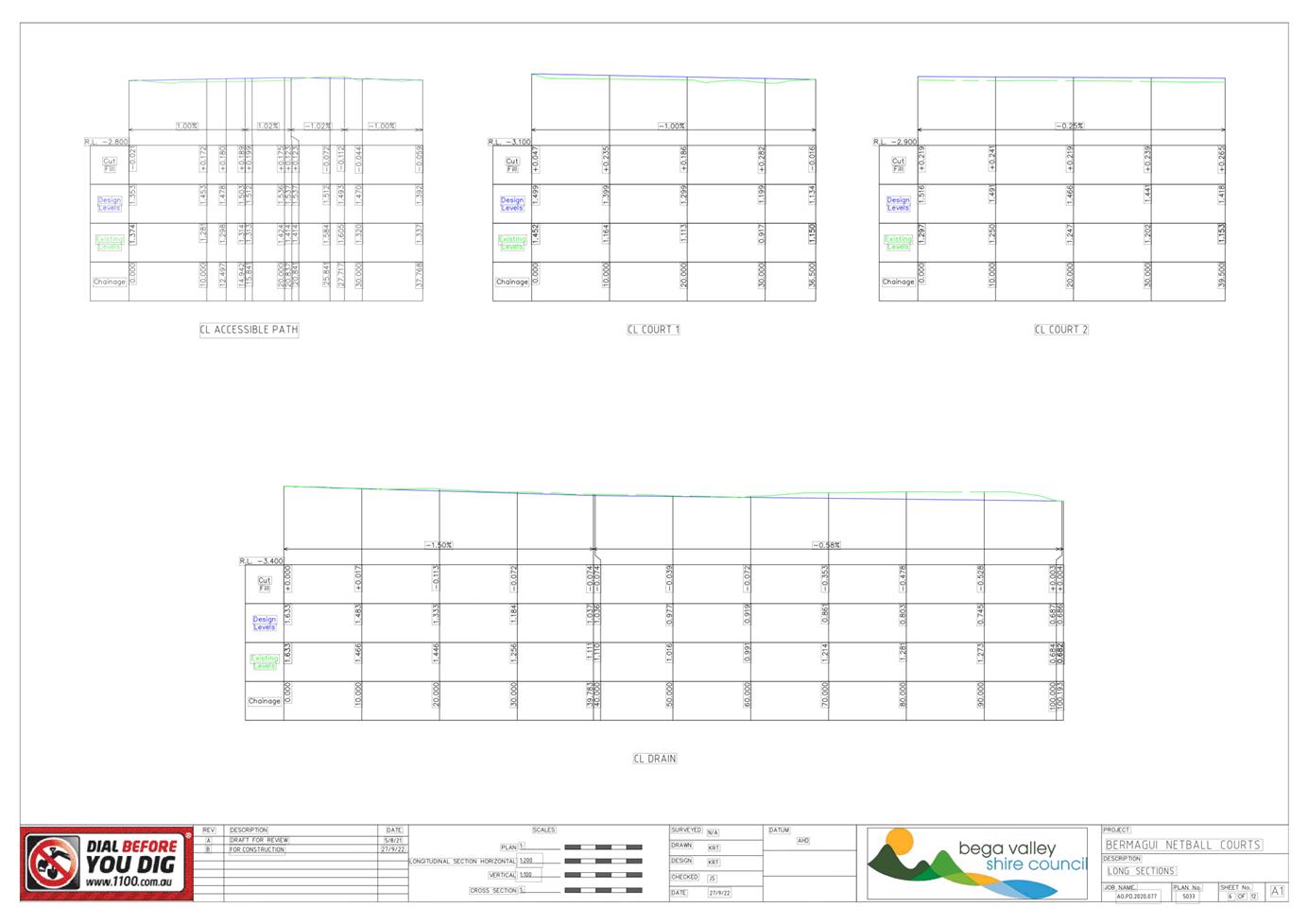

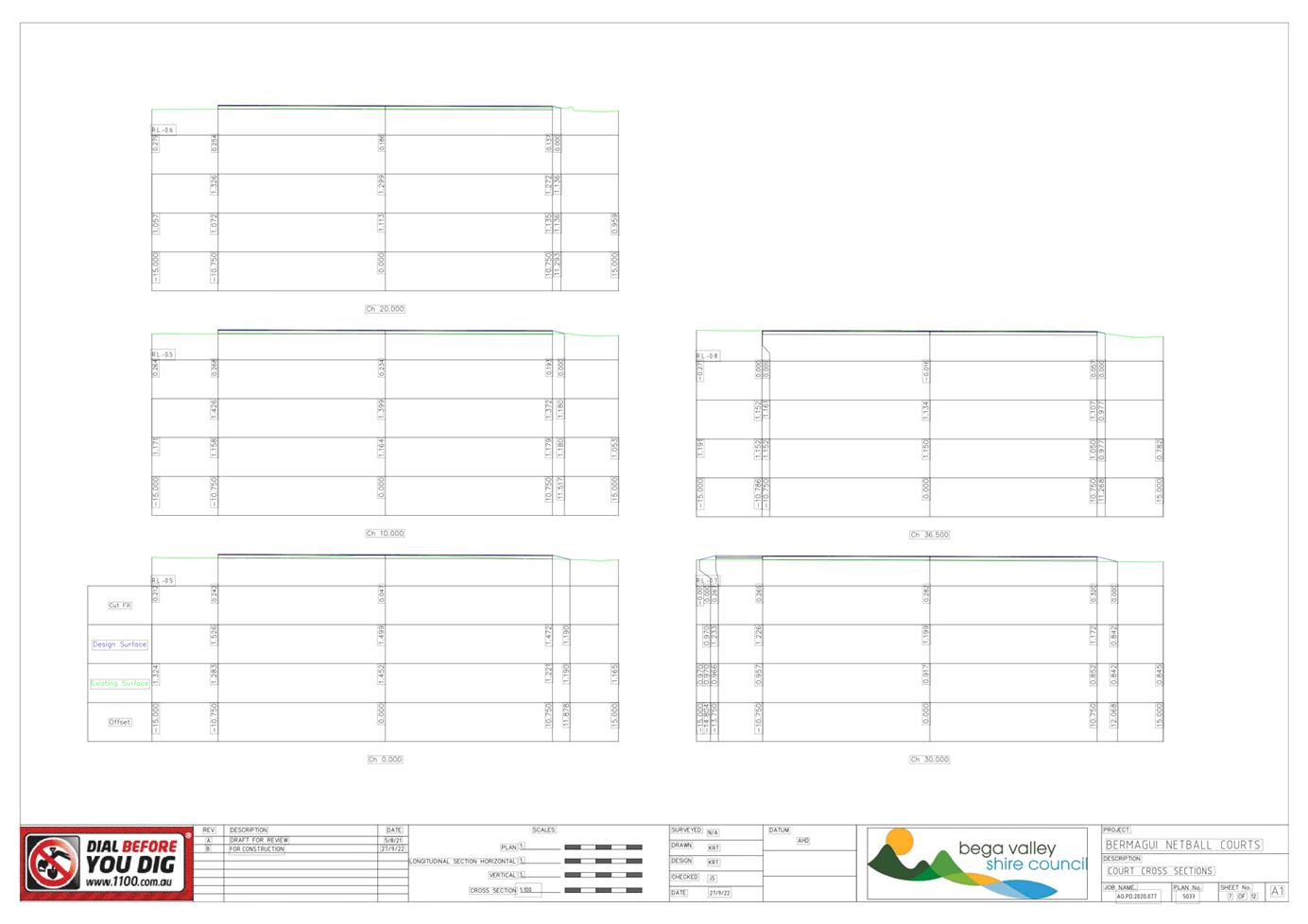

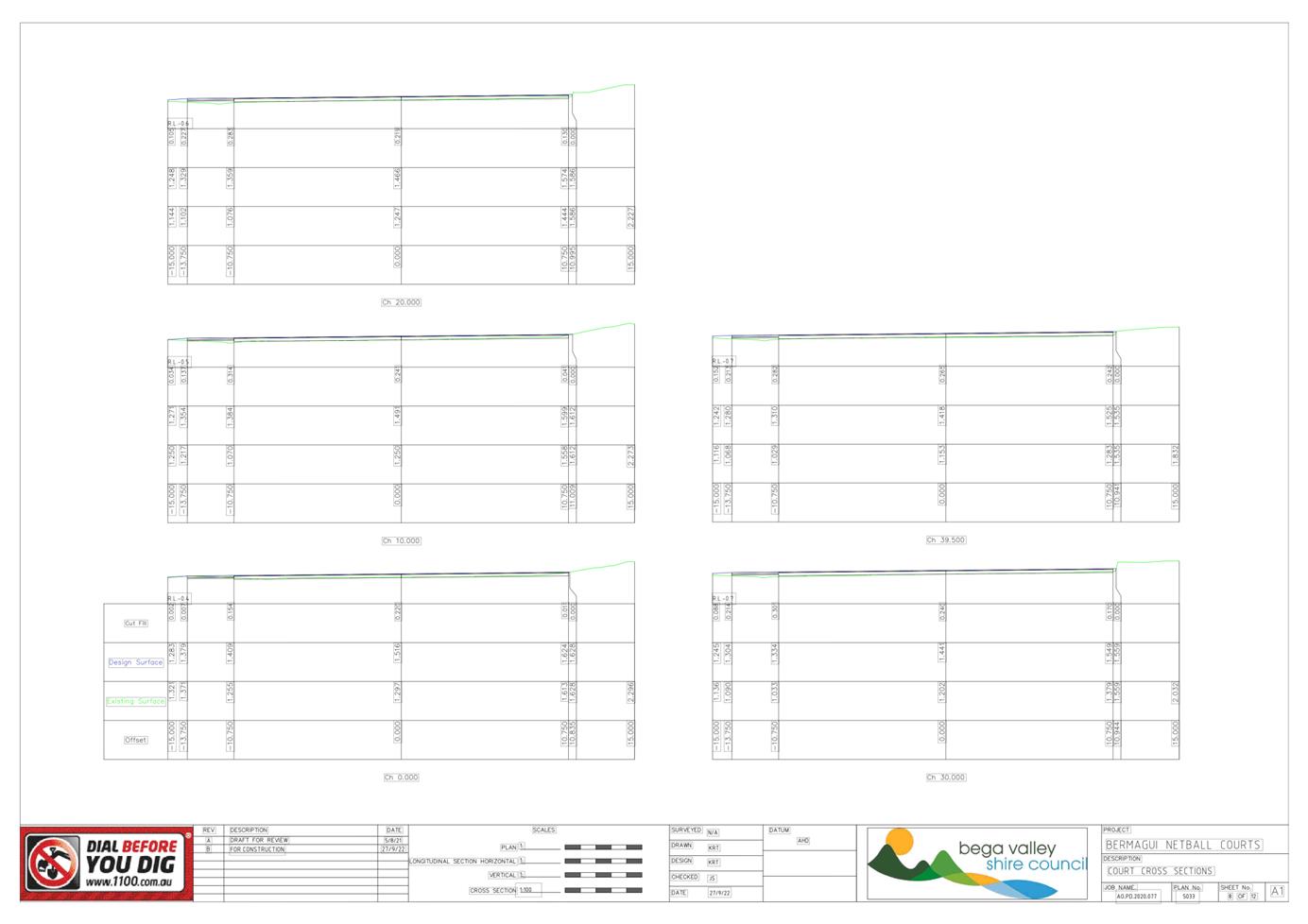

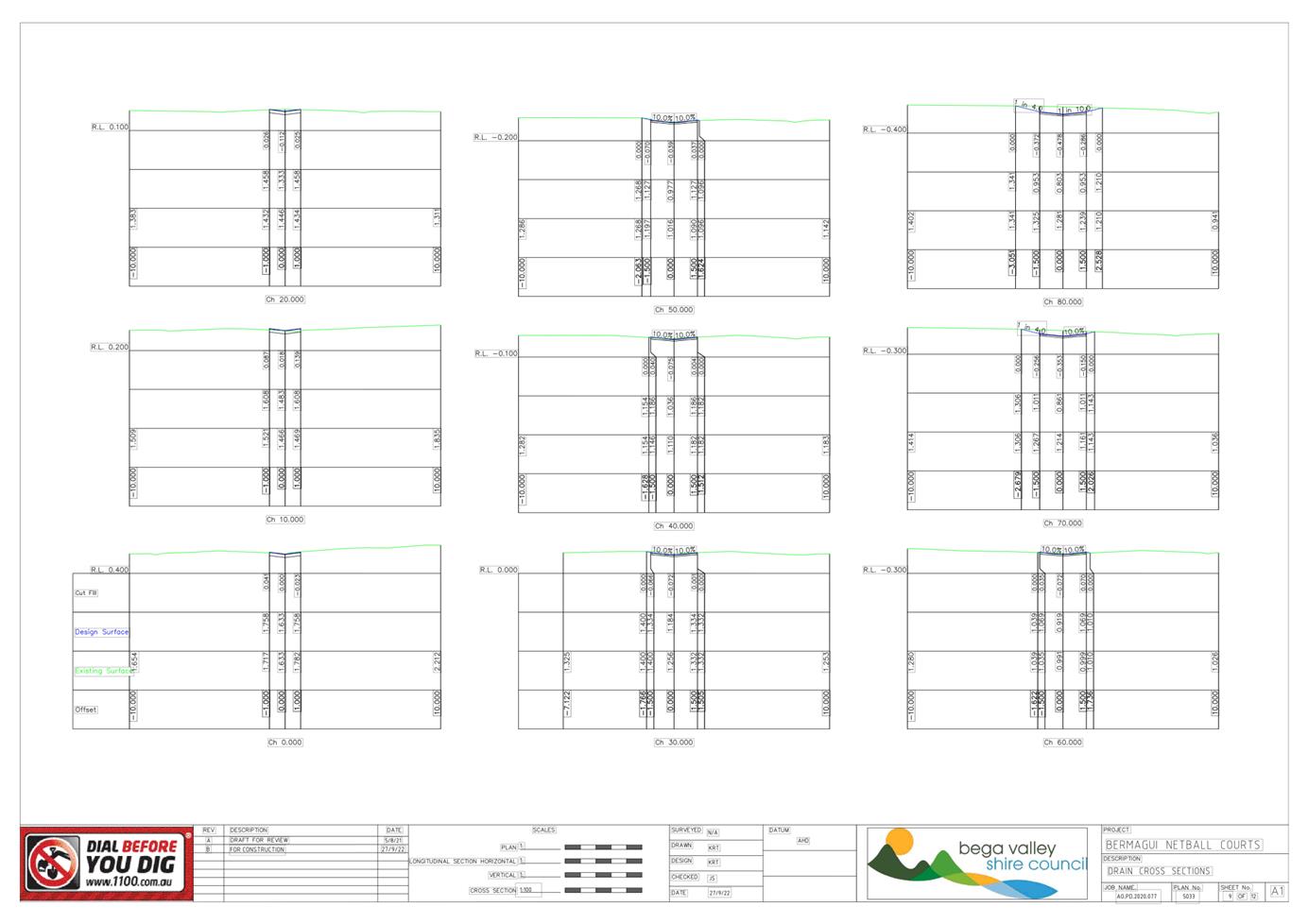

As per the long section for the path

of travel and the drain, no grades exceed 1% fall front to back, or 1.5% fall

left to right, with 3% being the maximum allowable grade for the designed

surface treatment. The available length of bay from the front edge is 7.9m to

the intersecting point with the drain. This easily allows for the 5.4m parking

bay and the 2.4m unmarked shared zone.

Options

That Council endorse the Officer recommendations in full.

Community

and Stakeholder Engagement

Engagement undertaken

There has

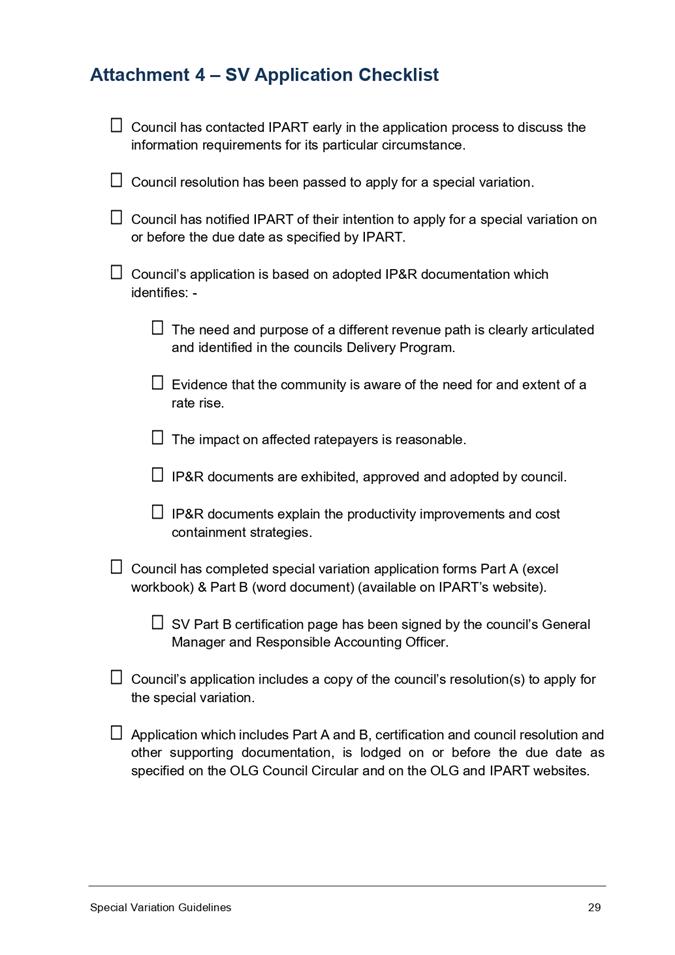

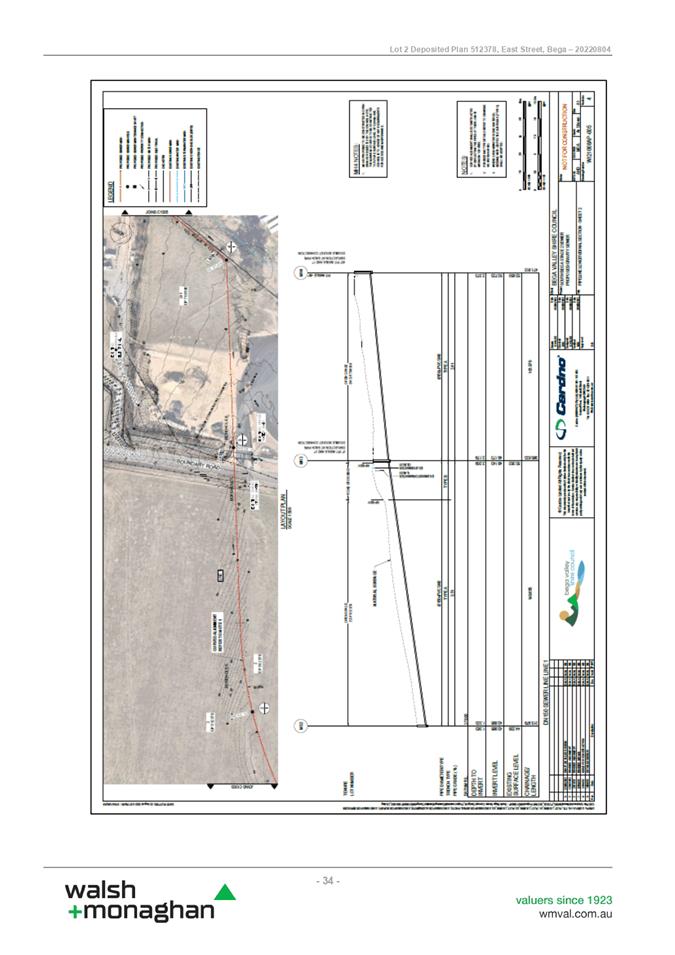

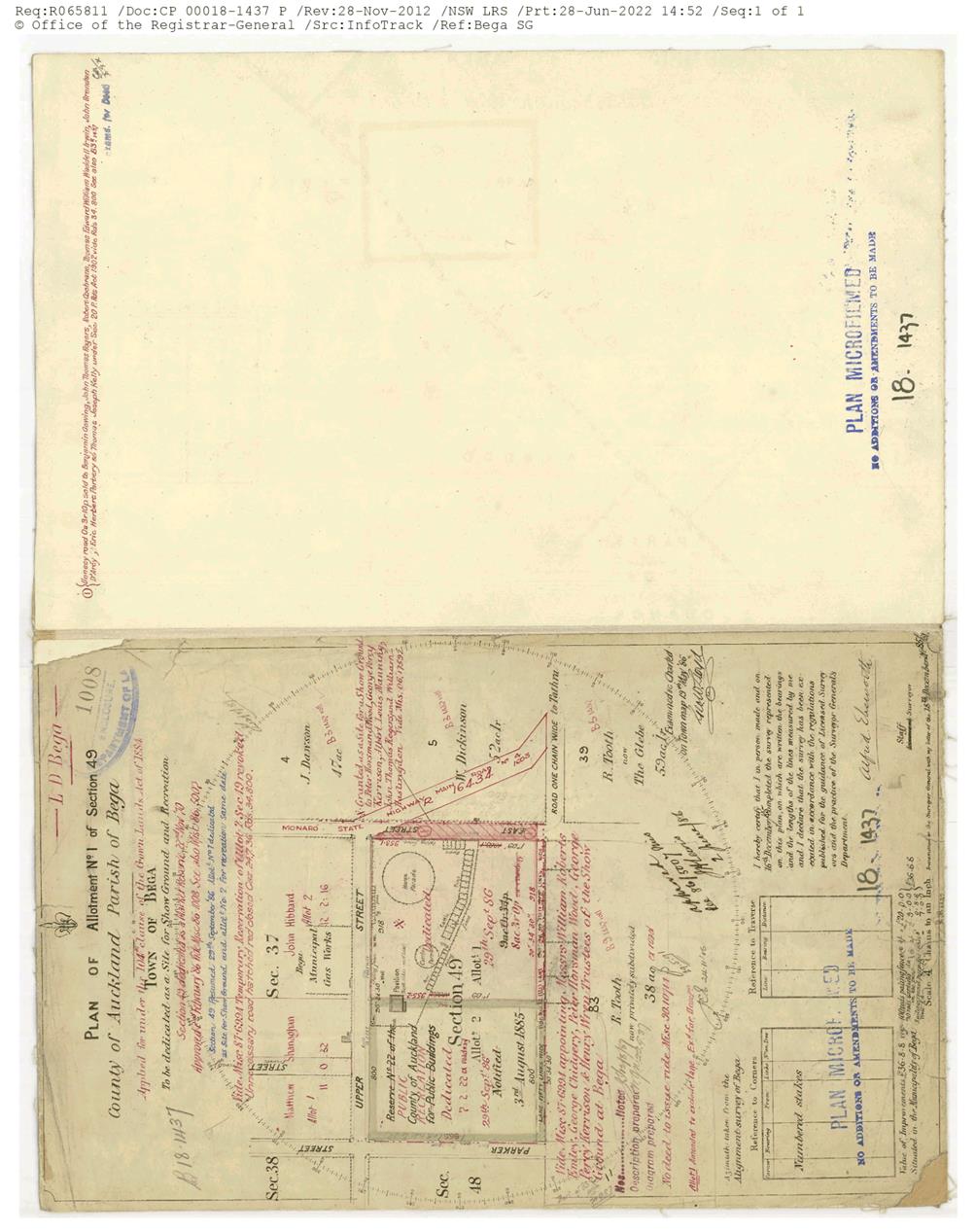

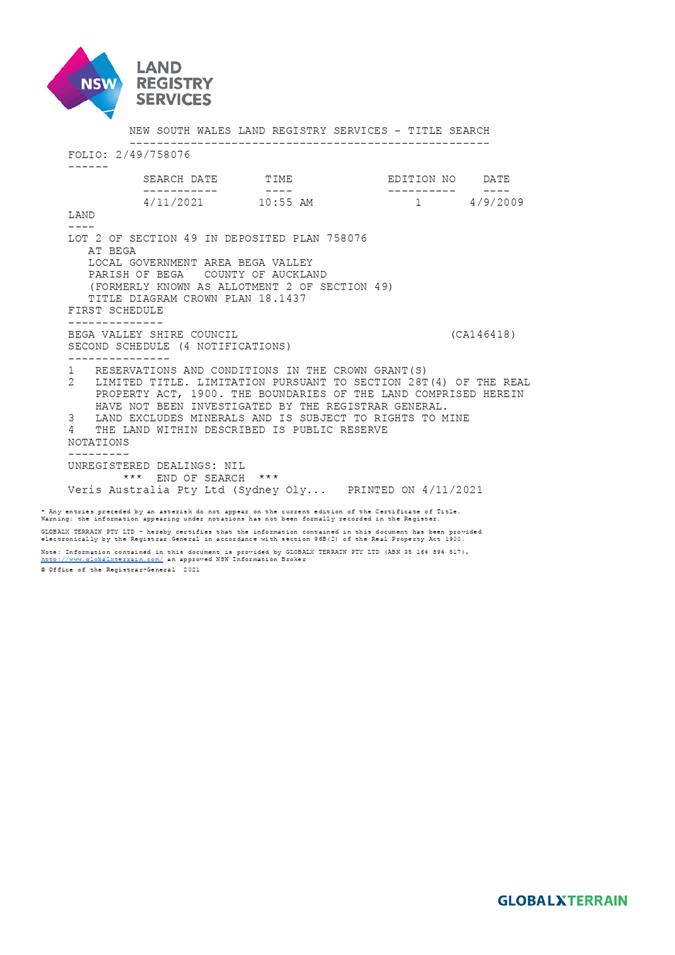

been no specific community engagement associated with this report